Download New Hampshire 2631 Template in PDF

In a world where quality child care is increasingly vital for working families, the State of New Hampshire offers a structure through which care providers can extend their services to families needing financial assistance. Form 2631 serves as a cornerstone in the Child Care And Development Fund (CCDF) Scholarship Program, administered by the Department of Health and Human Services, Division for Children, Youth, and Families. This detailed agreement is not just a form; it's a pledge by child care providers to abide by the standards and regulations required to participate in this vital program. Providers promise to bill only for the actual services provided, adhere to specific guidelines aimed at ensuring quality care, and submit accurate invoices for reimbursement. Moreover, this form delineates the responsibilities of providers, such as maintaining attendance records, confidentiality, and even the financial implications, including tax obligations and the handling of overpayments. From the compliance with state and federal laws to the agreement on handling cost shares and billing, Form 2631 encapsulates the operational framework for providers within the CCDF Scholarship Program, illustrating the program’s commitment to both child welfare and provider integrity. For those providers who are license-exempt, understanding and completing this form with accuracy is crucial, aligning their services with the state’s requirements and facilitating a partnership aimed at the betterment of child care services throughout New Hampshire.

Document Sample

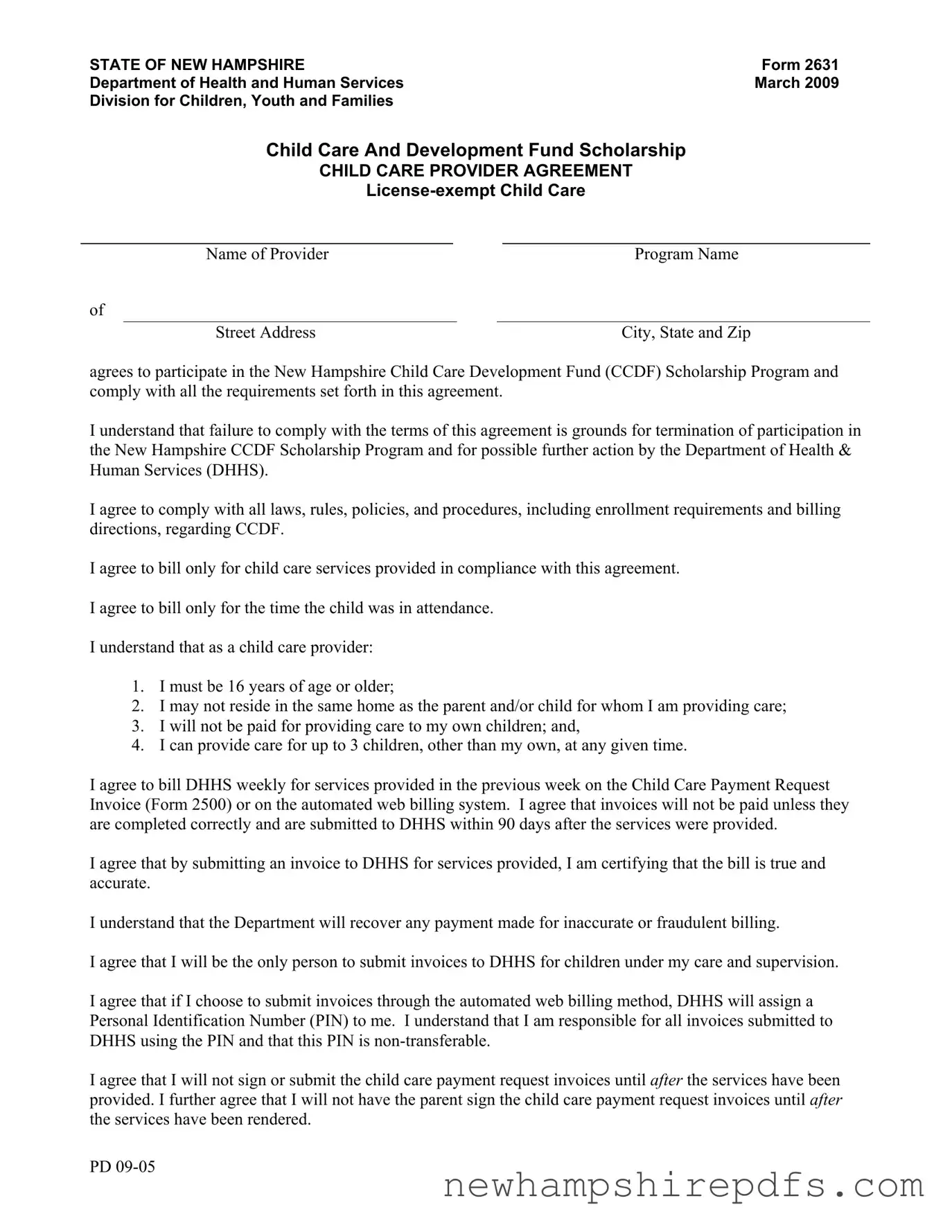

STATE OF NEW HAMPSHIRE |

Form 2631 |

Department of Health and Human Services |

March 2009 |

Division for Children, Youth and Families |

|

Child Care And Development Fund Scholarship

CHILD CARE PROVIDER AGREEMENT

Name of Provider |

Program Name |

of

Street Address |

City, State and Zip |

agrees to participate in the New Hampshire Child Care Development Fund (CCDF) Scholarship Program and comply with all the requirements set forth in this agreement.

I understand that failure to comply with the terms of this agreement is grounds for termination of participation in the New Hampshire CCDF Scholarship Program and for possible further action by the Department of Health & Human Services (DHHS).

I agree to comply with all laws, rules, policies, and procedures, including enrollment requirements and billing directions, regarding CCDF.

I agree to bill only for child care services provided in compliance with this agreement.

I agree to bill only for the time the child was in attendance.

I understand that as a child care provider:

1.I must be 16 years of age or older;

2.I may not reside in the same home as the parent and/or child for whom I am providing care;

3.I will not be paid for providing care to my own children; and,

4.I can provide care for up to 3 children, other than my own, at any given time.

I agree to bill DHHS weekly for services provided in the previous week on the Child Care Payment Request Invoice (Form 2500) or on the automated web billing system. I agree that invoices will not be paid unless they are completed correctly and are submitted to DHHS within 90 days after the services were provided.

