Fillable Power of Attorney Template for New Hampshire

In the scenic state of New Hampshire, residents have the unique ability to ensure their financial, healthcare, and personal affairs are managed according to their wishes, even when they are unable to do so themselves, by utilizing a Power of Attorney (POA) form. This crucial legal document, serving as a beacon of security and foresight, empowers individuals to designate someone they trust as their agent, granting them the authority to act on their behalf. Spanning a range of purposes from managing day-to-day financial transactions to making significant healthcare decisions, the Power of Attorney form encapsulates a breadth of responsibilities and powers that can be tailored to the principal's specific needs and circumstances. It stands as a testament to the trust placed in chosen agents, ensuring that, regardless of what the future holds, one's affairs are in competent and trusted hands. Moreover, the importance of understanding the legalities, the precise nature of the powers being granted, and the conditions under which the POA becomes effective or terminates cannot be overstated, highlighting the need for a thorough and informed approach when preparing this document.

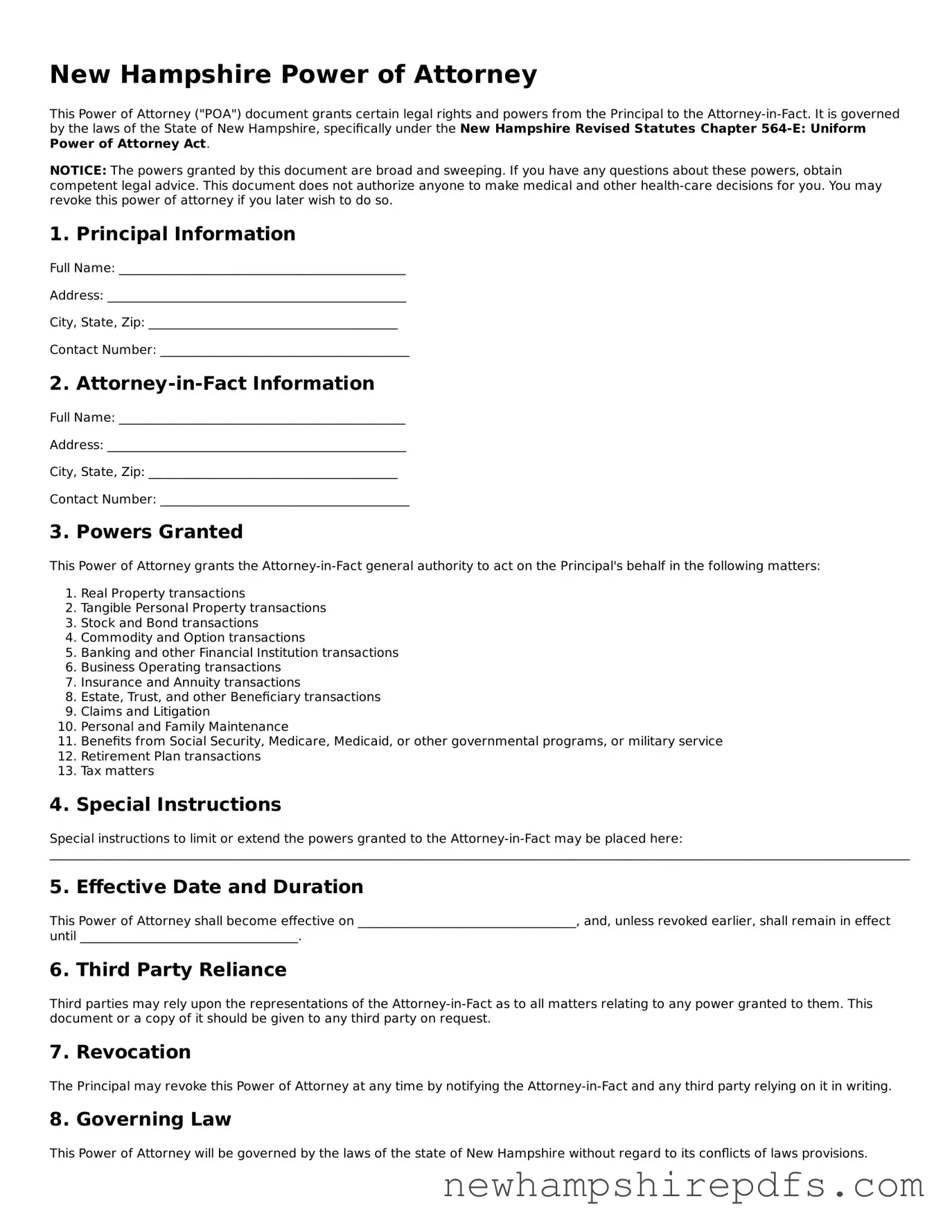

Document Sample

New Hampshire Power of Attorney

This Power of Attorney ("POA") document grants certain legal rights and powers from the Principal to the Attorney-in-Fact. It is governed by the laws of the State of New Hampshire, specifically under the New Hampshire Revised Statutes Chapter 564-E: Uniform Power of Attorney Act.

NOTICE: The powers granted by this document are broad and sweeping. If you have any questions about these powers, obtain competent legal advice. This document does not authorize anyone to make medical and other health-care decisions for you. You may revoke this power of attorney if you later wish to do so.

1. Principal Information

Full Name: ______________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

Contact Number: ________________________________________

2. Attorney-in-Fact Information

Full Name: ______________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

Contact Number: ________________________________________

3. Powers Granted

This Power of Attorney grants the Attorney-in-Fact general authority to act on the Principal's behalf in the following matters:

- Real Property transactions

- Tangible Personal Property transactions

- Stock and Bond transactions

- Commodity and Option transactions

- Banking and other Financial Institution transactions

- Business Operating transactions

