Download New Hampshire Reporting Template in PDF

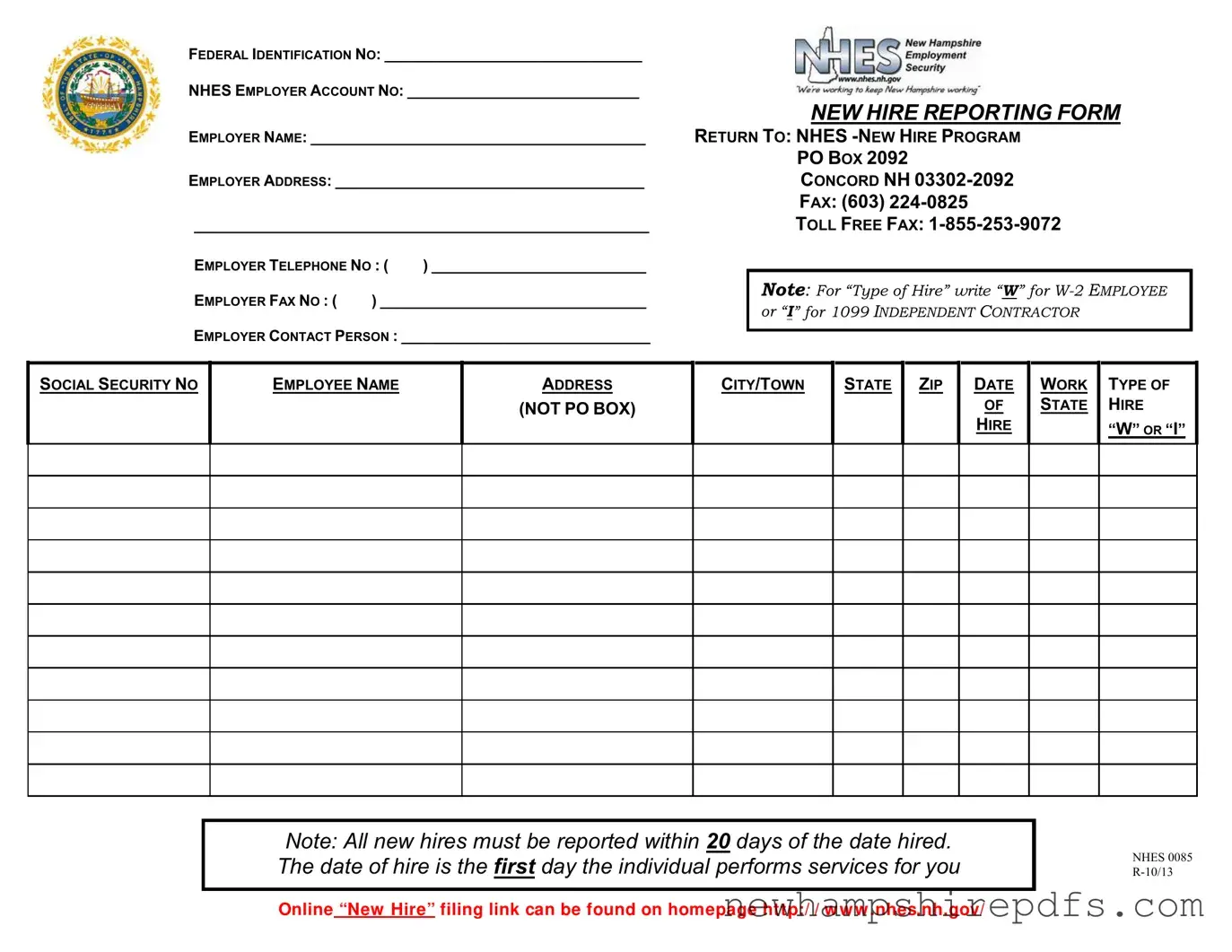

In the web of regulations and requirements businesses operate under, the New Hampshire Reporting Form serves as a vital document aimed at simplifying the process of reporting new hires in the state. For employers in New Hampshire, navigating the landscape of employment law means adhering to specific protocols, one of which involves the timely submission of this form to the New Hampshire Employment Security (NHES). This document, which must be submitted within 20 days of a new employee's start date, requires an array of information including the Federal Identification Number, NHES Employer Account Number, employer and employee details, and the type of hire—distinguished by "W" for W-2 employees and "I" for 1099 independent contractors. Additionally, it outlines the method for submission, offering both a physical address and fax numbers—including a toll-free option—for convenience. Notably, the form also provides a link to an online filing system, illustrating the state's effort to streamline and modernize the reporting process. The integration of digital filing methods signifies a recognition of burgeoning technology and its potential to facilitate regulatory compliance, making the New Hampshire Reporting Form a critical bridge between traditional employment practices and the evolving digital landscape.

