Fillable General Power of Attorney Template for New Hampshire

In New Hampshire, individuals have the opportunity to manage their financial and personal matters with greater flexibility and foresight by using the General Power of Attorney form. This crucial legal document allows someone to appoint another person, known as an agent, to handle a wide range of tasks and decisions on their behalf. The scope of these tasks can include managing bank accounts, buying or selling property, and handling other financial transactions. The form is designed to be comprehensive, covering a multitude of situations where the principal might need someone to act in their stead. Although this form grants broad powers, it is also bounded by the state’s regulations to ensure that it is used responsibly and in the best interest of the principal. The decision to grant such authority should not be taken lightly, as it requires trust and confidence in the appointed agent's judgment and integrity. Understanding its implications, how to properly complete it, and when it becomes effective are essential steps in this process. Furthermore, the form's durability—that is, whether it remains in effect even if the principal becomes incapacitated—can be stipulated, making it a versatile tool for future planning.

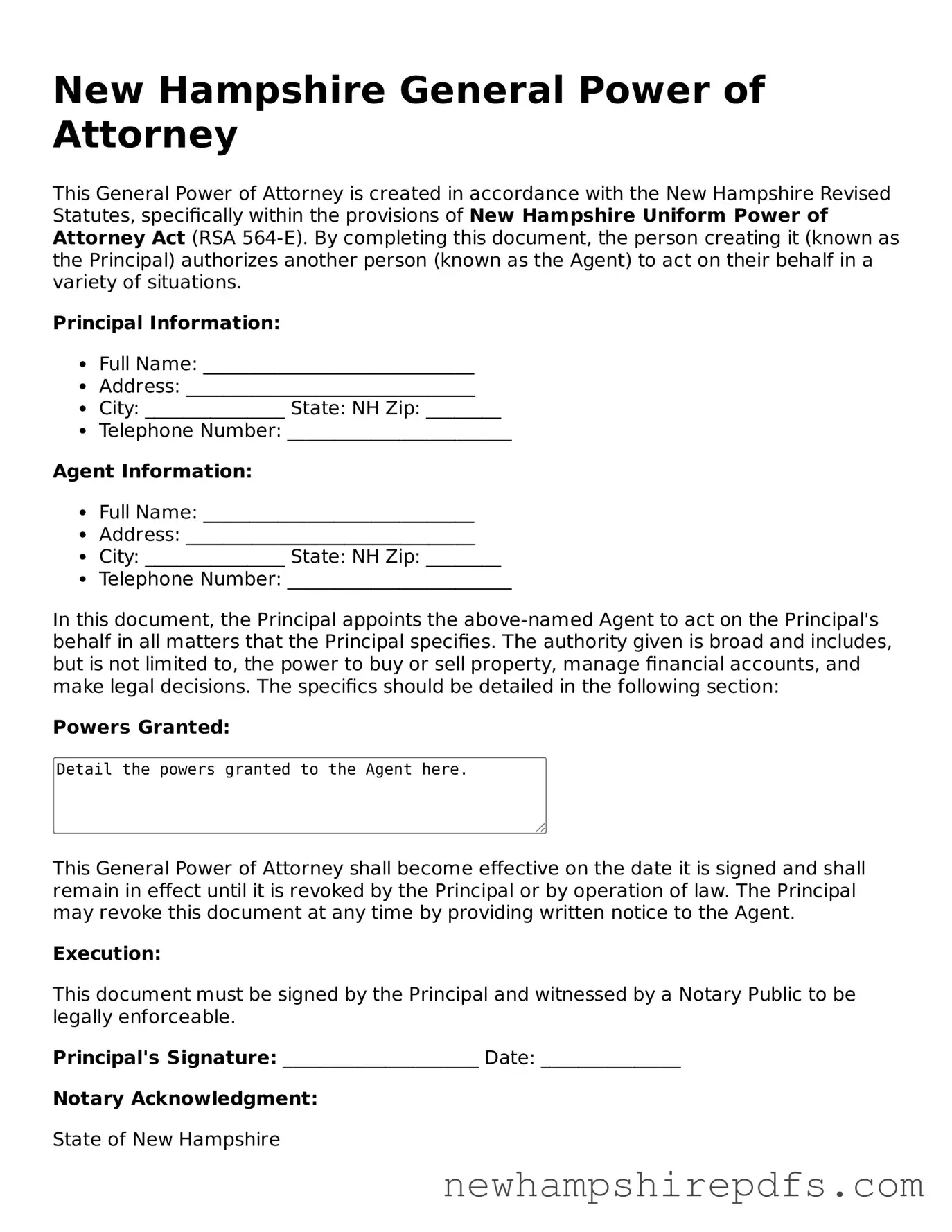

Document Sample

New Hampshire General Power of Attorney

This General Power of Attorney is created in accordance with the New Hampshire Revised Statutes, specifically within the provisions of New Hampshire Uniform Power of Attorney Act (RSA 564-E). By completing this document, the person creating it (known as the Principal) authorizes another person (known as the Agent) to act on their behalf in a variety of situations.

