Fillable Last Will and Testament Template for New Hampshire

In the picturesque state of New Hampshire, where the changing seasons reflect the cycle of life, the importance of preparing for the inevitable is embraced through the crafting of a Last Will and Testament. This legal document, a cornerstone of estate planning, ensures that an individual's final wishes regarding the distribution of their assets, the care of their minor children, and other personal matters are honored after their passing. The New Hampshire Last will and Testament form, meticulously designed to comply with state laws, empowers residents to make crucial decisions about their estate with clarity and confidence. It serves not just as a means to impart one’s assets but also embodies the last messages to loved ones, carrying profound personal and emotional value. Highlighting the necessity of such a document emphasizes the empowerment of individuals in making informed decisions about their legacies, while also navigating through the legal intricacies that govern the process in New Hampshire. It provides a legal framework that guides executors and beneficiaries, ensuring that the will maker's intentions are effectively realized, minimizing disputes among surviving relatives, and protecting the rights and inheritances of the designated heirs. Therefore, understanding the structure, requirements, and significance of the New Hampshire Last Will and Testament form is the first step for residents aiming to secure their legacy and provide peace of mind for themselves and their loved ones.

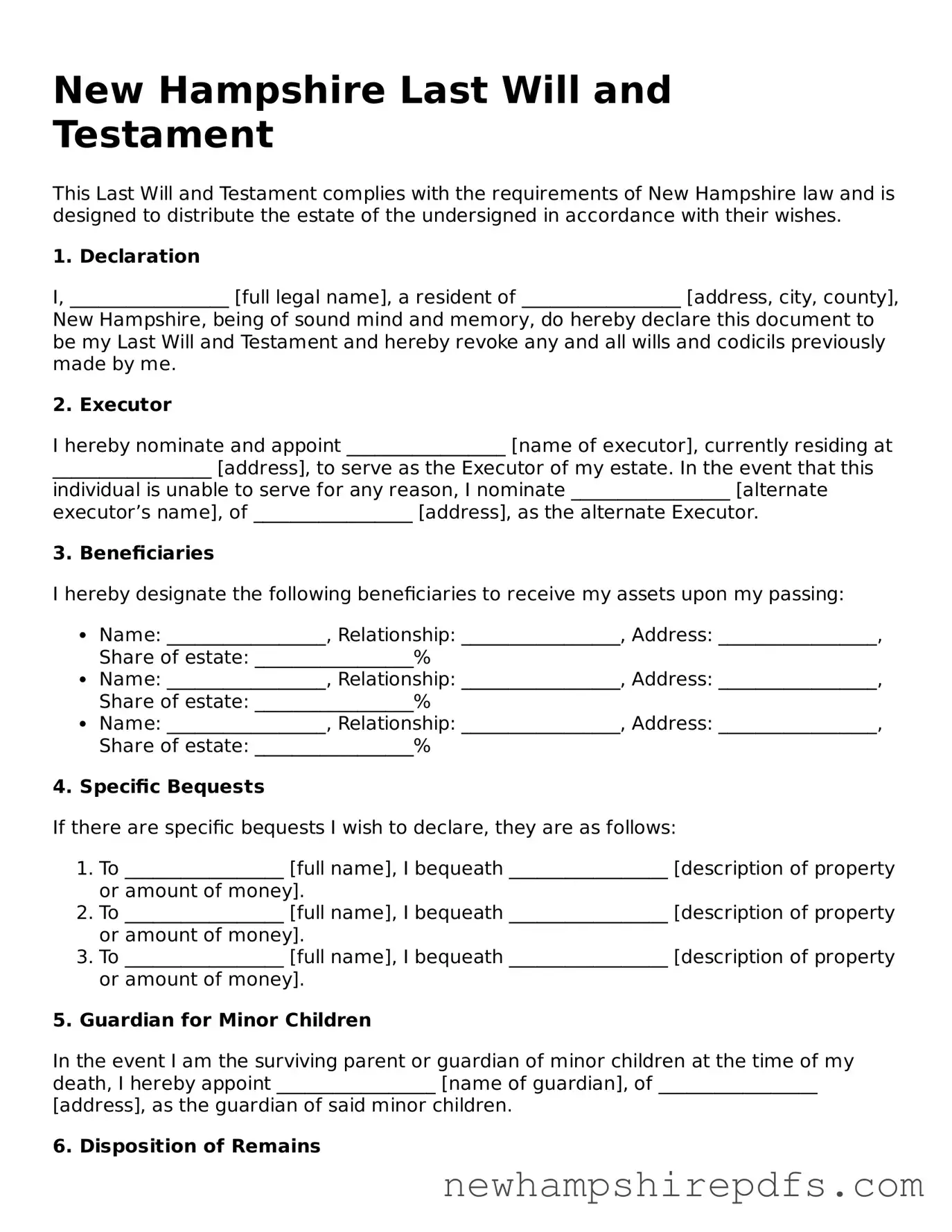

Document Sample

New Hampshire Last Will and Testament

This Last Will and Testament complies with the requirements of New Hampshire law and is designed to distribute the estate of the undersigned in accordance with their wishes.

