Download New Hampshire 2620 Template in PDF

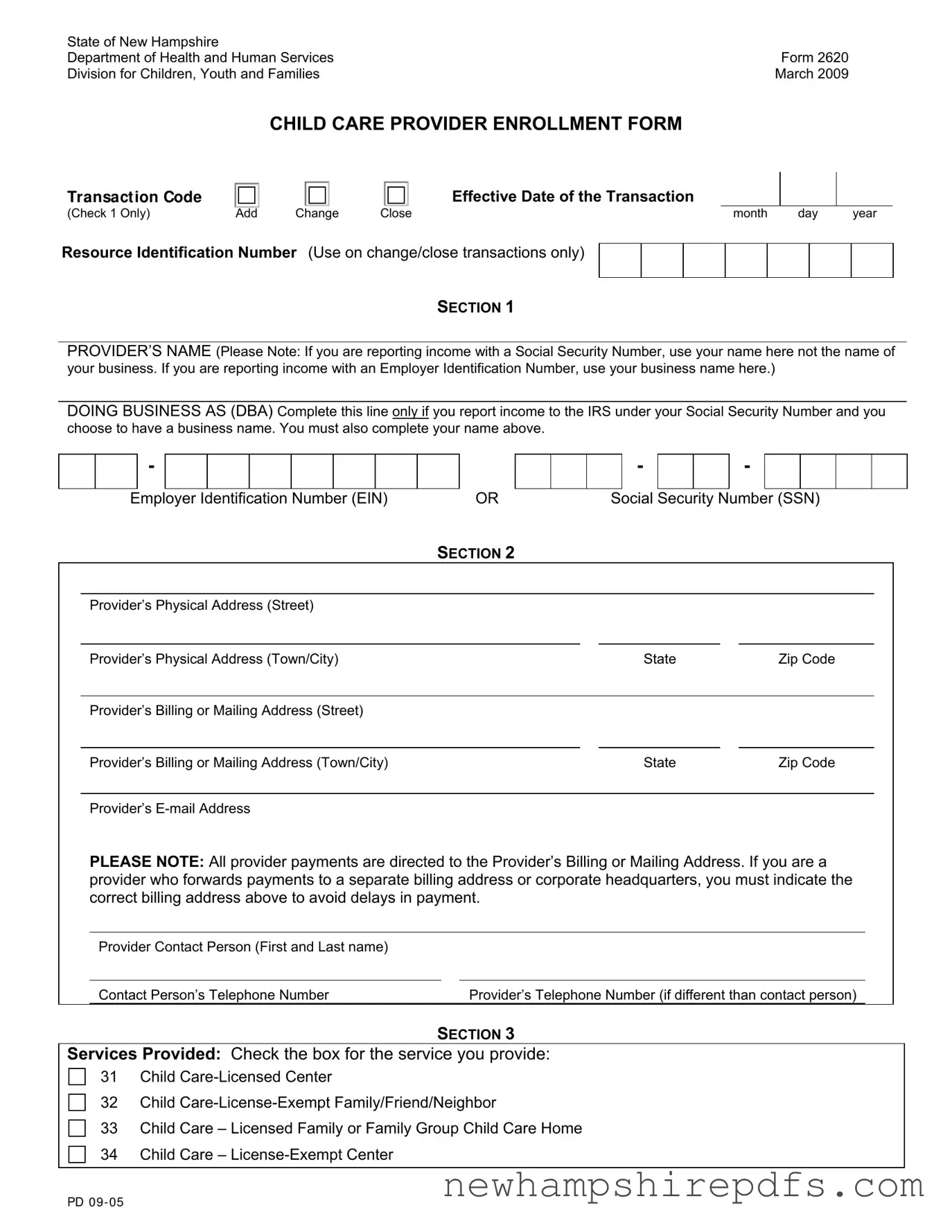

In March 2009, the State of New Hampshire Department of Health and Human Services introduced the Form 2620 for Child Care Provider Enrollment, marking a significant step in streamlining the process for child care providers to receive payments for their services. This comprehensive form serves multiple purposes, including the addition of new enrollments, changes to existing information, and the closure of enrollment. Providers must accurately fill out their personal or business identification information, depending on how they report income to the IRS, ensuring the department can efficiently process payments. Moreover, Form 2620 requires the submission of detailed contact and service provision information, emphasizing its role in facilitating effective communication between child care providers and the Department of Health and Human Services. To complete the enrollment process, providers are mandated to comply with departmental rules and submit additional documentation, including the Alternate W-9 Form. This meticulous approach underscores the department’s commitment to maintaining a robust registry of providers and ensuring compliance with its policies. The form also delineates the responsibilities of child care providers, including the understanding that they are accountable for their tax obligations given that the DHHS does not withhold taxes from payments for services rendered. The introduction of Form 2620 embodies the State of New Hampshire’s efforts to simplify administrative processes for child care providers while upholding high standards of accountability and service quality within the childcare sector.

Document Sample

State of New Hampshire |

|

Department of Health and Human Services |

Form 2620 |

Division for Children, Youth and Families |

March 2009 |

CHILD CARE PROVIDER ENROLLMENT FORM

TRANSACT ION CODE

Effective Date of the Transaction

(Check 1 Only) |

Add |

Change |

Close |

month |

day |

year |

Resource Identification Number (Use on change/close transactions only)

SECTION 1

PROVIDER’S NAME (Please Note: If you are reporting income with a Social Security Number, use your name here not the name of your business. If you are reporting income with an Employer Identification Number, use your business name here.)

DOING BUSINESS AS (DBA) Complete this line only if you report income to the IRS under your Social Security Number and you choose to have a business name. You must also complete your name above.

-

Employer Identification Number (EIN) |

OR |

- |

|

|

- |

|

|

|

|

Social Security Number (SSN)

SECTION 2

Provider’s Physical Address (Street) |