Principal Information:

- Full Name: _____________________________

- Address: _______________________________

- City: _______________ State: NH Zip: ________

- Telephone Number: ________________________

Agent Information:

- Full Name: _____________________________

- Address: _______________________________

- City: _______________ State: NH Zip: ________

- Telephone Number: ________________________

In this document, the Principal appoints the above-named Agent to act on the Principal's behalf in all matters that the Principal specifies. The authority given is broad and includes, but is not limited to, the power to buy or sell property, manage financial accounts, and make legal decisions. The specifics should be detailed in the following section:

Powers Granted:

This General Power of Attorney shall become effective on the date it is signed and shall remain in effect until it is revoked by the Principal or by operation of law. The Principal may revoke this document at any time by providing written notice to the Agent.

Execution:

This document must be signed by the Principal and witnessed by a Notary Public to be legally enforceable.

Principal's Signature: _____________________ Date: _______________

Notary Acknowledgment:

State of New Hampshire

County of ___________________

On this __________ day of ____________________, 20____, before me, a Notary Public, personally appeared ________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness hereof, I hereunto set my hand and official seal.

Notary Public: ___________________________________

My Commission Expires: _________________________

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | Allows one person to grant another person the authority to make a wide range of decisions on their behalf. |

| Scope | The form can include financial, real estate, business, and personal matters. |

| Governing Law | It is governed by New Hampshire Revised Statutes, specifically the Uniform Power of Attorney Act (Chapter 564-E). |

| Revocation | The document remains in effect until the principal dies or revokes the power granted, provided that it is executed properly. |

How to Use New Hampshire General Power of Attorney

A General Power of Attorney (POA) is a powerful legal document that grants someone else the authority to act on your behalf in various matters, should you be unable to do so yourself. The following steps are intended to guide you through the process of completing a General Power of Attorney form in New Hampshire. Filling out this form adequately ensures that your wishes regarding who can make decisions on your behalf are clearly documented and legally binding. It's important to approach this task with attention to detail and to fully understand each step to ensure the form is valid and reflects your intentions accurately.

- Choose an Agent: Start by selecting a trusted individual, known as an "agent," who will have the authority to act on your behalf. It's crucial that this person is reliable and capable of handling responsibilities according to your wishes.

- Fill in Your Information: Enter your full legal name and address. This identifies you as the "principal" who is granting the power of attorney.

- Specify Agent’s Details: Write the full legal name and address of your chosen agent. This ensures there's no confusion as to who is being granted the authority.

- Define the Powers: Clearly outline the specific powers and tasks you are delegating to your agent. You can grant broad powers covering a multitude of actions or limit the authority to specific acts.

- Determine Durability: Indicate whether the power of attorney should remain in effect if you become incapacitated. This means deciding if it's a "durable" power of attorney, which remains active, or "non-durable," which would end if you can no longer make decisions yourself.

- Sign and Date: After carefully reviewing the document, sign and date it in the presence of a notary public. This step is essential to validate the document.

Include Signatures from Witnesses: Depending on state requirements, you might need one or two witnesses to sign the document as well, acknowledging they observed you signing it of your own free will.- Notarization: Have the form notarized. This crucial step formally acknowledges that you signed the document willingly and under no duress, making it legally binding.

Once completed, this document serves as a formal delegation of your authority to your chosen agent, allowing them to make decisions in your stead under the conditions you've specified. It's wise to keep a copy of this document in a safe place and inform your agent where it can be found. Additionally, consider giving copies to relevant parties, such as your attorney or family members, to ensure that your agent’s authority is recognized and respected when needed.

Understanding New Hampshire General Power of Attorney

What is a General Power of Attorney form used for in New Hampshire?

In New Hampshire, a General Power of Attorney (POA) form is used to give someone else the authority to handle your affairs. This can include financial matters, buying or selling property, and other personal or business transactions. The person you choose to give this power to is called an "agent" or "attorney-in-fact," and they can act on your behalf according to the permissions you grant in the document.

