Fillable Durable Power of Attorney Template for New Hampshire

Embarking on the preparation of a Durable Power of Attorney in New Hampshire marks an important step towards securing one's future and ensuring peace of mind. This legal document, specifically designed to remain in effect even if the principal becomes incapacitated, grants an individual, known as the agent or attorney-in-fact, the authority to make significant decisions on behalf of the principal. It covers a wide range of matters, from financial decisions to real estate transactions, and its durability aspect ensures that the agent can act when the principal most needs assistance, without the need for court intervention. Tailored to reflect the unique laws and requirements of New Hampshire, the form must be completed with precision and foresight, often involving nuanced deliberations about who is best suited to serve as the agent and what specific powers should be granted. The significance of this document lies not only in the legal authority it grants but also in the trust and responsibility it symbolizes, making its preparation a profound demonstration of care for one's future and for the well-being of loved ones.

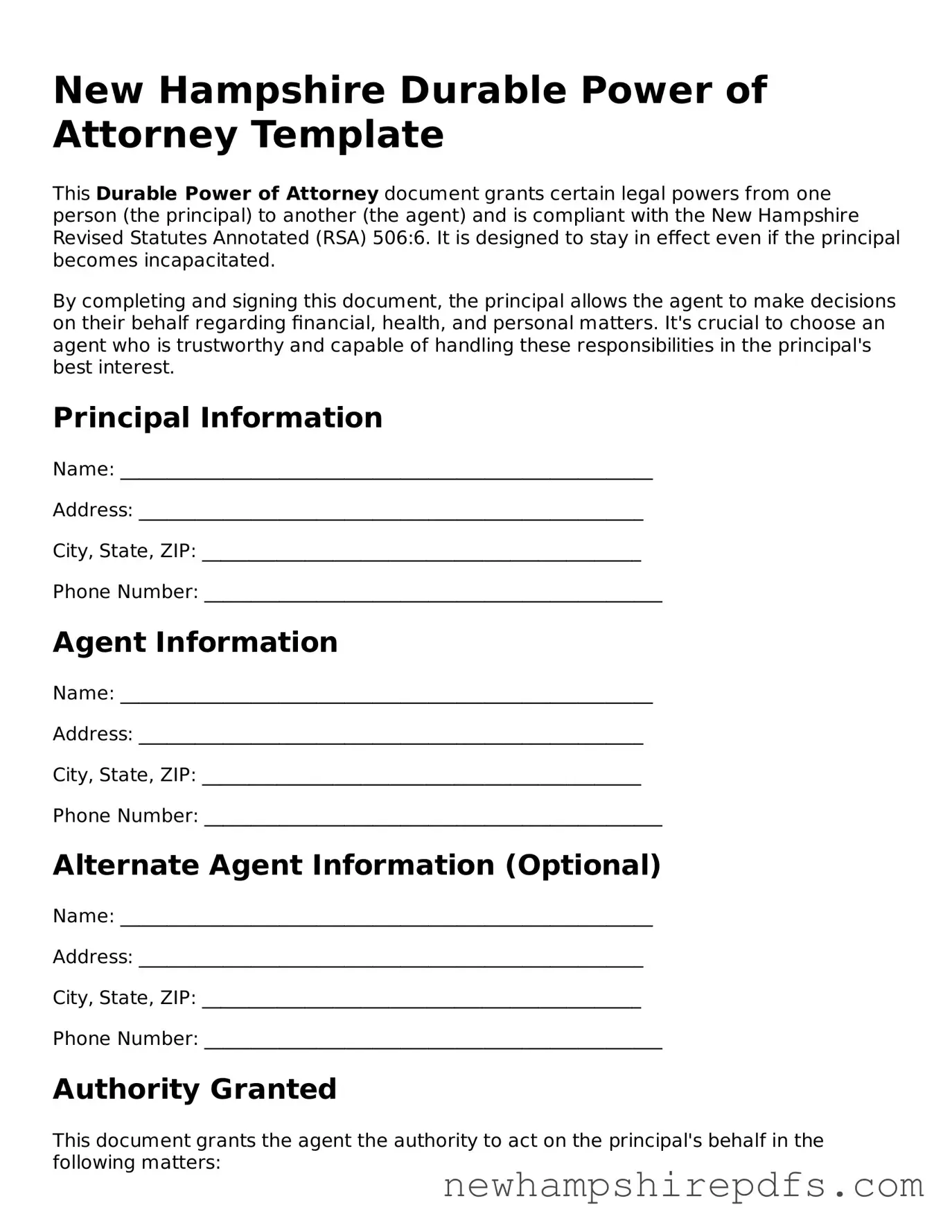

Document Sample

New Hampshire Durable Power of Attorney Template

This Durable Power of Attorney document grants certain legal powers from one person (the principal) to another (the agent) and is compliant with the New Hampshire Revised Statutes Annotated (RSA) 506:6. It is designed to stay in effect even if the principal becomes incapacitated.

By completing and signing this document, the principal allows the agent to make decisions on their behalf regarding financial, health, and personal matters. It's crucial to choose an agent who is trustworthy and capable of handling these responsibilities in the principal's best interest.

Principal Information

Name: _________________________________________________________

Address: ______________________________________________________

City, State, ZIP: _______________________________________________

Phone Number: _________________________________________________

Agent Information

Name: _________________________________________________________

Address: ______________________________________________________

City, State, ZIP: _______________________________________________

Phone Number: _________________________________________________

Alternate Agent Information (Optional)

Name: _________________________________________________________

Address: ______________________________________________________

City, State, ZIP: _______________________________________________

Phone Number: _________________________________________________

Authority Granted

This document grants the agent the authority to act on the principal's behalf in the following matters:

- Banking and other financial transactions

- Real estate and property transactions

- Government benefits and tax filings

- Healthcare decisions, if this authority is specifically granted

- Legal matters and proceedings