Document Sample

FEDERAL IDENTIFICATION NO: ______________________________

NHES EMPLOYER ACCOUNT NO: ___________________________

|

NEW HIRE REPORTING FORM |

EMPLOYER NAME: _______________________________________ |

RETURN TO: NHES |

|

PO BOX 2092 |

EMPLOYER ADDRESS: ____________________________________ |

CONCORD NH |

|

FAX: (603) |

_____________________________________________________ |

TOLL FREE FAX: |

EMPLOYER TELEPHONE NO : ( |

) _________________________ |

|

EMPLOYER FAX NO : ( |

) _______________________________ |

|

EMPLOYER CONTACT PERSON : _____________________________

NOTE: For “Type of Hire” write “W” for

or “I” for 1099 INDEPENDENT CONTRACTOR

SOCIAL SECURITY NO |

EMPLOYEE NAME |

ADDRESS |

CITY/TOWN |

STATE |

ZIP |

DATE |

WORK |

TYPE OF |

|

|

(NOT PO BOX) |

|

|

|

OF |

STATE |

HIRE |

|

|

|

|

|

HIRE |

|

|

|

|

|

|

|

|

|

|

“W” OR “I” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Note: All new hires must be reported within 20 days of the date hired. The date of hire is the FIRST day the individual performs services for you

NHES 0085

Online “New Hire” filing link can be found on homepage ht t p:/ / w w w .nhes.nh.gov/

Document Details

| Fact | Description |

|---|---|

| Form Title | New Hampshire Reporting Form |

| Governing Law | New Hampshire state law mandates the reporting of new hires to ensure proper enforcement of child support obligations. |

| Form Purpose | Used by employers to report new hires and rehires to the New Hampshire Employment Security (NHES). |

| Who Must File | All employers operating within New Hampshire are required to submit this form for each new employee. |

| Reporting Deadline | New hires must be reported within 20 days of their hire date. |

| Submission Information | The form can be submitted via mail to NHES - New Hire Program, PO BOX 2092, Concord NH 03302-2092, or by fax at (603) 224-0825, toll free fax 1-855-253-9072. |

| Online Submission | Employers can also file online on the NHES website homepage. |

| Type of Hire | Employers must indicate the type of hire by writing "W" for W-2 employee or "I" for 1099 independent contractor. |

How to Use New Hampshire Reporting

Filling out the New Hampshire Reporting form is straightforward and an important step for employers in the state. This document helps ensure all new hires are properly documented as per state guidelines. It should be completed for every employee, whether they are a W-2 Employee or a 1099 Independent Contractor, within 20 days of their first day of employment. The process is made easier by gathering all the necessary information before you start filling out the form. Here are step-by-step instructions to guide you through the completion and submission of the New Hampshire Reporting Form.

- Locate the Federal Identification Number and NHES Employer Account Number of your organization and fill these in the corresponding fields at the top of the form.

- Enter your organization's Employer Name and Address in the designated areas. Make sure to include any additional address lines if necessary.

- Provide the employer's telephone and fax numbers. Include the area code and any extensions if applicable.

- Write the name of the Employer Contact Person. This should be someone who can answer questions or provide further information about the form if needed.

- For each new hire, enter their Social Security Number, Full Name, Home Address (not a P.O. Box), City/Town, State, Zip Code, Date of Hire (the first day they began work), and Type of Hire (indicate "W" for W-2 employee or "I" for 1099 independent contractor).

- Once you have completed the form, review all the information for accuracy.

- Return the completed form to NHES - NEW HIRE PROGRAM, PO BOX 2092, CONCORD NH 03302-2092. You can also opt to fax it to (603) 224-0825 or 1-855-253-9072 for toll-free.

- If you prefer electronic filing or need more information, visit http://www.nhes.nh.gov/ and look for the Online “New Hire” filing link on the homepage.