Who should I choose as my agent on my General Power of Attorney form?

Choosing someone as your agent is an important decision. It should be someone you trust completely, as they will have significant control over your personal and financial matters. Many people select a close family member or a trusted friend. Make sure the person you choose is willing and able to handle the responsibilities, as they will be making decisions on your behalf.

Can I revoke my General Power of Attorney form in New Hampshire?

Yes, you can revoke your General Power of Attorney at any time, as long as you are mentally competent. To do so, you should inform your agent in writing and notify any institutions or individuals that were aware of the original POA. You might also need to record the revocation with the same authority where you registered the original POA if it was recorded.

Does a General Power of Attorney need to be notarized in New Hampshire?

Yes, for a General Power of Attorney to be legally valid in New Hampshire, it typically needs to be signed in the presence of a notary public. Notarization helps to verify the identity of the person signing the document and ensures that they are signing under their own free will, adding a layer of protection against fraud.

Is there a difference between a General and a Durable Power of Attorney in New Hampshire?

Yes, there's a significant difference. A General Power of Attorney usually becomes invalid if you become incapacitated. On the other hand, a Durable Power of Attorney remains in effect even if you become unable to make decisions for yourself. When creating a POA in New Hampshire, it's crucial to consider whether you want it to be durable, especially if you aim to plan for future incapacity.

Common mistakes

Filling out a New Hampshire General Power of Attorney (POA) form is a significant step in ensuring that one's financial affairs can be managed by someone else in case of an individual's incapacity or absence. However, mistakes in completing this form can lead to misunderstandings, legal complications, or the document being invalid. Here are five common mistakes people make, which everyone should be aware of to avoid potential problems.

Not specifying powers clearly. One of the most significant mistakes is not being clear about the powers granted to the agent. It's crucial to detail what the agent can and cannot do on your behalf. Without clarity, this might lead to the agent overstepping their boundaries or, conversely, not having enough authority to act effectively in certain situations.

Choosing the wrong agent. The decision of whom to appoint as your agent is paramount. Sometimes, individuals select an agent based on emotions rather than practicality. The designated agent should be trustworthy, competent, and capable of handling financial matters prudently. An unsuitable agent can mismanage funds, make poor decisions, or even commit fraud.

Failing to include a durability provision. A POA typically becomes invalid if the principal becomes incapacitated unless it is specifically stated to be durable. Neglecting to make a POA durable means it might not serve its primary purpose during a time when the principal needs it the most—during incapacity.

Not specifying a start and end date. Some people forget to indicate when the power of attorney will take effect and when it will end. This oversight can create confusion about the validity period of the document, potentially complicating matters when the agent needs to act on the principal's behalf.

Improper signing and notarization. The New Hampshire General Power of Attorney form must be signed and notarized correctly to be legally valid. A common error is not following the state's requirements for signing and notarization, such as neglecting to have the proper witness signatures or failing to have the document notarized. This oversight can lead to the document being considered invalid.

When completing the New Hampshire General Power of Attorney form, it is important to approach the process with attention to detail and foresight. Avoiding the above mistakes can help ensure that the document accurately reflects the principal's wishes, is legally valid, and can be relied upon when needed. Consulting with a legal professional can also provide guidance and help prevent common errors.

Documents used along the form

When preparing a General Power of Attorney (POA) in New Hampshire, it's crucial to have a comprehensive understanding of the supplemental forms and documents that can strengthen and clarify the intentions behind this legal instrument. These documents not only complement the POA but also ensure that an individual's wishes are fully protected and effectively communicated. Below are descriptions of five essential forms and documents often used alongside the New Hampshire General Power of Attorney form.

- Health Care Proxy or Advance Directive: This document allows an individual to appoint someone to make healthcare decisions on their behalf in the event they become unable to do so themselves. It may also include specific wishes regarding medical treatment and end-of-life care.

- Durable Power of Attorney for Health Care: Similar to a Health Care Proxy, this form specifically grants an agent the authority to make health care decisions. It remains effective even if the principal becomes incapacitated.

- Living Will: A Living Will outlines an individual’s desires regarding medical treatment if they are in a terminal condition or permanently unconscious. It works in conjunction with a Health Care Proxy or Durable Power of Attorney for Health Care to ensure an individual’s healthcare wishes are followed.