- Personal and family maintenance

Special Instructions

The principal may list any special instructions or limitations to the agent's power here:

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

Effective Date and Signatures

This Durable Power of Attorney becomes effective immediately upon signing, unless otherwise specified:

Effective Date: ________________________________________________

In witness whereof, I have executed this Durable Power of Attorney on this day:

Date: ________________

Principal's Signature: __________________________________________

Principal's Printed Name: ______________________________________

This document must be signed in the presence of a notary public or two adult witnesses who are not the agent or related to the agent or principal.

Notarization (if applicable)

State of New Hampshire)

County of _______________ )

On this __________ day of _______________, 20____, before me, _______________________________ (name of notary), personally appeared _____________________________ (name of principal), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public's Signature: ______________________________________

My commission expires: ________________________________________

PDF Form Breakdown

| Fact | Detail |

|---|---|

| Definition | A New Hampshire Durable Power of Attorney is a legal document that grants a chosen person or entity authority to manage the principal's affairs even after the principal becomes incapacitated. |

| Governing Law | The New Hampshire Durable Power of Attorney is governed by New Hampshire Statutes, specifically RSA 564-E:201 to 564-E:424, known as the Uniform Power of Attorney Act. |

| Validity Requirements | To be valid, the form must be signed by the principal and either notarized or witnessed by two non-related, competent adults, per RSA 564-E:105. |

| Scope of Authority | The appointed agent can be granted broad or limited authority to handle financial and property matters on behalf of the principal. |

| Duration | This power of attorney remains in effect during the principal’s incapacity and only ends upon the principal’s death or if revoked by the principal while competent. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are competent, by providing written notice to the agent and any entities relying on the document. |

| Agent’s Duties | The agent is required to act in the principal's best interest, maintain accurate records, and keep the principal's property separate from their own, as detailed in RSA 564-E:114. |

| Springing Powers | The document can specify that the agent’s power commences only upon the principal’s incapacity, making it a "springing" durable power of attorney. |

| Acceptance by Third Parties | New Hampshire law obligates third parties to accept a duly executed durable power of attorney unless they have specific reasons for refusal, as outlined in RSA 564-E:120. |

| Key Considerations | Selecting a trustworthy agent is critical, as they will have significant control over the principal's affairs and well-being. |