I agree that by submitting an invoice to DHHS for services provided, I am certifying that the bill is true and accurate.

I understand that the Department will recover any payment made for inaccurate or fraudulent billing.

I agree that I will be the only person to submit invoices to DHHS for children under my care and supervision.

I agree that if I choose to submit invoices through the automated web billing method, DHHS will assign a Personal Identification Number (PIN) to me. I understand that I am responsible for all invoices submitted to DHHS using the PIN and that this PIN is

I agree that I will not sign or submit the child care payment request invoices until after the services have been provided. I further agree that I will not have the parent sign the child care payment request invoices until after the services have been rendered.

PD

I agree that at all times for children receiving CCDF Scholarship under my care and supervision, I will be present and will directly provide care for those children.

I agree to keep all information concerning children and their families confidential except as otherwise allowed under law.

I agree to keep daily attendance records, which include start and stop times and parent/guardian’s signature, and other records related to billing for a period of seven years. I agree to provide all such records and information related to billing and/or services provided to DHHS or its agents as requested.

I agree to contact DHHS if I believe that I have received an overpayment.

I agree to be responsible for reporting funds received under this agreement as income to DHHS each calendar year as required if I am receiving any other services from DHHS.

I agree that I am responsible for the payment of all required federal and state taxes accrued. DHHS will issue a Form 1099 in January of each year if total reportable payment from all state agencies equal $600 or more.

**Note Form 1099 will not be issued for nonprofit agencies or corporations.

I agree that signing this form does not create an

I agree that the decision to charge or not to charge all or part of the cost share determined by DHHS is between the provider and the parent.

I agree that the decision to charge all or part of the difference between what DHHS reimburses and the actual charge is between the provider and the parent.

I understand that I may be terminated from participation in CCDF for failure to comply with this agreement or DHHS rules related to child care assistance. Additionally, I understand that either party may terminate this agreement without cause following 30 days written notification by registered mail. This agreement may be terminated without advance notice if the provider has not billed in over one year, a child’s health or safety is endangered or if the provider is determined to have fraudulently billed DHHS.

Any provider that has a founded fraudulent claim against them will be disqualified from participating in the CCDF Scholarship program for a minimum period of five years.