- Last Will and Testament: This crucial document specifies how an individual’s assets and estate will be distributed upon their death. It can appoint guardians for minor children and also name an executor to manage the estate’s affairs.

- Revocation of Power of Attorney: This form is used to cancel a previously granted Power of Attorney. It is essential for ensuring that a POA is only in effect when truly desired by the principal.

Altogether, each document plays a specific role in a well-rounded estate and healthcare planning strategy. Utilizing them in conjunction with a General Power of Attorney in New Hampshire helps in covering various aspects of an individual’s care and estate, ensuring decisions about their health, property, and finances align with their wishes, even in their absence or incapacity. It’s advisable to consult with a legal professional to fully understand each document's implications and to ensure they are properly prepared and executed.

Similar forms

The New Hampshire General Power of Attorney form is similar to other documents that also grant someone the authority to act on your behalf, but it has its own unique aspects. These documents include the Durable Power of Attorney, Medical Power of Attorney, and Limited Power of Attorney. Each serves a specific purpose and offers varying levels of control and duration over the decisions made on one's behalf.

Durable Power of Attorney: This document is quite similar to the General Power of Attorney in that it allows you to appoint someone to manage your affairs. The key difference lies in its durability. Unlike the General Power of Attorney, which may become invalid if you become incapacitated, the Durable Power of Attorney remains in effect. This is particularly important for long-term planning, ensuring that your affairs can be managed without interruption, even in the event of your incapacity.

Medical Power of Attorney: While the General Power of Attorney covers a broad range of legal and financial decisions, the Medical Power of Attorney is specifically focused on healthcare decisions. This document enables you to designate someone to make healthcare decisions on your behalf if you're unable to do so. It’s an essential tool for anyone looking to have a say in their medical treatment and end-of-life care, separate from their financial and legal affairs.

Limited Power of Attorney: Contrary to the broad authority granted by the General Power of Attorney, a Limited Power of Attorney is used to grant authority over specific tasks or for a limited time. For instance, you might use it to allow someone to sign documents related to the sale of your home while you're out of the country. It's designed for specific scenarios where full authority is not necessary or wanted, offering a more tailored approach to delegating decision-making power.

Dos and Don'ts

When filling out the New Hampshire General Power of Attorney form, it's crucial to approach the document with careful consideration and a clear understanding. This form is a powerful legal tool that allows you to grant someone else the authority to make wide-ranging legal and financial decisions on your behalf. Below are 10 dos and don'ts to consider ensuring your power of attorney accurately reflects your wishes and is executed in compliance with New Hampshire laws.

Do:

- Read the form thoroughly before beginning to fill it out. Understanding every section is key to accurately reflecting your intentions.

- Choose a trusted individual to serve as your Agent. This person will have extensive authority to act in your name, so it's vital that they are trustworthy and have your best interests at heart.

- Be specific about the powers you are granting. Although it's a general power of attorney, you have the flexibility to tailor the powers given to your needs and preferences.

- Consult with a legal professional if you have any doubts or questions. An experienced attorney can provide valuable guidance tailored to your situation.

- Sign the form in the presence of a notary public to validate its authenticity. In New Hampshire, notarization is a critical step in ensuring the document is legally binding.

- Keep the original document in a safe but accessible place, and provide copies to your Agent and any institutions that may require it.

- Inform your Agent about the exact powers you are granting them, and discuss how you expect these powers to be used.

- Consider setting a specific term for the power of attorney, especially if you only need it for a temporary period.

- Review and update the document as necessary, especially after major life events or changes in your relationship with your Agent.

- Include a revocation clause, detailing how you can terminate the power of attorney if needed.

Don't:

- Fill out the form in haste without fully understanding the implications of each section.

- Choose an Agent solely based on their relationship to you; ensure they have the capability and willingness to act in your best interest.

- Forget to specify any limitations or conditions on the Agent's power, which can help prevent unintended uses of the authority you’re granting.

- Omit a discussion with your chosen Agent about your expectations and the responsibilities involved. Clear communication is crucial.

- Overlook the importance of notarization, as failing to notarize the document could render it invalid in New Hampshire.

- Fail to inform relevant parties, such as family members or financial advisors, about the existence of the power of attorney and who you have chosen as your Agent.

- Assume the document will be effective in other states without verifying their specific requirements. Laws can vary significantly from state to state.

- Ignore the need for witnesses during the signing process, as their presence may be required to meet legal standards.

- Delay in executing the power of attorney, especially if you anticipate needing your Agent to act on your behalf in the near future.