How to Use New Hampshire Durable Power of Attorney

When planning for the future, it's important to consider who will handle your affairs in the event you're unable to do so yourself. The Durable Power of Attorney (DPOA) form in New Hampshire is a crucial document that allows you to appoint a trusted person as your agent to make decisions on your behalf. Filling out this form correctly is essential to ensure that your wishes are respected. This guide will walk you through the necessary steps to complete the New Hampshire Durable Power of Attorney form properly.

- Begin by gathering all necessary information including your full name, address, and the full name and address of the person you wish to designate as your agent.

- Read the form carefully to understand the scope of powers you're granting to your agent. This knowledge will guide your decisions throughout the process.

- Enter your full name and address in the designated spaces at the top of the form to identify yourself as the principal.

- In the section labeled "Designation of Agent," fill in the name, address, and contact information of the person you are appointing.

- If you wish to appoint a successor agent (a backup, in case the first agent is unable or unwilling to act), fill in their information in the provided space.

- Specify the powers you are granting to your agent. Be as clear and precise as possible. If there are any powers you do not wish to grant, you can strike through them or write "N/A" next to the specific entry.

- Indicate when you want the Durable Power of Attorney to become effective. Some forms allow you to choose whether it takes effect immediately or only upon a certain event, such as your incapacitation.

- If the form requires notarization, sign it in front of a Notary Public. Make sure you bring a valid form of identification to the notarization appointment.

- Have the agent (and any successor agents) acknowledge their appointment by signing the form where indicated. This step may also need to be witnessed or notarized, depending on the form and state requirements.

- Keep the original Durable Power of Attorney in a secure but accessible place. Provide copies to your agent, successor agents, and any other relevant parties, such as a financial institution or healthcare provider.

- Lastly, it's wise to review and potentially update your Durable Power of Attorney periodically to ensure it still reflects your wishes and that all contact information is current.

By following these steps, you can have peace of mind knowing you've taken a significant step in planning for your future well-being. Remember, this document is powerful and should be handled with the utmost care and consideration. If at any point you're unsure about how to proceed, consulting with a legal professional specializing in estate planning can provide clarity and guidance.

Understanding New Hampshire Durable Power of Attorney

What is a Durable Power of Attorney form used for in New Hampshire?

A Durable Power of Attorney (DPOA) form in New Hampshire is a legal document that allows you to appoint someone you trust, known as your agent or attorney-in-fact, to manage your financial affairs. This might include handling banking transactions, managing real estate, and making other financial decisions on your behalf. The "durable" aspect means the document remains in effect even if you become incapacitated.

How do I choose an agent for my Durable Power of Attorney?

Choosing an agent is a crucial decision since this person will have considerable authority over your finances. It should be someone you trust implicitly, such as a family member or close friend who has a good understanding of your wishes and financial matters. Consider their ability to handle financial transactions and whether they can act in your best interest, especially under stressful circumstances.

Is a lawyer required to complete a Durable Power of Attorney form in New Hampshire?

No, a lawyer is not strictly required to complete a Durable Power of Attorney form in New Hampshire. You can fill out the form on your own or with the help of online resources. However, consulting with a lawyer can be beneficial to ensure the form meets all legal requirements and accurately reflects your wishes. A lawyer can also provide valuable advice tailored to your specific financial situation.

When does a Durable Power of Attorney come into effect, and when does it end?

In New Hampshire, a Durable Power of Attorney comes into effect as soon as it is signed and notarized, unless the document specifies a different starting date. It will remain in effect until you pass away or revoke the document. Additionally, if your appointed agent is your spouse and you get divorced, the DPOA is automatically terminated unless otherwise stated in the document.

How can I revoke a Durable Power of Attorney?