|

|

|

|

|

|

|

|

|

Provider’s Physical Address (Town/City) |

|

State |

|

Zip Code |

|

|

|

|

|

Provider’s Billing or Mailing Address (Street) |

|

|

|

|

|

|

|

|

|

Provider’s Billing or Mailing Address (Town/City) |

|

State |

|

Zip Code |

|

|

|

|

|

Provider’s |

|

|

|

|

PLEASE NOTE: All provider payments are directed to the Provider’s Billing or Mailing Address. If you are a provider who forwards payments to a separate billing address or corporate headquarters, you must indicate the correct billing address above to avoid delays in payment.

Provider Contact Person (First and Last name)

Contact Person’s Telephone Number |

Provider’s Telephone Number (if different than contact person) |

SECTION 3

Services Provided: Check the box for the service you provide:

31 Child

32 Child

33 Child Care – Licensed Family or Family Group Child Care Home 34 Child Care –

PD 09 - 05

INSTRUCTIONS FOR COMPLETION OF PROVIDER ENROLLMENT FORM

All providers of child care services who wish to receive payment from the Department of Health and Human Services (DHHS) must be enrolled and are subject to all Department rules, regulations, policies, and procedures. This is done with completion of a child care enrollment packet. No payments will be made to any provider until the enrollment process has been completed. DHHS does not withhold tax money for individuals receiving payments for services. Payment of taxes is the responsibility of the individual.

Enrollment and Billing: At time of enrollment, all providers will be assigned a Resource Identification (ID) Number. A Provider Enrollment Notice will be sent informing you that the enrollment process has been completed.

Please retain this notice! The Provider Notice will give you the information required to be entered on all billing invoices that you submit to DHHS. To be reimbursed for child care services, you must bill on

DHHS billing invoice Form 2500.

Reporting Changes: Providers are required to report all changes to DHHS such as changes of address, incorporation, or provider name. Changes must be reported to DHHS by submitting them on a new FORM 2620 and ALTERNATE

Form Completion

Transaction Code Add- Check when you request a new enrollment. Transaction Code Change- Check when you report a change, or are

Resource ID Number- Enter your Resource ID number when you report a change or request an enrollment closing. Enter your number from left to right leaving unused spaces blank at the end.

Effective Date- Enter month, day, year. This date will be your first date of enrollment, date child care services will be provided by you, the effective date of your change, or your enrollment end date.

