Fillable Deed Template for New Hampshire

In the state of New Hampshire, the transfer of real property is a process that requires meticulous attention to legal detail, one of the most crucial being the completion of a deed form. This document, pivotal in its role, serves as the tangible proof of the transfer of property ownership from one party to another. The New Hampshire Deed form encapsulates all the necessary information to ensure a lawful transfer, including the identification of the grantor and grantee, the precise description of the property, and any conditions or warranties associated with the sale. It is imperative for individuals engaging in property transactions within the state to understand the variances in deed types—such as warranty deeds, which offer the highest level of buyer protection, and quitclaim deeds, which may convey property with no guarantees about title clearness. Accurate completion and proper filing of this document with the local county registry are crucial steps to validate the transaction and protect the parties’ rights. Therefore, familiarizing oneself with the form and its requirements is not just advisable but essential for a smooth and legally sound transition of property ownership.

Document Sample

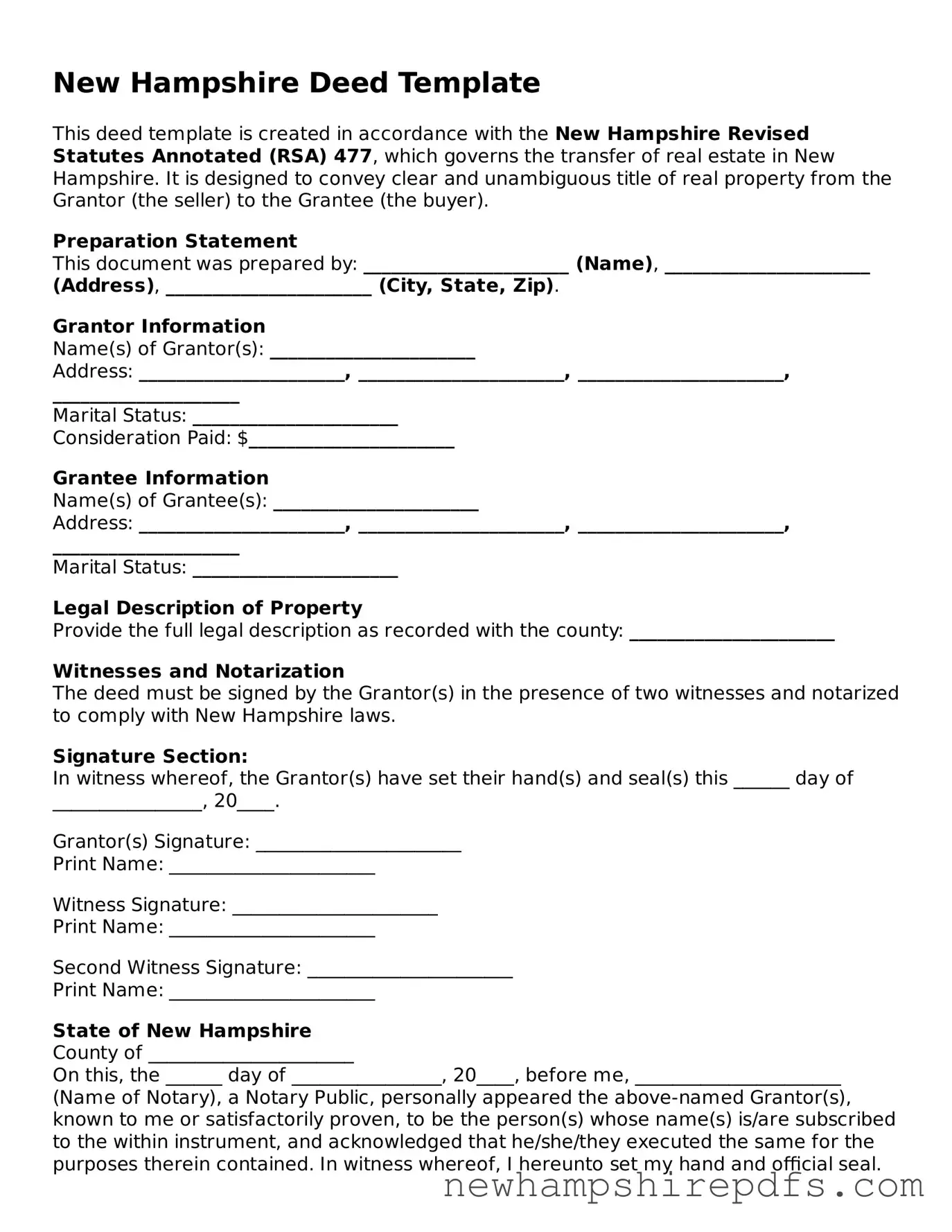

New Hampshire Deed Template

This deed template is created in accordance with the New Hampshire Revised Statutes Annotated (RSA) 477, which governs the transfer of real estate in New Hampshire. It is designed to convey clear and unambiguous title of real property from the Grantor (the seller) to the Grantee (the buyer).

Preparation Statement

This document was prepared by: ______________________ (Name), ______________________ (Address), ______________________ (City, State, Zip).

Grantor Information

Name(s) of Grantor(s): ______________________

Address: ______________________, ______________________, ______________________, ____________________

Marital Status: ______________________

Consideration Paid: $______________________

Grantee Information

Name(s) of Grantee(s): ______________________

Address: ______________________, ______________________, ______________________, ____________________

Marital Status: ______________________

Legal Description of Property

Provide the full legal description as recorded with the county: ______________________

Witnesses and Notarization

The deed must be signed by the Grantor(s) in the presence of two witnesses and notarized to comply with New Hampshire laws.

Signature Section:

In witness whereof, the Grantor(s) have set their hand(s) and seal(s) this ______ day of ________________, 20____.

Grantor(s) Signature: ______________________

Print Name: ______________________

Witness Signature: ______________________

Print Name: ______________________

Second Witness Signature: ______________________

Print Name: ______________________

State of New Hampshire

County of ______________________

On this, the ______ day of ________________, 20____, before me, ______________________ (Name of Notary), a Notary Public, personally appeared the above-named Grantor(s), known to me or satisfactorily proven, to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained. In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ______________________

My commission expires: ______________________

PDF Form Breakdown

| Fact | Description |

|---|---|

| 1. Governing Law | The New Hampshire Deed forms are governed under the New Hampshire Revised Statutes, specifically under Title XLVIII (48) relating to Conveyances of Realty and Interests Therein. |

| 2. Types of Deeds | In New Hampshire, common types of deeds include the Warranty Deed, which offers the highest level of buyer protection, the Limited Warranty Deed, and the Quitclaim Deed, each serving different purposes in real estate transactions. |

| 3. Recording Requirements | All deeds must be recorded with the County Registry of Deeds in the county where the property is located, following the execution to ensure the deed is considered valid against third parties. |

| 4. Witness and Notarization | While New Hampshire law does not mandate the presence of witnesses for the execution of a deed, it requires notarization. A notary public or other official authorized by state law must acknowledge the signature(s) on the deed. |

| 5. Transfer Tax | Transfer taxes are applicable when transferring property in New Hampshire and must be paid for the deed to be recorded. The amount varies based on the property's selling price and is the responsibility of both the buyer and the seller unless otherwise agreed. |