To revoke a Durable Power of Attorney in New Hampshire, you must provide a written notice of revocation to your agent and any third parties who have been relying on the document. It is also recommended to retrieve all copies of the DPOA and destroy them. For added security, you can record the revocation with the same entities where you recorded the original DPOA, such as banks or the county recorder's office.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form in New Hampshire is a significant step in financial and health care planning. However, individuals often encounter mistakes that can undermine the document's effectiveness and their intentions. Here are ten commonly observed errors:

- Not specifying powers clearly: One common mistake is the failure to delineate the agent's powers with preciseness. This vagueness can lead to disputes or a lack of authority when needed most.

- Choosing the wrong agent: Selecting an agent who lacks the decision-making capability, integrity, or availability required to act in your best interest is a critical error. Trustworthiness and reliability should be paramount considerations.

- Overlooking alternates: Failing to appoint an alternate agent leaves a void if the primary agent can't serve, potentially stalling critical decisions.

- Ignoring the need for witnesses and notarization: New Hampshire laws might specify witnessing and notarization to validate the DPOA. Skipping these legal formalities can render the document invalid.

- Lack of specificity regarding gifting powers: Without explicit instructions, agents might be unable to manage gifting, which can be essential for tax planning or personal wishes.

- Excluding digital asset management: In today's digital age, not including provisions for digital assets can leave significant parts of one's estate unmanaged.

- Forgetting to specify a termination date or conditions: Without clear termination criteria, a DPOA might continue beyond the intended period, potentially leading to unwanted consequences.

- Not discussing the DPOA with the chosen agent: An agent unaware of their appointment or unwilling to act can cause complications at critical times.

- Failure to comply with state-specific requirements: Each state, including New Hampshire, has unique requirements for DPOAs. Overlooking these can invalidate the document.

- Delaying the execution of the form: Procrastination or waiting for the "right time" can result in the DPOA not being in place when needed, leading to difficulties in managing affairs during incapacitation.

To ensure a Durable Power of Attorney form accurately reflects one's wishes and is legally valid, avoiding these pitfalls is crucial. A carefully selected agent, clear delegation of authority, and compliance with legal requirements will safeguard an individual's financial and health care decisions. Additionally, regular reviews and updates to the DPOA can help address changes in personal circumstances or laws, ensuring the document remains effective. Avoiding these common mistakes will enhance the DPOA's functionality and the peace of mind it offers.

Documents used along the form

When preparing for future uncertainties, many people consider establishing a Durable Power of Attorney (DPOA) in New Hampshire. This document allows you to designate someone to make decisions on your behalf should you become unable to do so. However, the DPOA is often just one part of a comprehensive plan. Other forms and documents usually complement it to ensure thorough coverage of all aspects of one's personal and financial affairs. Let's take a closer look at four such documents.

- Advance Directive: This document, also known as a living will, outlines your wishes regarding medical care if you're unable to communicate those decisions yourself. It covers decisions like life support and pain management, ensuring your preferences are known and respected.

- Health Care Proxy: Sometimes included within an Advance Directive, a Health Care Proxy specifically allows you to designate someone to make healthcare decisions on your behalf. This role is vital if you're incapacitated and unable to make your healthcare wishes known.

- Last Will and Testament: This document specifies how you want your assets distributed after your death. It also lets you name an executor to manage the estate's affairs, ensuring your wishes are carried out as intended.

- Trust: A Trust is a legal arrangement that lets you control how your assets are managed and distributed during your lifetime and after your death. It can help avoid probate, reduce estate taxes, and provide for the management of your assets if you become incapacitated.

Each of these documents plays a crucial role in a comprehensive estate plan. While a Durable Power of Attorney allows someone to handle your financial affairs, these additional documents cover healthcare decisions, asset distribution, and more, providing peace of mind for both you and your loved ones. It's important to consult with a legal professional to ensure these documents are properly executed and reflect your wishes accurately.