SECTION 1

Provider Name - This line must be completed whether you report income under your SSN# or EIN# Enter your own name here if you report income to the IRS under your Social Security Number.

Enter the name of your business here only if you report income to the IRS with an Employer Identification Number.

Doing Business As- Complete this line only if you report income to the IRS under your Social Security Number. If you have a business name, enter it. You must also indicate your first name, middle initial and last name on the line provided above.

Employer ID Number or Social Security Number- Enter the number you use to report income to the IRS (Enter only one number- either the SSN# or the EIN#).

SECTION 2

Provider Address- Enter your physical and billing or mailing address. (See note on the front of this form)

Contact Person- Enter the name, telephone number and email address of the person to contact for questions.

SECTION 3

Services Provided- Check the box for the child care service you provide.

Return this form, along with a completed ALTERNATE

Department of Health and Human Services

Data Management Unit

Box 2000

Concord, NH

PD 09 - 05

Document Details

| Fact | Description |

|---|---|

| Purpose of Form 2620 | This form is used for the enrollment, change of information, or closure of child care provider services within the New Hampshire Department of Health and Human Services. |

| Governing Body | The form is governed and mandated by the New Hampshire Department of Health and Human Services, specifically within the Division for Children, Youth and Families. | ,

| Key Sections | Form 2620 is divided into sections including provider information, service types, and transaction details (add, change, close). |

| Transaction Codes | Providers must indicate the nature of their submission by selecting the appropriate transaction code: Add, Change, or Close, to specify their request. |

| Identification Requirements | Providers reporting income must enter their own name if using an SSN or their business name if using an EIN. A DBA ("Doing Business As") name is also requested if applicable. |

| Effective Date of Transaction | The form requires providers to enter the effective date for when the enrollment, change, or closure becomes valid, using a month, day, year format. |

| Additional Forms | To complete enrollment or make changes, the form must be submitted along with an ALTERNATE W-9 Form to the Department of Health and Human Services Data Management Unit. |

How to Use New Hampshire 2620

Filling out the New Hampshire 2620 form is a straightforward process designed to enroll child care providers into the system, allowing them to receive payments for their services from the Department of Health and Human Services (DHHS). This process is essential for ensuring that providers are recognized by the DHHS and are compliant with all relevant department rules, regulations, policies, and procedures. It's also the first step toward billing the DHHS for childcare services provided. Once the enrollment is complete, providers will receive a notice containing their Resource Identification (ID) Number, which is crucial for submitting billing invoices. Here's how to correctly fill out the form:

- Transaction Code: Decide whether you are adding a new enrollment, changing an existing enrollment, or closing an enrollment. Check the appropriate box for your situation and fill in the effective date (month, day, year).

- Resource Identification Number: If you’re changing or closing an enrollment, enter your Resource ID number. Leave this blank if you’re adding a new enrollment.

- SECTION 1:

- Provider’s Name: Enter your name if you report income using a Social Security Number (SSN). If you report income with an Employer Identification Number (EIN), use your business name instead.

- Doing Business As (DBA): Complete this part only if you’re reporting income under an SSN and have a business name. Remember to include your first name, middle initial, and last name above.

- Enter your EIN or SSN, depending on which one you use for IRS reporting.

- SECTION 2: Provide your physical address and, if different, your billing or mailing address. This is important because all provider payments are directed to the address you list here. Don't forget to include contact information like the name and phone number of the person to contact for questions, along with your provider email address.

- SECTION 3: Check the box that corresponds to the type of child care service you provide. The options include licensed centers, license-exempt family/friend/neighbor, licensed family or family group child care homes, and license-exempt centers.

- After completing the form, attach it to a completed ALTERNATE W-9 FORM and mail both documents to the Department of Health and Human Services, Data Management Unit, Box 2000, Concord, NH 03302-2000.

By following these steps, you’ll ensure your enrollment or update is processed smoothly, keeping your focus on providing quality child care services rather than administrative tasks. Keep a copy of the completed form and the notice you receive afterward for your records, as this information will be required for billing purposes.

Understanding New Hampshire 2620

What is the New Hampshire Form 2620 and who needs to fill it out?