After the New Hampshire Reporting form is submitted, the information will be used to maintain accurate employment records in the state. This helps in various administrative and legal processes, ensuring compliance with state laws. It is crucial for employers to follow these steps carefully to avoid any potential issues. If there are any questions or if more information is needed during the process, employers are encouraged to contact NHES directly for assistance.

Understanding New Hampshire Reporting

What is the New Hampshire Reporting Form used for?

The New Hampshire Reporting Form is utilized by employers to report new hires in the state, as required by law. Whether hiring a W-2 employee or a 1099 independent contractor, this form facilitates the process by collecting essential information such as the employee’s social security number, name, address, and the date of hire. This ensures that newly hired individuals are properly recorded for tax and employment verification purposes.

Who needs to submit the New Hampshire Reporting Form?

All employers in New Hampshire must submit the New Hampshire Reporting Form for each new employee or independent contractor they hire. This requirement is not limited by the size of the business or the number of employees.

What is the deadline for submitting this form?

Employers are required to report all new hires within 20 days of their start date. The date of hire is considered the first day the employee performs services for the employer.

Can the New Hampshire Reporting Form be submitted online?

Yes, employers have the option to file the New Hire Reporting Form online. The online filing link can be found on the homepage of the New Hampshire Employment Security (NHES) website, providing a convenient and efficient way to comply with reporting requirements.

What information do I need to provide on the New Hampshire Reporting Form?

The form requires the employer’s details, such as name, address, telephone number, and federal identification number, as well as specific information about the new hire. For the new hire, you must include their social security number, name, residential address (no PO boxes), city/town, state, zip code, date of hire, and type of hire (W for W-2 employee or I for 1099 independent contractor).

What should I do if I don't have all the information required on the form?

It's important to complete the form as fully as possible to meet reporting requirements. If certain information is temporarily unavailable, submit the form with the information you have, and update the record as soon as the missing details are available. Timely submission with partial information is better than delaying beyond the 20-day period.

Where should I send the completed New Hampshire Reporting Form?

The completed form can be returned to NHES - New Hire Program at P.O. Box 2092, Concord, NH 03302-2092. Alternatively, it can be faxed using the fax number provided on the form (603-224-0825) or the toll-free fax number (1-855-253-9072).

What are the penalties for not submitting the New Hampshire Reporting Form?

Failure to report new hires may result in fines and penalties imposed by the state. It is crucial for employers to comply with the reporting requirements to avoid these consequences. Timely submission ensures that employers remain in good standing with state employment regulations.

Common mistakes

Filling out the New Hampshire Reporting Form is a crucial step for employers to comply with reporting requirements. Unfortunately, errors can occur that may cause delays or complicate the process. Understanding these common mistakes can significantly streamline reporting and ensure compliance with New Hampshire's employment laws.

One common error is incorrectly identifying the type of hire. Employ in the form, there is a specific notation to mark “W” for W-2 employees or “I” for 1099 independent contractors. Confusion between these categories can lead to incorrect tax withholding and reporting, affecting both the employer's records and the employee's tax liabilities.

Another mistake involves the misentry of the Federal Identification Number or NHES Employer Account Number. These numbers are critical for the New Hampshire Employment Security (NHES) to accurately identify and associate the new hire report with the correct employer. Errors in these numbers can misdirect or delay the processing of the information.

Employers often neglect to report new hires within the 20-day deadline. The law mandates that all new hires must be reported within 20 days of their first day of work. Late reporting can result in penalties and complicate unemployment insurance processes, among other issues.

Failing to provide complete employee information, such as the social security number, employee name, address, city/town, state, zip, and the date of hire, undermines the purpose of the form. Incomplete or inaccurate information can hinder necessary government functions such as child support enforcement and the detection of unemployment compensation fraud.

Typographical errors in the employer's contact information, including the telephone and fax numbers, can prevent NHES from reaching out if clarification or additional information is needed. This error can prolong the data verification process, delaying the integration of the new hire data into the state's employment records.

To ensure the New Hampshire Reporting Form is filled out correctly, employers should double-check that they have accurately categorized their employees, thoroughly reviewed all employer and employee identifiers, and adhered to reporting deadlines. Additionally, confirming the completeness of employee information and verifying contact details can expedite processing and reduce the possibility of errors. Taking these steps helps maintain the integrity of employment records and supports compliance with state reporting requirements.