This agreement becomes effective upon the date of your signature:

__________________________________________________________________________________

Name of Child Care Provider

___________________________________ |

_______________________________________ |

Signature |

Date |

Return this signed form to the Child Development Bureau

129 Pleasant Street

Concord, New Hampshire 03301

Keep a copy for your records

PD

STATE OF NEW HAMPSHIRE |

Form 2631(i) |

Department of Health and Human Services |

March 2009 |

Division for Children, Youth and Families |

|

Instructions for

PURPOSE:

All

INSTRUCTIONS:

Form 2631 must be completed by the child care provider. The completed form must be returned to the Child Development Bureau, Division for Children, Youth and Families.

The Child Development Bureau will return forms that have missing or incomplete information.

The Child Development Bureau will retain a copy of the completed form in the provider file.

FORM COMPLETION:

Enter the full legal name and physical address of the child care provider.

Read the entire document and if you have any questions contact the Child Development Bureau.

Sign and date the form.

Send original and keep a copy for your records.

RETENTION:

Form 2631 is retained permanently in the provider file.

PD

Document Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is for license-exempt child care providers participating in the New Hampshire Child Care Development Fund (CCDF) Scholarship Program. |

| 2 | Providers must agree to comply with all requirements, including laws, rules, policies, and procedures related to CCDF. |

| 3 | Providers must bill only for the time a child was in attendance and for services provided in compliance with the agreement. |

| 4 | Providers must submit invoices weekly for the previous week's services on Form 2500 or the automated web billing system. |

| 5 | Eligibility requirements for providers include being 16 or older, not residing in the same home as the care-receiving child, and not being paid for caring for one's own children. |

| 6 | Providers must keep all information about children and their families confidential, except as allowed under law, and maintain records for seven years. |

| 7 | The agreement specifies no employer-employee relationship creation between the provider and the Department of Health & Human Services (DHHS). |

How to Use New Hampshire 2631

Filling out the New Hampshire Form 2631 is a crucial step for license-exempt child care providers who wish to participate in the Child Care and Development Fund (CCDF) Scholarship Program. This form is an agreement that outlines the responsibilities and requirements that providers agree to meet as part of the program. It's important to carefully review all the conditions laid out in the document to ensure compliance and to maintain eligibility for receiving payments through the scholarship program. Here's a simple guide on how to complete the form accurately.

- Start by entering the full legal name of the child care provider at the space provided at the beginning of the agreement.

- Next, fill in the program name and street address, including city, state, and zip code, in the designated areas.

- Read through the entire agreement carefully. Pay close attention to each point, ensuring you understand the commitments regarding compliance with laws, billing practices, attendance documentation, and other specific requirements for participation in the CCDF Scholarship Program.

- If you have any questions or need clarification concerning the contents of the document, it’s advisable to contact the Child Development Bureau before signing.

- After reviewing the agreement and ensuring you meet all listed conditions (such as being over the age of 16, not residing in the same home as the children you'll be caring for, etc.), proceed to sign and date the form at the bottom where indicated.

- Once signed, send the original completed form to the Child Development Bureau, 129 Pleasant Street, Concord, New Hampshire 03301. It's crucial to send the original document as specified.

- Finally, make sure to keep a copy of the signed agreement for your records. This is important for future reference and for maintaining accurate and organized documentation of your participation in the program.

Proper completion and timely submission of this agreement form are essential steps to becoming a part of the CCDF Scholarship Program as a license-exempt provider. By adhering to the guidelines and fulfilling the required steps effectively, providers ensure their eligibility for the program and contribute to a smooth operational process, benefiting both their child care service and the families they support.

Understanding New Hampshire 2631

What is the purpose of the New Hampshire Form 2631?

The New Hampshire Form 2631 is designed for license-exempt child care providers who intend to receive payments for delivering child care through the Child Care and Development Fund (CCDF) Scholarships. By signing this form, a provider agrees to adhere to the rules and requirements set by the Department of Health and Human Services (DHHS), ensuring compliance with state laws, policies, and procedures related to CCDF.

Who needs to complete the New Hampshire Form 2631?

This form must be completed by any child care provider who is license-exempt and wishes to enroll in the Child Care and Development Fund (CCDF) Scholarship Program for receiving payments. It is crucial for providers who are not licensed but meet the other requirements set forth by DHHS for providing child care services.

How do I submit the completed New Hampshire Form 2631?