The New Hampshire Form 2620 is an enrollment form for child care providers who wish to receive payment from the Department of Health and Human Services (DHHS) for childcare services. It must be completed by all providers seeking payment for services provided, ensuring they adhere to department rules, regulations, policies, and procedures.

What are the different service types listed on Form 2620?

Form 2620 lists four types of child care services for which a provider can enroll: 31 Child Care-Licensed Center, 32 Child Care-License-Exempt Family/Friend/Neighbor, 33 Child Care – Licensed Family or Family Group Child Care Home, and 34 Child Care – License-Exempt Center. Providers must check the box corresponding to the service they provide.

How do I report income on Form 2620?

When completing Form 2620, the way you report income depends on whether you use a Social Security Number (SSN) or an Employer Identification Number (EIN). If reporting income with an SSN, enter your personal name in section 1. For those reporting with an EIN, the business name should be used instead.

Can I have a business name on Form 2620 if I report income under my Social Security Number?

Yes, you can. If you report income to the IRS under your Social Security Number but have a business name (Doing Business As - DBA), you can include this on the form provided. You must also complete your legal name in the space provided above the DBA section.

What should I do if I need to change my information after I've enrolled?

To report any changes such as address, incorporation, or provider name after your initial enrollment, you must fill out a new Form 2620 and an ALTERNATE W-9 FORM. These forms should be sent together to the address listed on the form for the Department of Health and Human Services.

What is the Resource Identification Number on Form 2620 for?

Upon enrollment, all child care providers are assigned a Resource Identification (ID) Number. This number is crucial for billing purposes, as it must be included on all billing invoices submitted to DHHS. It's a unique identifier for your services.

Where do I send the completed Form 2620 and associated documents?

Once completed, Form 2620 along with the ALTERNATE W-9 FORM should be mailed to the Department of Health and Human Services, Data Management Unit, Box 2000, Concord, NH 03302-2000. This submission is necessary for the enrollment process.

Am I responsible for paying taxes on payments received for child care services?

Yes, the Department of Health and Human Services does not withhold tax money for individuals receiving payments for services. As such, the responsibility of paying taxes on these payments lies with the individual provider.

Common mistakes

Filling out the New Hampshire 2620 form, which is essential for child care providers looking to enroll or update their information with the Department of Health and Human Services, requires careful attention to detail. Unfortunately, mistakes can easily be made, leading to delays or issues in the enrollment process. Here are four common errors:

- Inaccurate Identification Information: On the 2620 form, there's a critical distinction between personal and business identification. A common mistake is using the wrong identifier – either the Social Security Number (SSN) or Employer Identification Number (EIN). If you're reporting income with your SSN, your personal name should be used in Section 1. Conversely, if you're reporting with an EIN, the business name must be entered. Confusing these or inputting incorrect numbers can result in significant processing delays.

- Incorrect Address Details: The form asks for both a physical address and a separate billing or mailing address. Providers sometimes mistakenly enter the same address for both, or neglect to specify a distinctive billing address when payments are directed elsewhere, such as to a corporate headquarters. This oversight can lead to misplaced payments or important communications.

- Failure to Choose the Correct Service Provided: In Section 3, you're required to check the box that corresponds to the service you provide. Some people forget to check a box entirely or mistakenly check the wrong service. This not only confuses the type of child care provided but can also affect the processing of your enrollment and future reimbursements.

- Omission of Effective Date or Transaction Code: The form requires specifying a transaction code (to add, change, or close enrollment) and an effective date for the transaction. Overlooking these fields or entering an incorrect date can confuse the status of your enrollment or the specifics of your requested changes. It's essential to double-check these details for accuracy.

Avoiding these errors is crucial in ensuring that the process of enrolling or updating provider information goes smoothly. By providing accurate and detailed information as requested, you help ensure that the services offered to children and their families are uninterrupted and of high quality. Always review your form for completeness and accuracy before submission to the Department of Health and Services Data Management Unit. Accuracy in this documentation not only streamlines your own operations but supports the overall goal of delivering effective child care services.