Similar forms

The New Hampshire Durable Power of Attorney form is similar to other estate planning documents in various ways, yet it holds unique distinctions that are crucial for precise legal planning and personal decision-making. One of the distinguishing features of this form is its durability, denoting its effectiveness even if the principal becomes incapacitated.

The Healthcare Power of Attorney shares similarities with the New Hampshire Durable Power of Attorney in that both appoint someone to make decisions on behalf of the principal. The key difference lies in the scope of decisions each covers. While the Durable Power of Attorney often addresses financial and legal decisions, the Healthcare Power of Attorney is specific to medical and health-related decisions. This means that while both forms designate an agent to act on the principal's behalf, the context in which they operate is distinctly partitioned between health and wealth.

The General Power of Attorney is another document that bears resemblance to the Durable Power of Attorney, primarily in the delegation of decision-making authority to an appointed agent. The pivotal distinction between the two lies in their effectiveness upon the incapacitation of the principal. A General Power of Attorney typically ceases to be effective if the principal becomes incapacitated, which is contrary to the enduring nature of a Durable Power of Attorney that continues to operate irrespective of the principal’s mental state. Thus, the durability aspect fundamentally differentiates them, highlighting the importance of selecting the right type based on the principal's desires for continuity in the face of incapacity.

The Last Will and Testament is often confused with the Durable Power of Attorney, but they serve very different purposes in one's estate plan. While both documents are essential, the Last Will and Testament is used to express wishes regarding the distribution of an individual’s assets after death, appoint guardians for minors, and arguably signifies the principal's last wishes. In contrast, the Durable Power of Attorney is operative during the principal’s lifetime, particularly focusing on the management of the principal’s affairs in the event they are unable to do so themselves due to incapacity. Therefore, the Durable Power of Attorney complements the Last Will by covering the management and protection of assets during the principal’s life.

Dos and Don'ts

Things You Should Do

- Read the entire form thoroughly before beginning to fill it out, ensuring an understanding of each section's requirements and implications.

- Choose an agent (and an alternate agent) whom you trust implicitly, understanding the scope of their authority under this document.

- Be specific about the powers you grant to your agent, avoiding any ambiguity that could lead to confusion or misuse of the authority given.

- Consider discussing your wishes and instructions with the chosen agent(s) to ensure they understand your preferences and the responsibilities they are accepting.

- Have the form reviewed by a legal professional specializing in New Hampshire law to ensure that it accurately reflects your wishes and complies with current legal standards.

- Sign the document in the presence of a notary public to ensure its legality under New Hampshire law.

- Keep the original document in a safe but accessible place, and provide copies to your agent, alternate agent, and possibly your attorney.

- Inform a trusted family member or friend where the document is stored in case it needs to be accessed quickly.

- Regularly review and update the document as necessary to reflect any changes in your wishes or personal circumstances.

- Consider including a clause that necessitates your agent to provide regular updates or reports to a designated individual to maintain transparency.

Things You Shouldn't Do

- Don't choose an agent based solely on personal relationships without considering their capability to handle the responsibilities effectively.

- Don't leave any sections incomplete; an incomplete form may lead to legal uncertainties or the document being considered invalid.

- Don't use vague language when describing the powers granted to your agent; specificity is key to clarity and enforceability.

- Don't forget to sign and date the document in the presence of a notary; without this, the document may not be legally binding.

- Don't rely on generic forms without ensuring they comply with New Hampshire's specific legal requirements and statutes.

- Don't neglect to inform your agent and any alternates that you have designated them in this role; surprise responsibilities can lead to problems.

- Don't give your agent more power than necessary; limit their authority to what truly reflects your needs and wishes.

- Don't store the document in a location where no one can access it in case of an emergency; accessibility is critical.

- Don't fail to review and update the document periodically to ensure it remains relevant and effective.

- Don't overlook the potential need for a separate medical power of attorney, as the durable power of attorney focuses on financial and property matters.

Misconceptions

A Durable Power of Attorney (DPOA) is an essential legal document that allows you to appoint someone to manage your affairs if you're unable to do so yourself. However, there are several misconceptions about the New Hampshire Durable Power of Attorney form. Let's clarify some of these misunderstandings.