After thoroughly reading and signing the form, it should be sent to the Child Development Bureau, Division for Children, Youth, and Families at the address provided on the form: 129 Pleasant Street, Concord, New Hampshire 03301. It is recommended to keep a copy of the signed form for personal records. The Bureau retains a copy to include in the provider's file as part of the enrollment process.

What happens if I fail to comply with the agreement specified in Form 2631?

Failure to adhere to the terms laid out in the agreement can lead to termination from the CCDF Scholarship Program and may result in further actions by the Department of Health & Human Services (DHHS). Termination can occur for reasons such as not billing correctly, endangering a child’s health or safety, or if fraudulent billing is determined. Additionally, providers found to have submitted fraudulent claims may be disqualified from participating in the CCDF Scholarship Program for a minimum of five years.

Common mistakes

Filling out the New Hampshire 2631 form, a critical document for license-exempt child care providers who wish to participate in the Child Care and Development Fund (CCDF) Scholarship Program, requires careful attention to detail. Despite this, there are common mistakes that many providers make during the completion process. Understanding and avoiding these errors can streamline the application process, ensuring compliance and facilitating smoother transactions with the Department of Health & Human Services (DHHS).

One often-observed mistake is not reading the agreement thoroughly before signing. It's crucial to understand all the obligations and comply with the requirements, as failing to do so can lead to termination from the program. Moreover, inaccuracies in filing out personal and program information, such as the provider's full legal name and physical address, can cause unnecessary delays. Every detail on the form, including contact information, must be accurate and complete.

Another common error is delaying the submission of completed forms. Timeliness is key, as late submissions can lead to missed opportunities for funding. Additionally, a significant portion of providers forget to keep a copy of the form for their own records as recommended. This oversight can create challenges if discrepancies arise or if the document needs to be referenced in the future.

When it comes to the specifics of the agreement, errors often stem from a lack of compliance with billing practices. Not billing only for the time the child was in attendance, submitting invoices late, or failing to submit invoices correctly can lead to non-payment. Moreover, not maintaining daily attendance records and other pertinent information for the required seven years is a mistake that can have serious repercussions during audits or reviews.

In summary, the process of filling out the Form 2631 correctly involves:

- Reading and understanding all terms within the agreement before signing.

- Filling out all personal and program information accurately and completely.

- Submitting the form promptly and keeping a copy for personal records.

- Strictly adhering to billing practices and documentation requirements set forth in the agreement.

Becoming aware of these common oversights and proactively avoiding them can significantly enhance a provider’s participation in the New Hampshire CCDF Scholarship Program. It underscores the provider's commitment to compliance and the well-being of the children under their care.

Documents used along the form

The New Hampshire 2631 form is a critical document for license-exempt child care providers who wish to participate in the New Hampshire Child Care Development Fund (CCDF) Scholarship Program. Used in conjunction with other important forms and documents, it lays the foundation for a structured and compliant child care provision under the scheme. The array of documents often used alongside it ensures that both the child care provider and the recipients of care are protected and served according to the program's standards.

- Form 2500 - Child Care Payment Request Invoice: This form is essential for billing purposes. Care providers use it to bill the Department of Health and Human Services (DHHS) weekly for services provided. It requires detailed information, including the time the child was in attendance, to ensure accuracy in billing and payment.

- Form 1099 - Miscellaneous Income: Issued by the DHHS for tax purposes, this form reports the income received by the child care provider through the CCDF Scholarship Program. Any provider paid $600 or more in a year will receive this form, except for non-profit agencies or corporations.

- Confidentiality Agreement: While not a standardized form, a confidentiality agreement aligning with the privacy requirements set forth in the New Hampshire 2631 form is crucial. It stipulates the provider’s obligation to keep information about children and their families confidential, except as permitted by law.

- Daily Attendance Records: These records are a documentation requirement. Care providers must keep detailed attendance logs, including start and stop times and parent/guardian signatures. Although not a single standardized form, maintaining these records is mandatory for compliance and billing.

- Child Development and Care Eligibility Verification (CDC) Form: This document is used to verify a child's eligibility for the CCDF program. It ensures that children under the care of the provider meet the necessary criteria to receive scholarship funds.

- Provider Tax Information Form: Similar to the Form 1099 but more detailed, this document collects tax identification information and other relevant tax details from the provider. It's used to ensure correct tax reporting and compliance by the DHHS.