Documents used along the form

When engaging with the New Hampshire Department of Health and Human Services, particularly in the domain of child care services, the Form 2620 is a critical document for child care providers. This form is just the beginning of a series of documents that support or are necessitated by the process of enrollment, change, or closure of child care services providers. Linked with this essential form, there are several other documents often required to ensure a comprehensive completion of one's enrollment or updates to their provider status.

- Alternate W-9 Form: This form is essential for tax identification purposes and is used to report income for tax purposes. It must accompany Form 2620 when enrolling or making changes as a provider.

- DHHS Billing Invoice Form 2500: Required for billing the Department of Health and Human Services for child care services provided, this form is crucial after enrollment for reimbursement purposes.

- Child Care Licensing Application: For providers needing to obtain or update their license, this application is necessary to ensure compliance with state regulations concerning child care.

- Background Check Authorization Form: A mandatory form for all child care providers, ensuring the safety and well-being of children by conducting a background check on the provider.

- Health and Safety Training Documentation: Providers must prove completion of required health and safety training; this documentation keeps record of such completions.

- Child Care Program Plan: This document outlines the educational or developmental programs offered by the provider, necessary for licensing and for parents' review.

- Emergency Preparedness Plan: A critical document for all child care providers, detailing the plans in place for various emergency situations, ensuring children's safety at all times.

- First Aid/CPR Certification: Proof of current certification in First Aid and CPR for child care providers is often required to ensure they are equipped to handle medical emergencies.

Each of these documents plays a vital role in creating a safe, compliant, and successful child care environment. Together with Form 2620, they form a foundation for both the operational and regulatory aspects of providing child care services. For providers, understanding and properly submitting these documents is key to maintaining good standing with the Department of Health and Human Services, ultimately contributing to the well-being and development of children in their care.

Similar forms

The New Hampshire 2620 form, utilized by child care providers to enroll for payment from the Department of Health and Human Services (DHHS), has procedural and functional similarities to several other forms across various state and federal systems, designed to manage provider information and facilitate transactions. While the form primarily addresses child care services enrollment, it aligns with other documents in purpose and structure, aiming at standardizing provider data collection and ensuring efficient processing of payments or services.

One similar document is the IRS Form W-9, Request for Taxpayer Identification Number and Certification. Similar to the section in the New Hampshire 2620 form where providers report their Social Security Number (SSN) or Employer Identification Number (EIN), the W-9 is an official request for these details by the IRS. Both forms require the name of the individual or business entity for tax reporting and payment purposes. However, the IRS W-9 focuses more closely on tax identification for a wide range of financial transactions beyond child care services, setting a broader scope.

Another document displaying resemblance is the Provider Enrollment Form typically used by state Medicaid programs. Similar to the New Hampshire 2620, these forms are crucial for providers to receive payment for services rendered to Medicaid beneficiaries. They encompass provider identification, service offerings, and billing information. They also set forth the terms for enrollment, compliance with departmental rules, and the necessity of timely updates to provider data. Though Medicaid enrollment forms span a wider range of healthcare services beyond child care, the core objective of facilitating provider enrollment and ensuring accurate billing and payment remains aligned with the New Hampshire form's purpose.

Lastly, the Alternate W-9 Form, referenced alongside the New Hampshire 2620 form for change reporting, serves a similar role in providing updated tax and identity information. The Alternate W-9 is specifically designed to update information previously submitted, mirroring the "Change" transaction code process in the New Hampshire form. By allowing providers to maintain current information with the Department, both documents underscore the ongoing relationship between service providers and governmental agencies, ensuring that all transactions reflect the most recent and accurate data.

Dos and Don'ts

When filling out the New Hampshire 2620 form for child care provider enrollment, there are several best practices to ensure the form is completed correctly and efficiently. Pay close attention to these dos and don'ts:

- Do ensure you're using the most current form version by checking the New Hampshire Department of Health and Human Services website.

- Do choose the correct transaction code at the beginning of the form to indicate whether you are adding a new enrollment, changing information, or closing your enrollment.

- Do use your personal name when reporting income with a Social Security Number (SSN) and use your business name when reporting income with an Employer Identification Number (EIN) in Section 1.

- Do complete the "Doing Business As" (DBA) line if you are reporting income under your SSN and have a business name.