- It goes into effect immediately after signing. Many believe that the powers granted through a DPOA are deferred until the principal becomes incapacitated. However, unless the document specifies otherwise, it becomes effective as soon as it is signed and notarized in New Hampshire.

- It grants unlimited power. While a DPOA does grant significant authority, the powers can be limited. The document can specify which decisions the agent can make, ensuring the principal's wishes are followed.

- It's too complicated to create without a lawyer. While legal advice can be invaluable, New Hampshire provides resources for individuals to create their own DPOA. It's important to ensure the document is completed correctly, but the process can be straightforward with the right resources.

- It revokes previous powers of attorney. Signing a new DPOA in New Hampshire doesn't automatically revoke any previous versions. To invalidate an earlier document, this intent must be clearly stated within the new DPOA.

- It’s only for the elderly. People of all ages can benefit from having a DPOA. Accidents or sudden illnesses can occur at any time, making it crucial for anyone to have arrangements in place for their care and finances.

- It allows the agent to make health care decisions. A standard DPOA in New Hampshire is primarily for financial and property matters. Health care decisions require a separate document, known as a Durable Power of Attorney for Health Care.

- It’s the same in every state. Each state has its own laws regarding DPOAs. The New Hampshire Durable Power of Assistant form is tailored to meet the specific requirements and laws of New Hampshire, which may differ from those in other states.

- It can't be changed once it's signed. As long as the principal is competent, they can revoke or amend their DPOA at any time. Changes should be documented, signed, and notarized to be legally effective.

- It continues after the principal’s death. The authority granted through a DPOA in New Hampshire terminates upon the principal’s death. At that point, the executor of the estate takes over the management of the principal’s affairs.

Understanding the facts about the New Hampshire Durable Power of Attorney can help individuals make informed decisions about managing their affairs. It's an important part of planning for the future, offering peace of mind for both the person creating the document and their loved ones.

Key takeaways

When considering the New Hampshire Durable Power of Attorney form, it's essential to understand its purpose and how it functions. This legal document allows you to appoint someone you trust, often referred to as the "agent," to manage your financial affairs if you become unable to do so yourself. The "durable" aspect indicates that the power of attorney remains effective even if you become incapacitated.

- Choose Your Agent Wisely: The person you designate as your agent will have significant control over your finances and legal matters. It's crucial to select someone who is not just trustworthy, but also capable of managing these responsibilities. This could be a family member, a close friend, or a professional with a fiduciary duty to act in your best interest.

- Understand the Scope of Authority: The New Hampshire Durable Power of Attorney form allows you to specify the extent of power granted to your agent. You can choose to grant broad authority, covering all financial and legal decisions, or limit it to specific actions, such as managing real estate or financial accounts.

- Requirements for Making it Official: To ensure the form is legally binding, New Hampshire law may require the document to be notarized and witnessed. The exact requirements can vary, so it's important to consult the current state laws or a legal professional to make sure your document meets all legal standards.

- Revocation and Replacement: Life circumstances change, and there might come a time when you need to revoke or amend your Durable Power of Attorney. New Hampshire law allows you to revoke this document at any time, as long as you are mentally competent. You should inform your agent and any institutions or individuals dealing with the agent under its authority, and follow the proper legal procedure to formalize the revocation or amendment.

Using the New Hampshire Durable Power of Attorney form is a significant step in planning for the future. It ensures that someone you trust can manage your financial and legal affairs if you ever become unable to do so. Carefully selecting your agent and understanding both your rights and obligations are key to making the most out of this powerful legal tool.

Some Other New Hampshire Forms

Power of Attorney New Hampshire - It allows individuals to plan ahead for their financial and medical care, choosing agents who align with their values and preferences.

Bill of Sale for Car New Hampshire - This form is adaptable to state-specific requirements, ensuring compliance with local laws and regulations regarding ATV sales.