In cohesion, the New Hampshire 2631 form and the accompanying documents ensure a systematized operation of the CCDF Scholarship Program. Providers are guided through a framework of compliance for billing, attendance, and reporting, ensuring that the child care services offered are not only high quality but also meet the stringent requirements set by the Department of Health & Human Services (DHHS). Using these documents in tandem facilitates a transparent, accountable, and effective child care provision ecosystem.

Similar forms

The New Hampshire 2631 form is similar to various other documents that facilitate child care services and provider agreements across the United States. While each form has a unique purpose and scope within its own state or program, many share common features such as provider qualifications, billing procedures, and compliance with state or program-specific laws and policies. Below are a few documents that share similarities with the New Hampshire 2631 form, highlighting how exactly they compare.

Child Care Provider Agreement Forms in Other States: Just like the New Hampshire 2631 form, many states have their own versions of child care provider agreements for those participating in state-funded programs, such as the Child Care Development Fund (CCDF). These forms typically require the provider to adhere to program regulations, bill accurately for services provided, and maintain confidentiality and safety for the children under their care. They model the structure by laying out the expectations and responsibilities of the provider, including compliance with laws and policies, billing instructions, and the process for terminating the agreement.

IRS Form W-10 (Dependent Care Provider's Identification and Certification): While IRS Form W-10 serves a different purpose—it is used by taxpayers to report information about the child care provider for tax credits—it shares similarities with the New Hampshire 2631 form in its collection of provider details and the emphasis on official documentation of child care services. Both forms require accurate provider information and reinforce the legal aspects of child care services, though the New Hampshire 2631 includes more detailed agreements related to the scope of services and compliance with specific program rules.

Child Care Application Forms for Parents: On the other side of the spectrum, child care application forms that parents fill out to receive child care services or subsidies, like those used for CCDF eligibility, similarly gather detailed information and set expectations about the nature of care to be provided. While these forms are designed from the perspective of the parent or guardian, they correlate with documents like the New Hampshire 2631 form in ensuring that care provided is in line with state regulations, safety standards, and billing practices. The relationship between these forms emphasizes the interconnected roles of providers, parents, and state agencies in facilitating and regulating child care.

Dos and Don'ts

When completing the New Hampshire 2631 Form, specifically designed for license-exempt child care providers intending to participate in the Child Care And Development Fund (CCDF) Scholarship Program, certain practices should be followed to ensure accuracy and compliance. This guide outlines actions to adopt and avoid in the submission process.

Do:- Read the entire agreement thoroughly before signing to ensure you understand all requirements and obligations.

- Ensure your eligibility by confirming you meet criteria such as being 16 years of age or older, not residing in the same household as the child you're providing care for, and knowing you won't be paid for caring for your own children.

- Complete all sections of the form accurately, providing your legal name, street address, and other requested details without omissions.

- Keep daily attendance records and other documents related to billing for the required seven-year period.

- Bill DHHS weekly for services provided, using either Form 2500 or the automated web billing system after services are rendered.

- Submit invoices within 90 days following service provision to ensure timely payment.

- Retain a copy of the signed agreement for your records, as advised in the form instructions.

- Protect the confidentiality of information concerning children and their families, except as law permits.

- Report any overpayment received to DHHS immediately to avoid potential complications.

- Contact the Child Development Bureau if you have any questions while filling out the form.

- Leave any sections incomplete. Review the form carefully to prevent the Child Development Bureau from returning it for missing information.

- Sign or submit child care payment request invoices before services are provided; this should only be done retrospectively.

- Allow anyone else to use your Personal Identification Number (PIN) for invoice submissions if you opt for automated web billing.

- Forget to report all income received under this agreement to DHHS annually for tax purposes.

- Assume an employer-employee relationship with DHHS by signing this form; it is merely a provider agreement.

- Overlook the requirement to bill only for actual attendance time and services in accordance with the agreement.

- Ignore the program's billing and enrollment procedures. Understanding and complying with these is crucial for participation.

- Fail to maintain full responsibility for all invoices submitted under your care and supervision, including those submitted using your PIN.

- Neglect the agreement's terms related to confidentiality, record-keeping, and reporting, as these are fundamental to your participation.

- Delay notifying DHHS in the event of receiving an overpayment or encountering discrepancies in invoicing or payment.

Misconceptions

There are several misconceptions about the New Hampshire 2631 form that deserve clarification. This form is essential for license-exempt child care providers participating in the Child Care and Development Fund (CCDF) Scholarship Program in New Hampshire. Understanding these misconceptions can help providers ensure compliance and maintain their eligibility for the program.