- Don't leave any required fields blank. If a section does not apply to you, mark it as "N/A" to indicate that it has been acknowledged.

- Don't forget to include your Resource Identification Number when reporting a change or requesting to close your enrollment. This helps the Department of Health and Human Services track your file.

- Don't overlook the need to attach a completed ALTERNATE W-9 FORM when returning the form, as both are required for the enrollment process.

- Don't send the form without verifying all information for accuracy and completeness to prevent processing delays or issues with your enrollment. Double-check addresses, phone numbers, and email addresses for errors.

Adhering to these guidelines will help streamline the enrollment process and ensure your child care services are correctly registered with the Department of Health and Human Services.

Misconceptions

Understanding the New Hampshire Form 2620, especially for new child care providers, can sometimes feel overwhelming. Despite its straightforward design, there are prevalent misconceptions that need clarification to ensure smooth interactions with the Department of Health and Human Services (DHHS). Here are seven key misconceptions and the truths behind them:

Form 2620 is only for licensed child care providers: This form is actually for all providers of child care services who wish to receive payment from DHHS, including those that are license-exempt.

Once enrolled, no further action is required: Providers must report any changes, such as address or incorporation, to DHHS by submitting a new Form 2620 and an Alternate W-9 Form. Enrollment does not mean no further updates are necessary.

Tax withholdings are managed by DHHS: DHHS does not withhold taxes for individuals receiving payments for services. Those payments are the responsibility of the individual provider to report and pay taxes on.

You only need to complete certain sections that apply to you: All sections of the Form 2620 must be completed accurately. Even if certain sections seem not to apply, you need to review and fill them out as instructed.

Using a Social Security Number (SSN) instead of an Employer Identification Number (EIN) is always an option: You should use your SSN if you are reporting income under your personal name. However, if reporting income with an EIN, you must use your business name on the form.

Provider payments are made to the provider’s physical address: Payments are actually directed to the provider’s billing or mailing address as indicated on the form. It’s critical to specify the correct billing address to avoid delays.

Any service changes can be reported informally: Reporting changes to the type of child care service provided requires the submission of a new Form 2620 for processing. Informal updates are not sufficient.

Dispelling these misconceptions ensures that the process of enrolling and updating information with DHHS goes smoothly, allowing providers to focus on what truly matters: delivering quality child care services.

Key takeaways

Understanding the intricacies of the New Hampshire 2620 form is crucial for child care providers seeking to enroll or update their information with the Department of Health and Human Services (DHHS). Here are four key takeaways to ensure accuracy and compliance during this process:

- Accurate Reporting of Provider Name and Identification Numbers: It's essential to differentiate between personal and business information when filling out the form. Use your personal name when reporting income under a Social Security Number (SSN) and your business's name when using an Employer Identification Number (EIN). This distinction aids in proper identification and ensures that all payments and communications are accurately handled.

- Completion of the Doing Business As (DBA) Section: For those reporting income under their SSN but operating under a distinct business name, the DBA section must be filled out. This clarity prevents any confusion during payment processing and helps maintain a professional identity in all transactions with DHHS.

- Notification of Changes: Providers must proactively report any changes regarding their address, incorporation status, or provider name by submitting a new Form ATTR2620 and an Alternate W-9 Form. Timely updates are necessary for continued compliance and to avoid any disruption in payments or communication.

- Understanding Transaction Codes: Different transaction codes such as "Add," "Change," and "Close" categorize the purpose of each form submission. Accurately selecting the transaction code corresponding to the action you are taking (e.g., enrolling as a new provider, updating information, or closing enrollment) is critical for the smooth processing of your form.

Adhering to these guidelines not only simplifies the enrollment and billing process but also ensures that child care providers can efficiently navigate administrative requirements, allowing them to focus on delivering quality child care services.

More PDF Forms

Nh Bugs - It aligns with the state's initiative to keep a close eye on labor market shifts and enforce compliance with employment laws.

Nheasy - This document is a cornerstone for coordination between healthcare facilities and state health services, optimizing the allocation of resources.

New Hampshire Load - Requirements for eave overhang measurement in mobile and modular homes ensure precise permit applications.