Fillable Mobile Home Bill of Sale Template for New Hampshire

When embarking on the journey of buying or selling a mobile home in New Hampshire, an essential document that comes into play is the Mobile Home Bill of Sale form. This critical piece of paperwork serves as the linchpin in cementing the transaction, providing a legal record that ownership has been transferred from one party to another. Not only does it detail the agreement between buyer and seller, including the financial terms, but it also outlines the specifics of the mobile home itself, such as make, model, year, and serial number. Furthermore, this form plays a vital role in the registration process, ensuring that the new owner can rightfully establish their claim to the property. Beyond its functionality in the transaction process, the Mobile Home Robinette of Sale form acts as a safeguard for both parties, offering protection in the event of future disputes over the mobile home's ownership or condition at the time of sale. Hence, understanding its major aspects is not merely beneficial but crucial for anyone looking to navigate the complexities of buying or selling a mobile home in New Hampshire.

Document Sample

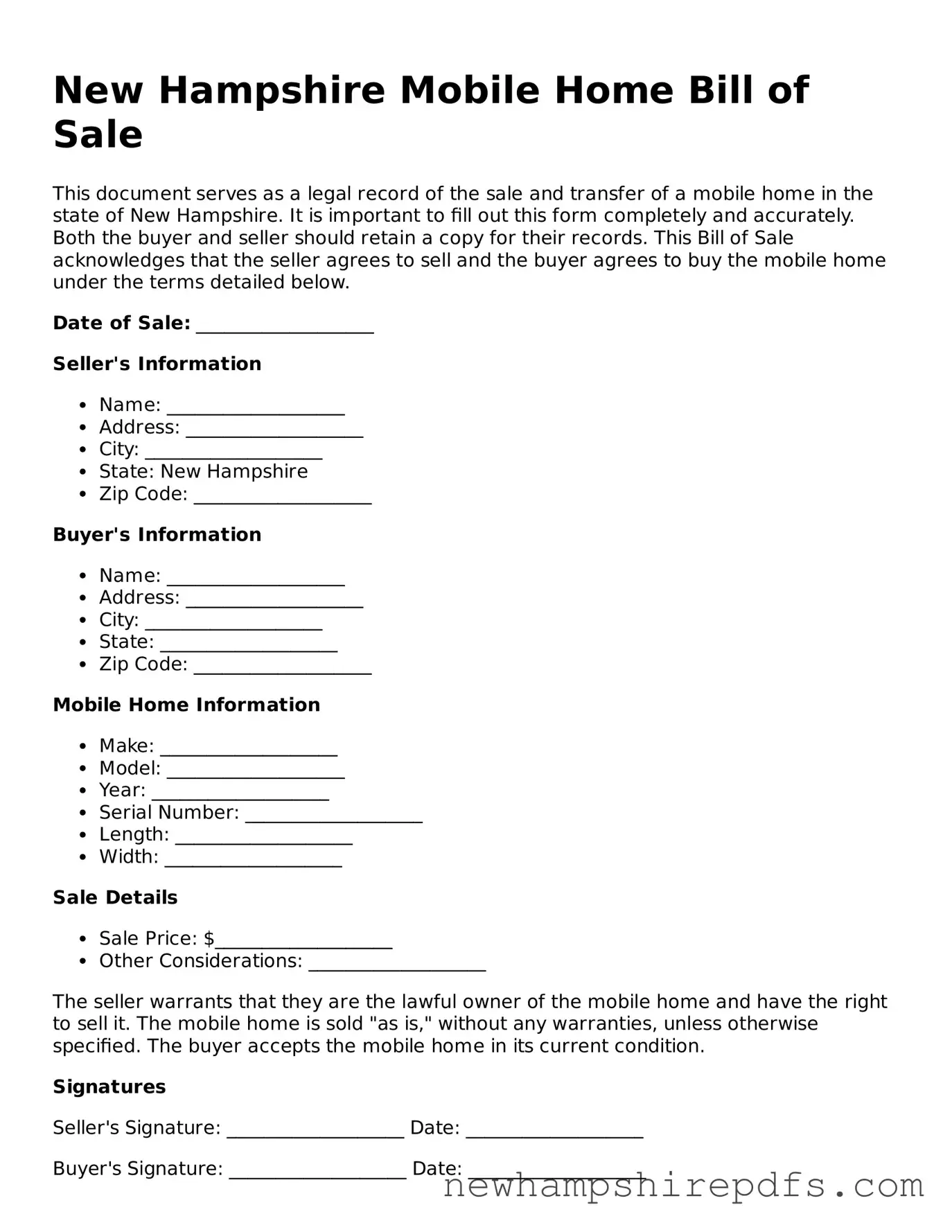

New Hampshire Mobile Home Bill of Sale

This document serves as a legal record of the sale and transfer of a mobile home in the state of New Hampshire. It is important to fill out this form completely and accurately. Both the buyer and seller should retain a copy for their records. This Bill of Sale acknowledges that the seller agrees to sell and the buyer agrees to buy the mobile home under the terms detailed below.

Date of Sale: ___________________

Seller's Information

- Name: ___________________

- Address: ___________________

- City: ___________________

- State: New Hampshire

- Zip Code: ___________________

Buyer's Information

- Name: ___________________

- Address: ___________________

- City: ___________________

- State: ___________________

- Zip Code: ___________________

Mobile Home Information

- Make: ___________________

- Model: ___________________

- Year: ___________________

- Serial Number: ___________________

- Length: ___________________

- Width: ___________________

Sale Details

- Sale Price: $___________________

- Other Considerations: ___________________

The seller warrants that they are the lawful owner of the mobile home and have the right to sell it. The mobile home is sold "as is," without any warranties, unless otherwise specified. The buyer accepts the mobile home in its current condition.

Signatures

Seller's Signature: ___________________ Date: ___________________

Buyer's Signature: ___________________ Date: ___________________