- Accurate categorization of the type of hire

- Proper entry of Federal and State identification numbers

- Adherence to the 20-day reporting requirement

- Completeness of employee information

- Accuracy of employer contact details

Mindfulness in completing the New Hampshire Reporting Form can not only prevent common mistakes but also contribute to a smoother operation within the NHES system. This in turn benefits employers, employees, and the state by ensuring accurate and timely data collection and compliance with legal requirements.

Documents used along the form

When an employer in New Hampshire hires a new employee, they are required to complete the New Hampshire Reporting Form. This document is crucial for updating the state's employment records and ensuring compliance with applicable laws. In addition to the New Hampshire Reporting Form, there are several other forms and documents that employers may find themselves needing to complete or provide in the process of hiring a new employee or managing employee information. Descriptions of some of these forms and documents are provided to help employers navigate their responsibilities more smoothly.

- W-4 Form (Employee's Withholding Certificate): This IRS form is completed by employees to determine federal income tax withholding based on their filing status and other factors.

- I-9 Form (Employment Eligibility Verification): Employers must complete this form to document that each new employee is legally authorized to work in the United States.

- W-9 Form (Request for Taxpayer Identification Number and Certification): Used to request the taxpayer identification number (TIN) of a U.S. person, including a resident alien, and to request certain certifications and claims for exemption. This is particularly relevant for independent contractors.

- Direct Deposit Authorization Form: This form allows employees to provide their bank information to their employer for direct deposit of their paycheck.

- State Tax Withholding Form: Similar to the federal W-4, this form is used to determine state income tax withholding amounts. The specific form varies by state.

- Employment Application Form: Used by employers to collect comprehensive information from job applicants, including employment history, educational background, and references.

- Employee Handbook Acknowledgment Form: This document confirms that an employee has received, read, and understands the company's employee handbook.

- Job Description: A detailed description of the job duties, responsibilities, necessary skills, outcomes, and work conditions of a position.

- Emergency Contact Form: This form collects information about whom to contact in case of an employee's emergency.

These forms and documents play an essential role in ensuring that both employers and employees fulfill their obligations and protect their rights. From tax withholding to eligibility verification, each document has a specific purpose and requirement under the law. Understanding the function and necessity of these documents can facilitate smoother hiring processes and employment practices.

Similar forms

The New Hampshire Reporting form is similar to various other documents used across different jurisdictions and for diverse purposes. Primarily, it shares commonalities with the Federal I-9 Employment Eligibility Verification form and the W-4 form used for withholding tax. These similarities lie in the collection of basic employee information, such as social security numbers, addresses, and employment details, making them crucial for compliance with employment and tax laws.

Federal I-9 Employment Eligibility Verification Form: Like the New Hampshire Reporting form, the I-9 form is a mandatory document for all employees in the United States. It is designed to verify an employee's identity and to establish that the worker is eligible to accept employment in the U.S. Both forms require personal information about the employee, including their name, address, and social security number. However, the I-9 form goes further by demanding documentation that proves identity and eligibility to work, a step not required by the New Hampshire form. The focus of the I-9 on eligibility and identity verification highlights its role in maintaining legal workforce standards.

W-4 Form: The W-4 form, used for tax withholding purposes, also shares similarities with the New Hampshire Reporting form. Both documents are essential from the beginning of an employment relationship. They collect employee information like the social security number, address, and name. The purpose of the W-4, however, is specifically to determine the amount of federal income tax to withhold from an employee's paycheck. It requires the employee to indicate their filing status, multiple jobs adjustments, dependents, and other income or deductions that affect withholding. While both forms are crucial for new hires, the W-4's primary role is in tax administration rather than employment verification or reporting.

Dos and Don'ts

When filling out the New Hampshire Reporting Form, it’s vital to ensure accuracy and adherence to guidelines to facilitate smooth processing. Here are some essential dos and don'ts:

What You Should Do:

- Double-check the federal and NHES employer account numbers. Accuracy here is crucial as these numbers are the backbone of your filing, ensuring it's matched to the correct employer records.

- Clearly fill out the employee’s information, including their full name, SSN, and detailed address (city, town, state, zip), avoiding PO Boxes as addresses. This information aids in accurate record-keeping and compliance with state laws.

- Mark the type of hire correctly with “W” for W-2 employees or “I” for 1099 independent contractors. This classification affects tax reporting and compliance.

