Fillable Articles of Incorporation Template for New Hampshire

The process of establishing a corporation in New Hampshire necessitates the completion of the Articles of Incorporation form, a critical document required by the Secretary of State. This form serves as the foundation for the legal existence of a new business entity, detailing essential information such as the corporation’s name, its purpose, the details of its registered agent, the number and type of authorized shares, among other key details. It sets the stage for the internal governance of the corporation and is the first significant step toward compliance with state regulations. Filing the Articles of Incorporation is not just a formality; it is a vital action that endows the corporation with its legal identity, enabling it to enter into contracts, own assets, and conduct business under the protection of state law. The specificity and accuracy of the information provided in this document are paramount, as they define the corporation's legal and operational boundaries.

Document Sample

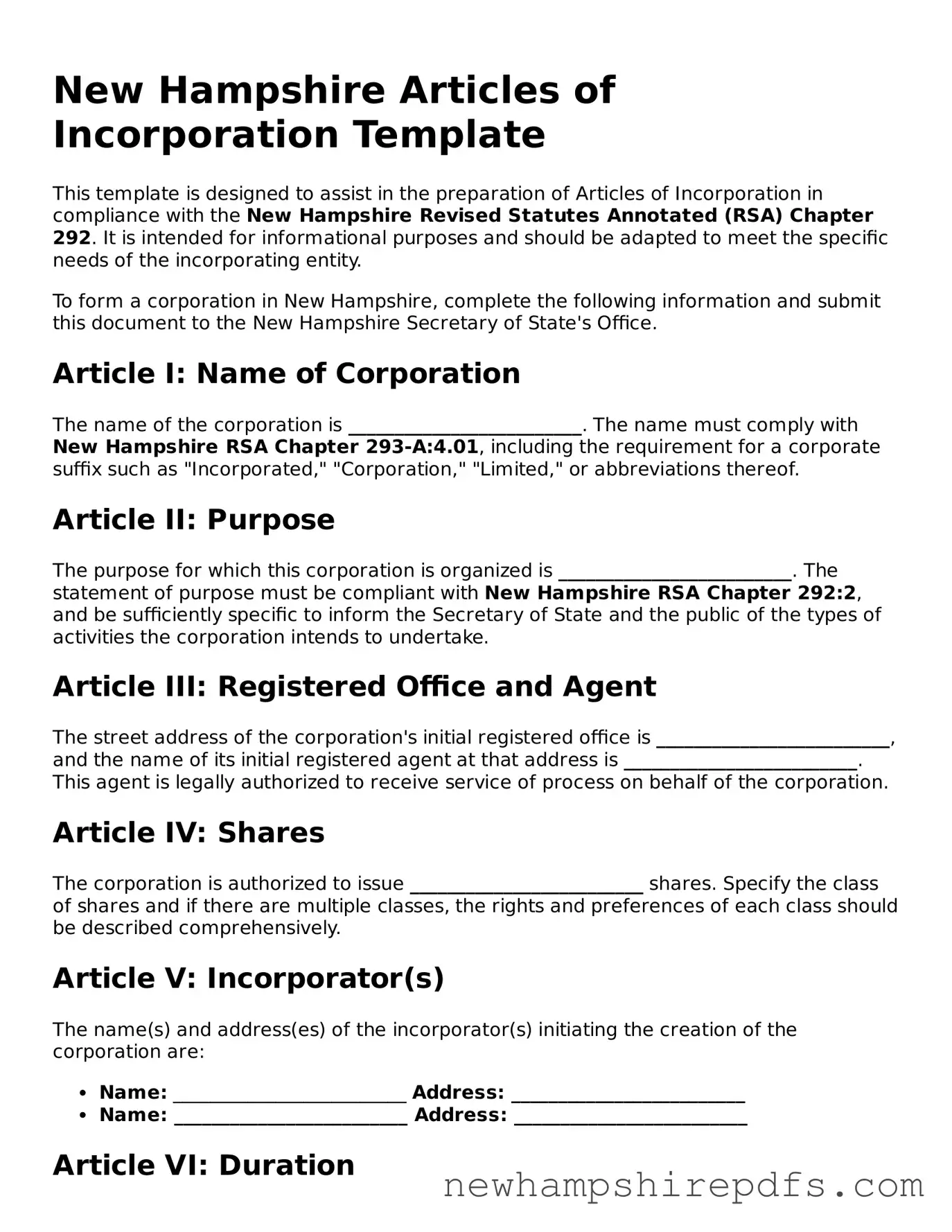

New Hampshire Articles of Incorporation Template

This template is designed to assist in the preparation of Articles of Incorporation in compliance with the New Hampshire Revised Statutes Annotated (RSA) Chapter 292. It is intended for informational purposes and should be adapted to meet the specific needs of the incorporating entity.

To form a corporation in New Hampshire, complete the following information and submit this document to the New Hampshire Secretary of State's Office.

Article I: Name of Corporation

The name of the corporation is _________________________. The name must comply with New Hampshire RSA Chapter 293-A:4.01, including the requirement for a corporate suffix such as "Incorporated," "Corporation," "Limited," or abbreviations thereof.

Article II: Purpose

The purpose for which this corporation is organized is _________________________. The statement of purpose must be compliant with New Hampshire RSA Chapter 292:2, and be sufficiently specific to inform the Secretary of State and the public of the types of activities the corporation intends to undertake.

Article III: Registered Office and Agent

The street address of the corporation's initial registered office is _________________________, and the name of its initial registered agent at that address is _________________________. This agent is legally authorized to receive service of process on behalf of the corporation.

Article IV: Shares

The corporation is authorized to issue _________________________ shares. Specify the class of shares and if there are multiple classes, the rights and preferences of each class should be described comprehensively.

Article V: Incorporator(s)

The name(s) and address(es) of the incorporator(s) initiating the creation of the corporation are:

- Name: _________________________ Address: _________________________

- Name: _________________________ Address: _________________________

Article VI: Duration

The corporation will exist perpetually unless a specific duration is listed here: _________________________.

Article VII: Directors

The number of directors constituting the initial board of directors is _________________________, and their names and addresses are as follows:

- Name: _________________________ Address: _________________________

- Name: _________________________ Address: _________________________

Article VIII: Bylaws

The initial bylaws of the corporation shall be adopted by the board of directors at their first meeting. The power to alter, amend, or repeal the bylaws is vested in the board of directors unless otherwise provided in the bylaws or the New Hampshire RSA.

Article IX: Amendment of Articles of Incorporation

The corporation reserves the right to amend or repeal any provision contained in these Articles of Incorporation in the manner now or hereafter prescribed by statute and these Articles of Incorporation.

Article X: Indemnification

The corporation shall indemnify any director, officer, employee, or agent of the corporation to the fullest extent permitted by the New Hampshire RSA Chapter 292:2, as it may be amended from time to time.

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this day of _________________________, 20____.

__________________________________

Signature of Incorporator

__________________________________

Printed Name of Incorporator

This template provides a basic outline and should be reviewed and completed in consultation with legal counsel to ensure compliance with current New Hampshire law and to address any additional legal and operational issues that may be relevant to the specific circumstances of the corporation being formed.

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Governing Law | The New Hampshire Articles of Incorporation are governed by the New Hampshire Revised Statutes Annotated (RSA) 293-A, specifically under Chapter 293-A:2.02, which outlines the requirements for incorporating a business in the state. |

| Form Purpose | The purpose of the Articles of Incorporation form is to officially register a corporation with the New Hampshire Secretary of State and to outline the basic structure of the corporation, including its name, purpose, and organizational structure. |

| Required Information | Information required on the form includes the corporation’s name, the nature of its business, the total number of authorized shares, par value (if any), the name and address of the registered agent, and the names and addresses of the incorporators. |

| Filing Method | The Articles of Incorporation can be filed with the New Hampshire Secretary of State's office either online or through mail, providing flexibility to applicants based on their preference or convenience. |