This document is subject to and governed by the laws of the State of New Hampshire. It is advised to consult with a legal professional before finalizing the sale. Completing this document does not necessarily fulfill all legal obligations related to the sale of a mobile home in New Hampshire. The parties must comply with all applicable state laws and regulations.

PDF Form Breakdown

| Fact Number | Fact Detail |

|---|---|

| 1 | The New Hampshire Mobile Home Bill of Sale form is a legal document that records the sale and transfer of ownership of a mobile home from the seller to the buyer within the state of New Hampshire. |

| 2 | This form requires specific information, including the names and addresses of both the seller and the buyer, as well as the make, model, year, and serial number of the mobile home. |

| 3 | The form must also include the sale date and the purchase price of the mobile home to be legally valid. |

| 4 | In New Hampshire, the law necessitates that the bill of sale for a mobile home be notarized, meaning a notary public must witness the signing of the document. |

| 5 | Governing law for the Mobile Home Bill of Sale in New Hampshire is under RSA 382-A, which pertains to the Uniform Commercial Code (UCC) as adopted by the state, specifically dealing with personal property sales. |

| 6 | Using a Mobile Home Bill of Sale in New Hampshire is essential for the buyer's protection, as it provides proof of ownership and can assist in resolving any future legal disputes that may arise. |

| 7 | Additionally, this document can be crucial for the buyer for tax assessment purposes and must be presented when registering the mobile home with local authorities. |

| 8 | It’s recommended that both the buyer and seller keep copies of the notarized Mobile Home Bill of Sale for their records and any future verification needs. |

| 9 | Aside from the Bill of Sale, the transfer of a mobile home in New Hampshire may require additional documents, such as a Certificate of Title, especially if the mobile home is considered real property. |

| 10 | Failure to properly complete and submit the necessary forms, including the Bill of Sale, can result in legal complications, making it vital for both parties to ensure all paperwork is accurately completed and duly notarized. |

How to Use New Hampshire Mobile Home Bill of Sale

When selling or buying a mobile home in New Hampshire, the transaction is formalized with a Bill of Sale form. This document plays a pivotal role in recording the details of the sale, ensuring both the buyer and the seller have a written account of the conditions and terms. It’s also vital for registration, tax, and legal purposes. Completing this form accurately is essential to avoid potential discrepancies or legal complications down the line. Here’s how to accurately fill out the New Hampshire Mobile Home Bill of Sale form step by step.