- Misconception 1: Age Requirement Is Flexible

Some believe that the age requirement to be a child care provider under this program is flexible. However, the form clearly states that providers must be 16 years of age or older, establishing a firm age requirement for eligibility.

- Misconception 2: Providers Can Live With the Child or Parent

Contrary to what some may think, child care providers cannot reside in the same home as the parent and/or child for whom care is being provided, ensuring a professional distance and compliance with program rules.

- Misconception 3: Payment for Caring for Your Own Children Is Allowed

Another common misconception is that providers can be paid for caring for their own children. The agreement specifies that providers will not be paid for providing care to their own children, highlighting the program's intention to support external child care services.

- Misconception 4: There's No Limit to the Number of Children You Can Care For

Some providers might think there is no limit to the number of children they can care for. However, the form restricts providers to caring for up to 3 children other than their own at any given time, ensuring manageable and quality care.

- Misconception 5: Invoices Can Be Submitted Late

There's a belief that the timing of invoice submission is flexible. Yet, providers agree to submit invoices within 90 days after the services were provided, maintaining the program's administrative efficiency and financial accountability.

- Misconception 6: The Form 1099 is Issued to All Providers

A common misunderstanding is that all child care providers receive a Form 1099. According to the agreement, DHHS issues a Form 1099 only if the total reportable payment equals $600 or more, and not for nonprofit agencies or corporations, ensuring compliance with tax laws.

- Misconception 7: An Employer-Employee Relationship Is Created with DHHS

Many believe signing the Form 2631 establishes an employer-employee relationship with the Department of Health & Human Services. The agreement clarifies that signing this form does not create such a relationship, maintaining the provider's status as an independent entity.

Understanding these key aspects of the New Hampshire 2631 form can help license-exempt child care providers navigate the requirements and responsibilities of participating in the CCDF Scholarship Program, ensuring they can effectively support the families they serve while adhering to the program's guidelines.

Key takeaways

Filling out and using the New Hampshire Form 2631 is a crucial step for license-exempt child care providers looking to participate in the Child Care and Development Fund (CCDF) Scholarship Program. Here are key takeaways to ensure providers fill out and use the form correctly:

- Eligibility Requirements: To be eligible, a provider must be at least 16 years of age, cannot reside in the same home as the child they are caring for, cannot be paid for caring for their own children, and can care for up to three non-related children at a time.

- Billing Process: Providers agree to bill the Department of Health & Human Services (DHHS) weekly for services provided the previous week, using Form 2500 or an automated web billing system. It's critical that bills are submitted within 90 days of service.

- Accuracy and Accountability: By submitting an invoice, a provider is certifying the truth and accuracy of the bill. The DHHS will reclaim payments for any inaccurate or fraudulent billing, underscoring the importance of accurate record-keeping.

- Unique Billing Identification: Providers choosing to use the automated web billing method will receive a Personal Identification Number (PIN) from DHHS, which is non-transferable and solely for their use, ensuring secure and responsible billing.

- Record Keeping: Providers must keep meticulous daily attendance records and all related billing records for seven years and furnish them to DHHS upon request. This also includes complying with a request if you believe you have received an overpayment.

- Tax Responsibilities: All payments received under this agreement must be reported as income to DHHS, and providers are responsible for paying all federal and state taxes accrued from these payments. A Form 1099 will be issued by DHHS if applicable.

- Relationship and Payment Terms: Signing the agreement does not create an employer-employee relationship between the provider and DHHS. It also leaves the decision on whether to charge parents a cost share up to the provider.

- Termination Clauses: The agreement highlights conditions under which a provider can be terminated from the CCDF, including failure to comply with the terms or fraudulent billing, with a minimum disqualification period of five years for founded fraudulent claims.

Understanding and adhering to these guidelines ensures not only compliance with the DHHS requirements but also a smoother operation of child care services under the CCDF Scholarship Program. Keeping informed and engaged with the terms of this agreement is fundamental to a successful partnership with DHHS and the families served.

More PDF Forms

Nheasy - The form is vital for tracking the movement of residents between nursing facilities within New Hampshire, enhancing care continuity.

New Hampshire Load - This document provides a comprehensive application process for obtaining a permit to transport loads that exceed legal limits in New Hampshire.