| Filing Fee | There is a filing fee required when submitting the Articles of Incorporation, which is subject to change. The most current fee should be verified on the New Hampshire Secretary of State's website or by direct inquiry. |

| Corporate Name Requirements | The corporation’s name must be distinguishable from other business names already registered with the New Hampshire Secretary of State and must include a corporate designator such as "Corporation," "Incorporated," "Limited," or an abbreviation of these terms. |

| Registered Agent | The Articles must designate a registered agent with a physical address in New Hampshire, who is authorized to receive legal documents on behalf of the corporation. |

| Amendment Process | The articles can be amended after filing, as business needs change. This process is outlined in RSA 293-A:10.06 and requires filing an Articles of Amendment form along with a specified fee. |

How to Use New Hampshire Articles of Incorporation

Establishing a corporation in New Hampshire involves a key step: completing the Articles of Incorporation. This document is crucial because it officially brings your corporation into existence under state law. Filling out the Articles of Incorporation requires attention to detail and accuracy. The following guide is designed to walk you through each step of the process, ensuring that you can efficiently and correctly file this important form.

Here are the steps you need to take:

- Begin by obtaining the form. New Hampshire's Articles of Incorporation can typically be found and downloaded from the official website of the New Hampshire Secretary of State.

- Provide the name of the corporation. Ensure that the name complies with New Hampshire naming requirements. It should be unique and not easily confused with existing business names in the state.

- List the purpose for which the corporation is being established. Be specific but concise.

- Enter the name and physical address of the corporation’s registered agent. The registered agent is responsible for receiving important legal and tax documents on behalf of the corporation.

- State the number of shares the corporation is authorized to issue. Remember, the structure of your corporation's stock can have significant implications for taxes and governance.

- Include the name and address of each incorporator. Incorporators are the individuals or entities that are establishing the corporation.

- Specify the directors of the corporation if they have already been selected. Provide their names and addresses.

- Detail how the corporation's bylaws will be adopted. Bylaws are crucial since they outline the internal rules governing the management of the corporation.

- Indicate the duration of the corporation if it is not intended to be perpetual.

- Sign and date the form. The signature of each incorporator is required to authenticate the document and affirm that the information provided is accurate.

- Finally, submit the completed form along with the required filing fee to the New Hampshire Secretary of State. Check the current filing fee on the Secretary of State’s website, as fees can change.

After submitting the Articles of Incorporation, you should receive a confirmation that your corporation has been officially registered. This document is a vital first step in establishing your business's legal and operational foundation in New Hampshire. Remember to keep a copy of the filed Articles of Incorporation for your records. It is a legal requirement to maintain this document, along with other corporate records.

Understanding New Hampshire Articles of Incorporation

What are the Articles of Incorporation in New Hampshire?

The Articles of Incorporation is a legal document that is required to formally establish a corporation within the state of New Hampshire. This document outlines essential information about the corporation, such as the company name, purpose, office address, the number of shares it is authorized to issue, and the names and addresses of the incorporators.

Who needs to file the Articles of Incorporation in New Hampshire?

Any group intending to form a corporation in New Hampshire must file the Articles of Incorporation with the New Hampshire Secretary of State. This is a mandatory step for both profit and non-profit organizations seeking to be legally recognized as corporations within the state.

How do you file the Articles of Incorporation in New Hampshire?

Filing can be completed online through the New Hampshire Secretary of State’s website or by mailing a printed form to their office. The form needs to be filled out with accurate and complete information about the corporation, accompanied by the appropriate filing fee. Online filing is faster and preferred by many for its convenience.

What information is required to complete the Articles of Incorporation form?

Required information includes the corporation’s name, the specific purpose for which it is being formed, the name and address of its registered agent in New Hampshire, the number of shares the corporation is authorized to issue, and the names and addresses of the incorporators, among other details.

Is there a filing fee for the Articles of Incorporation in New Hampshire?

Yes, there is a filing fee that must be submitted along with the Articles of Incorporation. The fee amount varies depending on whether the corporation is for-profit or non-profit. Current fee amounts can be found on the New Hampshire Secretary of State’s website or by contacting their office directly.