- Start by entering the date of the sale in the designated space.

- Next, fill in the full legal names and addresses of both the seller and the buyer. Make sure these details are precise to avoid any confusion.

- Describe the mobile home in detail. Include the make, model, year, and vehicle identification number (VIN). If there are any additional identifying features, list them here.

- Specify the sale price of the mobile home in dollars, ensuring that both parties agree on this amount.

- If there are any terms and conditions associated with the sale, such as warranties or specific responsibilities of the buyer and seller, mention them clearly in the provided section.

- Both the seller and the buyer must sign and print their names on the form. The date of signing should be recorded next to the signatures.

- In some cases, witness signatures may be required. If so, make sure a witness signs the form, verifying the authenticity of the transaction.

- For added security and verification, it’s highly recommended to notarize the bill of sale. Though not always a requirement, having the form notarized can provide legal protection and peace of mind for both parties.

Once the form is fully completed and signed by all parties, make sure to distribute copies accordingly. The buyer will require the original for registration and legal purposes, while the seller should keep a copy for personal records. This document serves as a crucial piece of evidence in the transaction, offering protection and clarity. It’s important that both the buyer and seller review all the information carefully before signing, to ensure all details are correct and mutually agreed upon.

Understanding New Hampshire Mobile Home Bill of Sale

What is a Mobile Home Bill of Sale form in New Hampshire?

A Mobile Home Bill of Sale form in New Hampshire is a legal document that records the sale and transfer of ownership of a mobile home from the seller to the buyer. It contains important information including the names and addresses of the parties involved, the sale price, and a detailed description of the mobile home, among other details.

Why is a Mobile Home Bill of Sale form necessary?

This form is necessary because it provides a written record of the transaction, which is crucial for legal, tax, and personal record-keeping purposes. It serves as proof of ownership for the buyer and helps to protect the rights of both buyer and seller in the event of future disputes.

What information is typically included in the New Hampshire Mobile Home Bill of Sale form?

The form typically includes the names and addresses of the buyer and seller, the sale date, the sale price, a description of the mobile home (including make, model, year, and serial number), and the signatures of both parties. It may also include information about any warranties or guarantees.

Is notarization required for a Mobile Home Bill of Sale in New Hampshire?

Notarization is not a mandatory requirement for a Mobile Home Bill of Sale in New Hampshire to be legally valid. However, getting the form notarized can add an extra layer of legal protection and authenticity to the document.

Can you sell a mobile home in New Hampshire without a Bill of Sale?

While technically it might be possible to sell a mobile home without a Bill of Sale, it is highly discouraged. A Bill of Sale is essential for providing legal proof of the transaction and transferring ownership. Without this document, the buyer's legal ownership could be difficult to prove, potentially leading to legal complications.

How does a Mobile Home Bill of Sale affect property taxes in New Hampshire?

The Mobile Home Bill of Sale may have implications for property taxes, as it provides official documentation of the sale price and transfer of ownership. Local tax authorities could use this information to reassess the property value and adjust taxes accordingly. Buyers and sellers should consult with a tax advisor or local tax office for specific advice.

What steps should be taken after completing the Mobile Home Bill of Sale form?

After completing the form, both the buyer and seller should keep a copy for their records. The buyer should also take steps to officially register the mobile home in their name if required by local law, and consult with an insurance provider to ensure the mobile home is properly insured.

Does a Mobile Home Bill of Sale need to be filed with any New Hampshire state or local government offices?

While the Mobile Home Bill of Sale itself does not usually need to be filed with state or local government offices, the buyer may need to use this document to register the mobile home and transfer the title into their name, depending on local regulations. It is best to contact the local Department of Motor Vehicles or similar entity for specific requirements.