- Believe that the power of attorney is irrevocable. You have the right to revoke or amend the document as long as you are competent to do so.

Misconceptions

General Power of Attorney forms are crucial legal instruments that allow individuals to grant others the authority to make decisions on their behalf. However, several misconceptions surround the New Hampshire General Power of Attorney form. Understanding the truth behind these misconceptions is essential for anyone looking to utilize this legal document effectively.

It grants unlimited power: Many believe that a General Power of Attorney form provides the agent with unrestricted power over all aspects of the principal's life. In reality, the form allows the principal to specify the scope of powers granted to the agent, which can be as broad or as limited as the principal desires.

It remains effective after the principal's death: Another common misconception is that the General Power of Attorney remains in effect after the principal's death. However, all powers granted through this form terminate upon the principal's death.

It overrules a will: Some people mistakenly believe that a General Power of Attorney can override the provisions of a will. In reality, a will takes precedence over a General Power of Attorney, and the form does not affect the distribution of assets after the principal's death.

Only for the elderly: While it's true that older adults often use General Power of Attorney forms, individuals of all ages can benefit from them. They are useful in a variety of scenarios, such as military deployment or extended travel.

Requires legal expertise to create: Some assume that drafting a General Power of Attorney form is complex and requires a lawyer. Although legal advice can be helpful, New Hampshire provides resources and templates to help individuals create their forms without a lawyer.

It is irrevocable: Another misconception is that once granted, a General Power of Attorney cannot be revoked. The truth is that the principal can revoke the power of attorney at any time, as long as they are mentally competent.

Effective immediately upon signing: Many believe that the General Power of Attorney takes effect as soon as it is signed. While this can be true, the principal also has the option to make it a "springing" power of attorney, meaning it only becomes effective under circumstances specified in the document, such as the principal’s incapacitation.

One size fits all: There is a notion that a single General Power of Attorney form is suitable for all situations. In fact, the form should be customized to reflect the specific needs and wishes of the principal.

Co-agents must always agree on decisions: While appointing co-agents can provide additional oversight, the principal can structure the power of attorney to allow co-agents to act independently of each other.

Notarization is optional: A widely held misconception is that notarization is not mandatory. In New Hampshire, for a General Power of Attorney to be legally binding, it must be notarized.

Addressing these misconceptions ensures individuals are fully informed about the capabilities and limitations of the New Hampshire General Power of Attorney form. It empowers them to make better decisions regarding their legal and financial affairs.

Key takeaways

When dealing with the New Hampshire General Power of Attorney (POA) form, it's essential to understand its significance and the correct way to complete and use it. This document grants another person the authority to make broad legal and financial decisions on your behalf. Here are key takeaways to ensure proper handling and utilization of the form:

- Ensure all provided information is accurate and complete. The document needs the correct names, addresses, and relevant identification details for both the principal (the person granting the power) and the agent (the person receiving the power).

- Clearly define the scope of authority given to the agent. Although a General Power of Attorney provides broad powers, specifics about what the agent can and cannot do should be explicitly stated to avoid ambiguity and misuse.

- The form must be signed in the presence of a notary public to be legally binding. This step verifies the identity of the principal and ensures that the decision to grant power of attorney was made willingly and without coercion.

- Consider the duration of the POA. The document should specify when the agent’s power begins and ends. If no end date is mentioned, it generally remains effective until revoked or until the principal's death.

- Communicate with the chosen agent about their responsibilities and your expectations. This conversation can help prevent misunderstandings and ensure that the agent is willing and able to act in your best interest.

- Keep the original document in a secure but accessible place, and provide copies to relevant parties, such as financial institutions or healthcare providers, who need to be aware of the agent's authority.

- To revoke the power of attorney, a written document clearly stating the revocation should be created and distributed to the agent and any institutions or individuals that were informed of the original POA.

Properly filling out and using the New Hampshire General Power of Attorney form can help ensure that your affairs are managed according to your wishes, even when you are not able to make those decisions yourself. Always consult with a legal advisor to tailor the POA to your specific needs and circumstances.

Some Other New Hampshire Forms

Acknowledgement Certificate Notary - It provides an added layer of assurance to all parties in a transaction that the document signed holds up to legal scrutiny and requirements.

Free Car Bill of Sale - A crucial element for personal property transactions, establishing a record of sale for items such as vehicles, electronics, and furniture.

Create Promissory Note - The agreement can be modified with both parties' consent, accommodating unforeseen changes in the lending arrangement.