How long does it take to process the Articles of Incorporation in New Hampshire?

The processing time can vary depending on the filing method and the current workload of the Secretary of State’s office. Online submissions may be processed more quickly than paper submissions. Generally, it takes a few weeks for the process to be completed.

What happens after the Articles of Incorporation are filed?

Once filed and approved, the corporation is legally formed and recognized by the state of New Hampshire. The entity can then proceed to conduct business, enter into contracts, hire employees, and carry out other activities permitted under its corporate status. The corporation must also adhere to any ongoing compliance requirements, such as annual reports and tax obligations.

Can the Articles of Incorporation be amended after they are filed?

Yes, corporations may need to amend their Articles of Incorporation from time to time. Amendments are filed with the New Hampshire Secretary of State along with the required amendment form and fee. Examples of common amendments include changing the corporate name, address, or the number of authorized shares.

Common mistakes

Filling out the New Hampshire Articles of Incorporation is a critical step for establishing a corporation in the state. However, several common mistakes can complicate the process, leading to delays or rejection of the application. Being aware of these pitfalls can streamline the process and help ensure successful registration.

Not Checking Name Availability: One of the most common mistakes is failing to verify the availability of the corporation's name before submission. The chosen name must be unique and not too similar to any existing business entity names in New Hampshire. Failure to check name availability can result in immediate rejection.

Incomplete Filing Information: The form requires specific details about the corporation, including its purpose, principal office address, and information about its directors and registered agent. Omitting any required information can delay processing.

Incorrect Registered Agent Information: The registered agent acts as the corporation's official contact for legal correspondence. Providing incorrect information for the registered agent, whether it's an inaccurate address or the wrong name, jeopardizes the corporation's legal standing.

Neglecting to Attach Necessary Documents: Depending on the nature of the corporation, additional documentation may be required along with the Articles of Incorporation. Failing to include necessary attachments can lead to processing delays.

Failing to Specify Stock Information: For corporations planning to issue stock, the Articles of Incorporation must include details about the number and type of shares. Missing or vague stock information can create legal and financial issues down the line.

Not Using the Most Current Form: The Secretary of State's office periodically updates the Articles of Incorporation form. Using an outdated version can result in submission rejection.

Incorrect Filing Fee: The filing fee for the Articles of Incorporation varies depending on the corporation's characteristics and the method of filing. Incorrect payment amounts can delay processing.

Overlooking Signature Requirements: All required parties must sign the Articles of Incorporation. Overlooking or missing signatures can invalidate the submission.

Lack of Precision in Defining the Business Purpose: A clear and precise description of the corporation's business purpose is necessary for legal clarity and compliance. Vague or overly broad descriptions can raise red flags during the review process.

Attention to detail when completing the New Hampshire Articles of Incorporation is paramount. Small oversights can lead to significant setbacks. By meticulously reviewing the form for accuracy and completeness, and ensuring that all legal requirements are met, corporations can navigate the filing process more smoothly. This focused approach can ultimately save time, resources, and prevent unnecessary complications in establishing a corporate presence in New Hampshire.

Documents used along the form

When forming a corporation in New Hampshire, entrepreneurs must prepare and file the Articles of Incorporation, a pivotal document that marks the legal birth of the corporation. However, this form is just the starting point. To fully establish and operate a corporation compliantly, other forms and documents play crucial roles throughout the corporation's life cycle. This guide outlines some of the most commonly used forms and documents that accompany the Articles of Incorporation, helping individuals navigate the complex landscape of corporate setup and compliance.

- Bylaws: These internal rules govern the corporation's operations, including the roles and responsibilities of directors and officers. Bylaws are essential for outlining how decisions are made within the corporation.

- IRS Form SS-4: Used to obtain an Employer Identification Number (EIN) from the IRS. An EIN is necessary for tax purposes, hiring employees, and opening a business bank account.

- Initial Report: Some states require corporations to submit an initial report after incorporation, detailing essential information about the business, such as the names and addresses of directors.