Can a Mobile Home Bill of Sale form be used for financing the purchase of a mobile home?

Yes, a Mobile Home Bill of Sale form can be used to support the financing of a mobile home purchase. Lenders may require this document as part of the loan application process to verify the sale and confirm the details of the mobile home being financed.

What are the consequences of not using a Mobile Home Bill of Sale when selling a mobile home in New Hampshire?

Not using a Mobile Home Bill of Sale can lead to various legal and financial risks, including disputes over ownership, difficulty in proving ownership for registration and insurance purposes, and potential issues with tax assessments. It's strongly advised to use a Bill of Sale to ensure a clear, legal sale and transfer of ownership.

Common mistakes

When completing the New Hampshire Mobile Home Bill of Sale form, several common mistakes can lead to delays or complications in the transaction process. These errors can vary from simple oversights to more significant inaccuracies that could affect the legality of the document. Understanding and avoiding these mistakes is crucial for both the buyer and the seller.

Not including detailed information about the mobile home: It's essential to provide comprehensive details about the mobile home, such as the make, model, year, serial number, and any distinguishing features. Leaving out any of these details can cause confusion and discrepancies in the sale.

Failing to verify the accuracy of the information: Both parties need to ensure that all the information on the form is accurate and truthful. Misrepresentations or errors, whether intentional or accidental, can invalidate the agreement or lead to future legal disputes.

Omitting the sale price or entering it incorrectly: The sale price must be clearly stated and agreed upon by both parties. Incorrectly listing the sale price or leaving it blank can cause issues with tax assessments, financing, and the transfer of ownership.

Not specifying the payment terms: If the payment for the mobile home is not made in full at the time of sale, the specific terms, including installment payments, interest rates, and due dates, should be clearly outlined in the bill of sale.

Skipping over the disclosure of liens or encumbrances: The seller must disclose any liens, mortgages, or encumbrances on the mobile home. Failure to disclose such information can result in legal complications for the buyer in the future.

Forgetting to include the date of the sale: The sale date is crucial for record-keeping and legal purposes. It establishes when the ownership transfer is intended to occur and can affect warranty periods and responsibility for the mobile home.

Leaving out signatures and dates: The bill of sale must be signed and dated by both parties to be legally binding. Unsigned or undated documents may not be recognized as valid contracts, making it difficult to enforce the agreement.

Not witnessing or notarizing the document when required: While New Hampshire may not mandate notarization for all mobile home sales, getting the document notarized or witnessed can add a layer of authenticity and may be required by certain institutions or for specific situations.

In conclusion, when filling out a New Hampshire Mobile Home Bill of Sale form, paying close attention to detail and ensuring the completeness and accuracy of all entered information is crucial. Avoiding these common mistakes can help facilitate a smooth and legally sound transaction, protecting the interests of both the buyer and the satellite.

Documents used along the form

Transferring ownership of a mobile home in New Hampshire involves several documents in addition to the Mobile Home Bill of Sale form. These forms ensure that the sale complies with state laws and regulations and helps both the buyer and seller to protect their rights. Below is a list of documents that are often required or recommended to be used together with the Mobile Home Bill of Sale for a smooth and legally compliant transaction.

- Title Application: This form is necessary for the buyer to apply for a new title in their name. It serves as proof of ownership and is required for registering the mobile home.

- Manufacturer’s Certificate of Origin: For new mobile homes, this document acts as the initial title, indicating the mobile home’s manufacturer, make, model, and year. It’s transferred from the seller to the buyer.

- Release of Lien: If there was a loan on the mobile home that has been paid off, this document, issued by the lender, releases the lien on the mobile home, allowing the title to be transferred to the new owner.

- Property Tax Receipts: Buyers should request the most recent property tax receipts to ensure that all taxes on the mobile home have been paid up to date. This helps to avoid any legal issues related to unpaid taxes.