1. Declaration

I, _________________ [full legal name], a resident of _________________ [address, city, county], New Hampshire, being of sound mind and memory, do hereby declare this document to be my Last Will and Testament and hereby revoke any and all wills and codicils previously made by me.

2. Executor

I hereby nominate and appoint _________________ [name of executor], currently residing at _________________ [address], to serve as the Executor of my estate. In the event that this individual is unable to serve for any reason, I nominate _________________ [alternate executor’s name], of _________________ [address], as the alternate Executor.

3. Beneficiaries

I hereby designate the following beneficiaries to receive my assets upon my passing:

- Name: _________________, Relationship: _________________, Address: _________________, Share of estate: _________________%

- Name: _________________, Relationship: _________________, Address: _________________, Share of estate: _________________%

- Name: _________________, Relationship: _________________, Address: _________________, Share of estate: _________________%

4. Specific Bequests

If there are specific bequests I wish to declare, they are as follows:

- To _________________ [full name], I bequeath _________________ [description of property or amount of money].

- To _________________ [full name], I bequeath _________________ [description of property or amount of money].

- To _________________ [full name], I bequeath _________________ [description of property or amount of money].

5. Guardian for Minor Children

In the event I am the surviving parent or guardian of minor children at the time of my death, I hereby appoint _________________ [name of guardian], of _________________ [address], as the guardian of said minor children.

6. Disposition of Remains

I direct that upon my death, my remains shall be _________________ [buried/cremated/otherwise handled] according to the following instructions: _________________.

7. Severability

If any part of this Last Will and Testament is deemed unenforceable by a court, the remaining parts shall remain in full force and effect.

8. Signatures

This Will was signed in the presence of witnesses on __________________ [date].

Testator: __________________ [signature]

Witness #1: __________________ [signature]

Witness #2: __________________ [signature]

This document was prepared in compliance with the laws of the State of New Hampshire and is intended to be a legally binding document. By signing below, all parties agree to the terms and provisions contained within this Last Will and Testament.

PDF Form Breakdown

| Fact | Detail |

|---|---|

| Legal Age Requirement | A person must be at least 18 years old to create a valid Will in New Hampshire. |

| Witness Requirement | A Will must be signed by at least two competent witnesses who are not beneficiaries. |

| Self-Proving Affidavits | New Hampshire allows the use of a self-proving affidavit to make the Will self-proved, simplifying the probate process. |

| Revocation | A Will can be revoked by creating a new Will or by physically destroying the original with the intent to revoke. |

| Governing Law | The New Hampshire Revised Statutes Title LVI Chapters 551 to 564-A govern Wills in New Hampshire. |

How to Use New Hampshire Last Will and Testament

Creating a Last Will and Testament is a critical step in managing your estate and ensuring that your wishes are honored. This document dictates how your assets should be distributed among your heirs and can also appoint guardians for minor children. In New Hampshire, the process to create a legally binding Last Will and Testament requires careful attention to detail and adherence to state laws. To fill out this form correctly, follow the steps outlined below. This will ensure that your document is valid and can safeguard your last wishes.

- Gather all necessary information including asset details, beneficiary names, and guardian information for any minor children.

- Enter your full legal name and address at the top of the document to establish your identity as the testator (the person creating the will).

- If applicable, specify any previous wills that this document replaces, indicating that this will is your final and most current testament.

- Appoint an executor, who will manage and distribute your estate according to the instructions laid out in your will. Include the executor's full name and contact details.

- Designate guardians for any minor children, providing their full names and contact information, to ensure they are cared for by trusted individuals in your absence.

- List all beneficiaries along with their relationship to you and specific assets or portions of your estate they will receive. Be as clear and detailed as possible to avoid any confusion or disputes.

- If desired, add instructions for the distribution of personal items or properties that hold sentimental value. This can help prevent future conflicts among your heirs.

- Review all provided details carefully to ensure accuracy and completeness. Any errors or omissions could lead to disputes or difficulties in executing your will.

- Sign and date the document in front of two witnesses who are not beneficiaries of the will. New Hampshire law requires these witnesses to also sign, acknowledging they observed you signing the will voluntarily.

- Consider having the document notarized to further authenticate its validity, although this is not a legal requirement in New Hampshire.

Once completed, store your Last Will and Testament in a secure yet accessible location and inform your executor or a trusted family member of its location. Periodically review and update your will as necessary to reflect any changes in your life circumstances or wishes. Following these steps can provide peace of mind, knowing that your affairs are in order for the benefit of your loved ones.

Understanding New Hampshire Last Will and Testament

What is required for a Last Will and Testament to be valid in New Hampshire?

In New Hampshire, for a Last Will and Testament to be considered valid, the document must be written by someone who is at least 18 years old and of sound mind at the time of drafting. The Will must be in writing, signed by the testator (the person making the Will), and witnessed by at least two individuals who observed the testator signing the document. These witnesses must also sign the Will in the presence of the testator and in each other's presence.

Can I write my Last Will and Testament in New Hampshire without an attorney?

Yes, you can write your Last Will and Testament in New Hampshire without the assistance of an attorney. However, it is advised to consider consulting with a legal professional, especially if your estate includes significant assets, to ensure that the Will complies with state laws and fully reflects your wishes.