- Shareholder Agreement: This document outlines the rights and obligations of the shareholders, including how shares can be bought, sold, or transferred. It helps prevent disputes among shareholders.

- Stock Certificates: Physical or digital documents that represent ownership in the corporation. They detail the number of shares owned by a shareholder.

- DBA Filing (Doing Business As): If the corporation operates under a name different from its legal name, a DBA filing with the state or local government is required.

- Business Licenses and Permits: Depending on the nature of the business and its location, various federal, state, or local licenses and permits may be required to legally operate.

- Minutes of Board Meetings: Recordings of the discussions and decisions made during board meetings. Keeping accurate minutes is essential for legal compliance and can protect the corporation in legal matters.

- Annual Reports: Most states require corporations to file annual reports, updating the state on key information such as address changes, current officers, and business activities.

While the Articles of Incorporation create the foundation of a corporation, the journey doesn't stop there. Each of the documents listed plays a pivotal role in ensuring the legal and operational structure of the corporation is set up correctly and maintained over time. Entrepreneurs should familiarize themselves with these documents and consider seeking professional advice to navigate the technical and legal complexities of corporate formation and compliance. By doing so, they ensure their corporation is built on a solid legal foundation, ready to grow and succeed in the competitive business landscape.

Similar forms

The New Hampshire Articles of Incorporation form is similar to other foundational business documents required for forming a corporation in various jurisdictions. While specifics may vary, the purpose and core information requested remain largely consistent. These documents lay the legal groundwork for a company's operation, outline its structure, and establish its legal identity. Commonalities include information on the company's name, principal place of business, purpose, duration, incorporator details, and information regarding shares of stock.

The form closely mirrors the Articles of Organization used by Limited Liability Companies (LLCs). Both documents require essential details about the business, including the name, primary business activities, and the registered agent responsible for legal communications. However, the Articles of Incorporation specifically cater to corporations and thus, include details on corporate structure, such as stock information, which is not applicable to LLCs. The distinction reflects the different management structures and regulatory requirements faced by corporations compared to LLCs.

It also shares similarities with the Statement of Information that many states require businesses to file annually or biennially. This document updates the state on any changes to the corporation's address, directors, or registered agent. Although the initial Articles of Incorporation do not serve the same purpose as the ongoing updates of the Statement of Information, both are vital to maintaining a corporation’s good standing with the state. The common link is the necessity to provide up-to-date, accurate information about the business's operational and legal status.

Dos and Don'ts

When you're setting up a corporation in New Hampshire, filling out the Articles of Incorporation is a fundamental step. To ensure the process goes smoothly and your application is accepted without delays, here’s what you should and shouldn't do:

Things You Should Do

- Ensure all the information is accurate and up-to-date. Double-check names, addresses, and other details to prevent any discrepancies.

- Include a detailed description of the corporation’s purpose. It’s important to be clear and specific to avoid any confusion regarding the nature of your business.

- Choose a registered agent within New Hampshire. Your registered agent must have a physical address in the state and be available during business hours to handle legal documents.

- Sign and date the document where required. An authorized officer of the corporation must sign the Articles of Incorporation to affirm the accuracy of the information provided.

- Keep a copy of the filled form for your records. After submitting, having a personal copy will be helpful for future reference and in preparing for any additional steps.

Things You Shouldn't Do

- Don’t leave any required fields blank. Incomplete forms may result in rejection or delay of your application.

- Avoid using a post office box as the address for your registered agent. A physical address in New Hampshire is required for the purpose of receiving legal documents.

- Don’t forget to include the filing fee. Check the current fee schedule as it can change and make sure your payment accompanies the form.

- Avoid guessing on specific legal questions. If you’re unsure about something, it’s better to seek clarification or professional advice rather than risk inaccuracies in your filing.

- Don’t use informal language or nicknames in your filings. Stick to the full, legal names of individuals and the official name of your corporation as it should appear in all legal documents.