- Proof of Insurance: Often, the buyer will need to show proof of insurance on the mobile home before the sale can be completed. It protects both buyer and seller against potential liabilities.

- Mobile Home Park Agreement: If the mobile home is located in a park, an agreement or lease with the park is necessary. This document outlines the terms and conditions of the mobile home’s location, including rent, rules, and any park-related fees.

Together, these documents complement the Mobile Home Bill of Sale, ensuring a comprehensive approach to transferring ownership. It's crucial for both parties to thoroughly understand and properly complete these documents to ensure the legality of the sale and to safeguard their interests throughout the process.

Similar forms

The New Hampshire Mobile Home Bill of Sale form is similar to other types of property transfer documents, each serving to formalize the process of transferring ownership. These documents, while tailored to different types of property, share common functions: they provide proof of transfer, specify the terms of the sale, and include vital information about the seller, buyer, and the property itself. Below are some examples of documents with similar purposes and content, explained in detail.

Vehicle Bill of Sale: Much like the Mobile Home Bill of Sale, a Vehicle Bill of Sale is used when one party sells a vehicle to another. Both documents include critical details such as the make, model, year, and identification numbers of the property being sold (for vehicles, the Vehicle Identification Number or VIN; for mobile homes, a serial number or similar identifier). Both forms also capture the sale price, the names and contact information of both seller and buyer, and they may specify the condition of the sale item. The primary difference lies in the type of property being transferred, but the core purpose and structure of the document remain the same.

Real Estate Purchase Agreement: This document is another parallel, particularly because a mobile home can be considered real estate when it is attached to a specific piece of land. Like the Mobile Home Bill of Sale, a Real Estate Purchase Agreement outlines the terms of the sale, identifying information about the property, and details regarding the seller and buyer. It also covers the purchase price, closing details, and any conditions or clauses specific to the real estate transaction. The main distinctions are the inclusion of more comprehensive legal terms and conditions that are specific to real estate transactions, such as financing terms and any contingencies relating to the property inspection.

General Bill of Sale: The General Bill of Sale is a more versatile document used to record the sale of various types of personal property, including but not limited to, equipment, firearms, and general personal property. Like the Mobile Home Bill of Sale, it captures the essential information of the transaction: seller and buyer’s details, a description of the item sold, and the price. Although it lacks the specificity related to mobile homes or vehicles, such as identification numbers or make and model details, its purpose to prove ownership transfer and detail the terms of the sale aligns closely with that of the Mobile Home Bill of Sale.

Dos and Don'ts

When filling out the New Hampshire Mobile Home Bill of Sale form, it's important to ensure that all information is accurate and comprehensive. This document is a legal record that proves the transfer of ownership of a mobile home from the seller to the buyer. To assist you in completing this form properly, here is a list of things you should and shouldn't do.

Do:

- Verify the mobile home's information: Make sure that the mobile home's description, including its make, model, year, and serial number, is accurately recorded.

- Include personal details of both parties: Clearly write the full names, addresses, and contact information of both the seller and the buyer.

- Record the sale date and price: State the exact sale date and the total amount agreed upon for the sale of the mobile home.

- Describe the condition of the mobile home: Specify the current condition of the mobile home, including any existing damages or modifications.

- Use clear and legible handwriting: Ensure that all entries are easy to read to avoid misunderstandings or processing delays.

- Sign and date the form: Both the seller and the buyer must sign and date the form to validate the agreement.

- Make copies for both parties: After completing the form, make sure each party receives a copy for their records.

- Check for notarization requirements: Some transactions may require the bill of sale to be notarized. Verify if this applies to your situation.

- Include any warranties or guarantees: If any are provided, clearly state the details on the form.

- Retain a copy for your records: Keep a copy of the signed form in your personal records for future reference.

Don't:

- Omit relevant information: Leaving out important details can invalidate the form or cause legal complications.

- Use pencil or erasable ink: Fill out the form in permanent ink to prevent alterations or tampering.