How can I change my Last Will and Testament once it has been made?

In New Hampshire, you can change your Last Will and Testament at any time while you are still alive and of sound mind. Changes can be made by drafting a new Will that revokes the previous one or by creating a legal addendum called a codicil, which is attached to the current Will. Both methods require the same formal witnessing and signing procedures as the original Will.

What happens if I die without a Last Will and Testament in New Hampshire?

If you die without a Last Will and Testament in New Hampshire, your estate will be distributed according to the state's intestacy laws. This typically means your assets will be divided among your closest relatives, starting with your spouse, children, parents, and then extending outwards to more distant relatives. The absence of a Will may lead to outcomes that might not align with your intended wishes for the distribution of your assets.

Do I need to notarize my Last Will and Testament in New Hampshire for it to be valid?

No, notarization is not a requirement for a Last Will and Testament to be valid in New Hampshire. However, having a Will notarized can be beneficial as it allows the document to be self-proving. A self-proving Will can expedite the probate process since the court can accept the document without needing to call the witnesses who signed it to testify to its authenticity.

Common mistakes

When creating a Last Will and Testament, it's essential to approach the process with care and attention to detail. Unfortunately, people often make several common mistakes while filling out their Last Will and Testament form, especially in New Hampshire. These errors can complicate the probate process and could lead to a distribution of your estate that doesn’t align with your intentions.

One of the key mistakes is not being specific enough about who receives what. Without clear instructions, it can be challenging for the executor of the will to distribute assets as you would have wanted. This vagueness can also lead to disputes among your heirs, potentially resulting in prolonged legal battles that could diminish the value of your estate.

Another frequent oversight is failing to update the will after major life changes. Events such as marriage, divorce, the birth of a child, or the death of a beneficiary should prompt a review and possibly an update to your will to ensure it reflects your current wishes and circumstances.

- Not appointing an executor or choosing someone unqualified for the role. The executor plays a crucial part in managing and distributing your estate. It’s vital to appoint someone who is both willing and able to take on these responsibilities.

- Forgetting to sign the will in the presence of witnesses. In New Hampshire, as in many states, for a will to be legally valid, it must be signed by the person making the will (the testator) in the presence of two witnesses. These witnesses must also sign the document, affirming they observed the testator’s signature.

- Using ambiguous language that can lead to multiple interpretations. It’s crucial that the language in your will is clear and leaves no room for misinterpretation.

- Not considering the impact of taxes and debts on your estate. Understanding and planning for these financial factors can help ensure that your beneficiaries receive the inheritance you intend for them.

- Attempting to pass along assets that are already directed by law to pass in another manner, such as life insurance policies or retirement accounts that have named beneficiaries.

Lastly, one of the most critical mistakes is trying to do it all alone without seeking professional advice. While it is possible to create a will on your own, consulting with an estate planning attorney can provide valuable insights and help avoid potential pitfalls. They can ensure that your will is not only clear and comprehensive but also complpliant with New Hampshire law. By being aware of and avoiding these common mistakes, you can create a Last Will and Testament that effectively communicates your wishes and protects the interests of your loved ones.

Documents used along the form

When preparing a Last Will and Testament in New Hampshire, several additional forms and documents are often required to ensure a comprehensive estate plan. These documents complement the Will by covering aspects that the Will itself does not address, or by providing necessary information to executors and beneficiaries. This ensures clarity, minimizes legal complications, and provides peace of mind to all parties involved.

- Advance Directive: A document allowing individuals to state their wishes for end-of-life medical care, in case they become unable to communicate their decisions themselves. It often includes a living will and a power of attorney for health care.

- Durable Power of Attorney for Finances: Grants a trusted person authority to manage the financial affairs of the individual, should they become incapacitated.

- Funeral Planning Declarations: Specifies the individual's preferences for funeral arrangements and the disposition of their remains, alleviating the burden on loved ones to make these decisions during a time of grief.

- Trust Agreement: Establishes a trust to manage the individual's assets according to their wishes, either during their lifetime or after their death. This can help avoid probate and manage estate taxes.

- Digital Assets Memorandum: Provides instructions and powers to handle the individual's digital assets, including social media accounts, digital files, and online financial accounts.

- Letter of Intent: A non-binding document accompanying the Will that provides additional personal wishes that are not legally enforceable, such as preferences for personal items distribution.

- Life Insurance Policies: Documents detailing life insurance policies, beneficiaries, and terms of payout, which are important for financial planning and ensuring beneficiaries are aware of policies they may need to claim.

- Personal Property Memorandum: Often referenced in the Will, this document allows individuals to specify the distribution of tangible personal property not otherwise singled out in the Will.

- Beneficiary Designations: Forms that designate beneficiaries for specific assets, such as retirement accounts and life insurance policies, which pass outside of the Will.

Each of these documents serves a particular purpose and contributes to a complete and effective estate plan. By addressing a broad range of personal and financial matters, they work together with the Last Will and Testament to ensure an individual's wishes are honored. Legal professionals in New Hampshire can provide guidance on the preparation and integration of these documents into an estate plan.