Misconceptions

When it comes to incorporating a business in New Hampshire, the Articles of Incorporation form is crucial. Several misconceptions surround this document, which can lead to confusion or errors during the filing process. Below are five common misconceptions about the New Hampshire Articles of Incorporation form.

It's only for large businesses: One common misconception is that the Articles of Incorporation are exclusively for large corporations. In reality, this form is a requirement for any business wishing to incorporate in New Hampshire, regardless of its size. Incorporation can offer significant benefits, including liability protection and tax advantages, to small and medium-sized businesses as well.

<.li>Online filing is optional: Another misconception is that filing the Articles of Incorporation online is optional or even discouraged. However, New Hampshire encourages online filing for its convenience, faster processing time, and reduced risk of error. While paper filings are still accepted, incorporating online streamlines the process, making it easier and quicker for businesses to start.

Filing the form is the final step in starting your business: Filing the Articles of Incorporation is a crucial step, but it's not the only task on the checklist for starting a business in New Hampshire. After filing, businesses must also obtain necessary licenses and permits, comply with tax requirements, and fulfill other regulatory obligations. Viewing the filing of the Articles of Incorporation as one step in a broader process is crucial to ensure full compliance with state laws and regulations.

<.li>

It requires extensive legal knowledge to complete: While it's essential to understand the legal foundations of your business, the notion that completing the Articles of Incorporation requires deep legal knowledge isn't accurate. The form asks for basic information about your business, such as its name, the nature of the business, the names of the incorporators, and the registered agent's information. Carefully reading the instructions and seeking clarification when necessary can help most people complete the form accurately.

Amendments can't be made once filed: Sometimes businesses hesitate to file the Articles of Incorporation out of concern that they can't make changes later. In reality, New Hampshire allows businesses to amend their Articles of Incorporation. While amendments require additional filings and sometimes fees, they can be an essential part of iterating on your business model and ensuring your documentation remains accurate.

In summary, while the Articles of Incorporation is a fundamental legal requirement for incorporating a business in New Hampshire, misunderstandings about its purpose, the process of filing, and its implications can lead to unnecessary complications. Clearing up these misconceptions can help smooth the path to successfully launching and running an incorporated business in New Hampshire.

Key takeaways

When incorporating a business in New Hampshire, the Articles of Incorporation form plays a crucial role. This document not only establishes the existence of your corporation within the state but also sets the foundation for its legal and operational structure. Below are four key takeaways that you should consider when preparing to fill out and file this form.

- Be thorough and accurate: Accuracy cannot be overstated when completing the Articles of Incorporation. Mistakes or omissions can delay the approval process or potentially necessitate refiling, which can incur additional costs and extend the time before your business can officially operate.

- Understand the required information: Familiarize yourself with the specific information that New Hampshire requires for incorporation. This usually includes the corporate name, purpose, registered agent information, number of shares the corporation is authorized to issue, and details about the incorporators. Making sure you have this information beforehand will streamline the filing process.

- Select a registered agent wisely: A registered agent acts as the corporation's official contact for legal and state communications. The agent must have a physical address in New Hampshire and be available during normal business hours. This role is pivotal for ensuring that you receive crucial legal documents in a timely manner.

- Prepare for ongoing compliance: Filing the Articles of Incorporation is just the beginning. Corporations in New Hampshire must also file annual reports and meet other regulatory requirements to maintain good standing. Being aware of these obligations from the start can help you plan better for the future and avoid potential legal pitfalls.

Approaching the Articles of Incorporation with a methodical and informed mindset will not only facilitate a smoother filing process but also contribute to the long-term success and compliance of your corporation within New Hampshire.

Some Other New Hampshire Forms

Rifle Bill of Sale - A documentation tool for the lawful transfer of a firearm from a seller to a buyer.

Auto Bill of Sale New Hampshire - Without this form, transferring ownership of a vehicle can be more complicated, potentially leading to legal challenges or registration issues.

Nh Bill of Sale Template - In cases of a gift or non-traditional transfer, the Bill of Sale serves as documentation of the transfer for no monetary consideration.