- Forget to check for liens: Ensure there are no outstanding liens against the mobile home before completing the sale.

- Rely solely on verbal agreements: Always document any agreements or terms related to the sale on the bill of sale.

- Rush through the process: Take your time to review all the information carefully before signing.

- Ignore state-specific requirements: Each state may have different requirements for a mobile home bill of sale. Comply with New Hampshire's specific regulations.

- Alter the form after signing: Any changes made after both parties have signed should be agreed upon in writing and initialed by both parties.

- Assume the bill of sale transfers the title: In most cases, you will also need to complete a separate title transfer process with the state.

- Forget to verify the buyer's or seller's identity: Confirm that all parties are who they claim to be to prevent fraud.

- Sign without understanding: Ensure you fully understand every aspect of the agreement before signing.

Misconceptions

When transferring ownership of a mobile home in New Hampshire, it's paramount to have accurate and up-to-date information. There are a few common misconceptions regarding the Mobile Home Bill of Sale form that need clarification to ensure both buyer and seller navigate this process smoothly and effectively.

- It's Just a Simple Document: Many people mistakenly believe that the Mobile Home Bill of Sale is a simple document that just records the sale. However, it serves as a legally binding contract between the buyer and seller, detailing the agreement's terms and ensuring the legal transfer of ownership.

- One Size Fits All: Another misconception is that there is a one-size-fits-all form for every mobile home sale in New Hampshire. In reality, while there is a standard form, specific details and requirements may vary depending on the local jurisdiction. It is essential to verify that the form used complies with local regulations.

- No Need for a Witness or Notarization: Many assume that the Mobile Home Bill of Sale does not need to be witnessed or notarized. This is not always the case. Depending on the local jurisdiction's requirements in New Hampshire, having the document witnessed or notarized can be necessary to ensure its legal validity.

- Only the Buyer Needs to Keep a Copy: A common misconception is that only the buyer needs to keep a copy of the Mobile Home Bill of Sale. Both the buyer and seller should keep copies of the bill of sale for their records. It serves as proof of transfer and can be important for tax purposes, securing financing, or addressing any future disputes that may arise.

It's crucial for both parties involved in the transaction of a mobile home to understand these key points to prevent legal and administrative issues down the line. By demystifying these common misconceptions, buyers and sellers can ensure a smoother and more secure transfer process.

Key takeaways

Filling out and using the New Hampshire Mobile Home Bill of Sale form correctly is crucial for the valid transfer of ownership. Here are key takeaways to ensure the process is done correctly:

Ensure all parties have accurate information about the mobile home, including make, model, year, and serial number. This information helps in identifying the mobile home and ensuring that the sale is for the correct item.

The sale price should be clearly stated in the form. Both the buyer and the seller need to agree on this amount, and it should be written in numeric and written form to avoid confusion and ensure clarity.

Include the date of sale on the form. This is important for record-keeping and can be vital for future reference if there are any disputes or inquiries regarding the transaction.

Both the buyer and the seller must sign and print their names on the form. These signatures are essential to validate the form and legally transfer ownership of the mobile home from the seller to the buyer.

The form should mention any warranties or disclosures related to the mobile home. If the mobile home is being sold "as is," this should be clearly stated to inform the buyer that the seller is not responsible for future repairs or maintenance.

It is advisable for both the buyer and the seller to keep a copy of the completed Bill of Sale. Having this document on hand will be useful for registration, title transfer, and resolving any potential disputes regarding the sale.

Following these guidelines will help ensure that the sale of a mobile home in New Hampshire is conducted smoothly and protects the interests of both the buyer and the seller.

Some Other New Hampshire Forms

Bill of Sale for Car New Hampshire - This document conveniently organizes all necessary information about the sale into one place, simplifying future reference or legal needs.

Auto Bill of Sale New Hampshire - Filling out this form accurately is crucial, as errors can complicate the registration and titling process for the new owner.

Nh Small Estate Probate - A convenient tool for beneficiaries aiming to collect their inheritance without enduring probate court delays.