- Report new hires within the 20-day window from their start date. Timeliness is key in fulfilling your obligations and avoiding potential penalties.

What You Shouldn’t Do:

- Leave any fields blank. Incomplete forms can lead to processing delays or requests for additional information, hindering the speed and efficiency of the reporting process.

- Use PO Boxes for employee addresses. The form specifically requires a residential or physical address for accurate record-keeping and potential legal requirements.

- Forget to include the employer contact person. This information is essential should any clarifications or additional information be needed.

- Ignore the submission deadlines. Delaying beyond the 20-day reporting window can lead to non-compliance issues and potentially impose unnecessary penalties on your business.

Adhering to these guidelines will not only ensure that you remain in compliance with New Hampshire's new hire reporting requirements but will also streamline the process for both you and the state's employment department. Remember, the key to successful reporting is attention to detail and prompt action.

Misconceptions

When it comes to the New Hampshire Reporting Form, there are several misconceptions that employers and employees alike might hold. Understanding these can help ensure compliance with state regulations and smooth the hiring process. Here are five common misunderstands clarified:

- Misconception 1: The form is only for traditional W-2 employees. In reality, the form requires employers to report both W-2 employees and 1099 independent contractors, as indicated by the “Type of Hire” section where one must mark “W” for W-2 employees or “I” for 1099 independent contractors. This broadens the scope of reporting to include a wider range of employment types.

- Misconception 2: Reporting is optional or only for large businesses. Contrary to this belief, all employers, regardless of size, are required to report new hires to the NHES - New Hire Program. This requirement ensures that the state can efficiently manage employment data for purposes such as enforcing child support obligations.

- Misconception 3: Employers have a significant amount of time to report new hires. The form stipulates a specific timeframe, mandating that new hires must be reported within 20 days of their first day of work. This timeline helps maintain up-to-date employment records and supports state efforts in managing the workforce effectively.

- Misconception 4: The reporting process is cumbersome and time-consuming. Although the prospect of extra paperwork might seem daunting, New Hampshire provides an online “New Hire” filing link found on the homepage, which simplifies the process. This digital option can save time and resources, making compliance easier for employers.

- Misconception 5: Personal contact information is not crucial on the form. Every detail requested, including the employer's telephone and fax numbers, contact person, and the full address of the employee (explicitly noting that PO boxes are not accepted for employee addresses), is critical. This information ensures clear communication between the state and employers or employees should any issues or questions arise regarding the submission.

By addressing these misconceptions, employers can better understand their obligations and the processes involved in reporting new hires in New Hampshire. Such awareness not only aids in legal compliance but also contributes to a smoother transition for new employees into their roles within the state's workforce.

Key takeaways

When it comes to filing the New Hampshire Reporting Form for new hires, here are key points every employer should know:

- The Federal Identification Number and NHES Employer Account Number must be provided to ensure accurate reporting and identification.

- All employers must report new hires, including both W-2 employees and 1099 independent contractors, indicating the type of hire correctly using "W" for W-2 employee or "I" for an independent contractor.

- Complete employer information, including name, address, telephone, and fax numbers, along with a specific contact person, is required to facilitate communication.

- The employee's social security number, full name, residential address (not a P.O. Box), city/town, state, zip code, date of hire, and type of hire have to be clearly indicated on the form.

- It's crucial to report the date of hire accurately, defined as the first day the employee performs services for the employer.

- New hires must be reported within 20 days of their start date to comply with state guidelines.

- Employers can submit the New Hire Reporting Form via mail or fax to the specified addresses and numbers listed on the form for convenience.

- An online filing option is also available, offering a streamlined process accessible through the link provided on the New Hampshire Employment Security's homepage.

- Compliance with these reporting requirements is essential for maintaining proper records and adhering to state employment laws.

Understanding and following these guidelines ensure that employers fulfill their reporting obligations accurately and on time, contributing to the efficient administration of employment records in New Hampshire.

More PDF Forms

Nheasy - The use of the NH 3820 form is crucial for managing the discharge process, whether returning to the community or transferring within the care system.

New Hampshire Load - The New Hampshire Department of Transportation provides this form to streamline the permit application for oversized or overweight vehicles.

New Hampshire 2620 - Addressing the tax responsibility of providers directly in the form helps clarify financial obligations from the onset of enrollment.