- Insurance and Annuity transactions

- Estate, Trust, and other Beneficiary transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement Plan transactions

- Tax matters

4. Special Instructions

Special instructions to limit or extend the powers granted to the Attorney-in-Fact may be placed here: ____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

5. Effective Date and Duration

This Power of Attorney shall become effective on ___________________________________, and, unless revoked earlier, shall remain in effect until ___________________________________.

6. Third Party Reliance

Third parties may rely upon the representations of the Attorney-in-Fact as to all matters relating to any power granted to them. This document or a copy of it should be given to any third party on request.

7. Revocation

The Principal may revoke this Power of Attorney at any time by notifying the Attorney-in-Fact and any third party relying on it in writing.

8. Governing Law

This Power of Attorney will be governed by the laws of the state of New Hampshire without regard to its conflicts of laws provisions.

9. Signature

Principal's Signature: ____________________________________ Date: _________________

Attorney-in-Fact's Signature: ______________________________ Date: _________________

State of New Hampshire

County of ___________________

Subscribed, sworn to, or affirmed before me on _____________(date) by ________________________________(name of Principal) and ________________________________(name of Attorney-in-Fact).

Notary Public: ___________________________________________

My Commission Expires: __________________________________

PDF Form Breakdown

| Fact | Detail |

|---|---|

| 1. Governing Law | New Hampshire's Power of Attorney forms are primarily governed by Chapter 564-E: Uniform Power of Attorney Act. |

| 2. Durability | In New Hampshire, all Powers of Attorney are considered durable unless the document explicitly states otherwise, meaning they remain in effect if the principal becomes incapacitated. |

| 3. Principal Requirements | The person creating a Power of Attorney in New Hampshire must be of sound mind and capable of making informed decisions at the time of creating the document. |

| 4. Agent Obligations | The appointed agent must act in the principal's best interest, maintain accurate records, and avoid conflicts of interest. |

| 5. Types of Powers | There can be different types of Powers of Attorney in New Hampshire, including General, Limited, and Health Care PoAs, each serving different purposes and granting different levels of authority. |

| 6. Signing Requirements | The Power of Attorney must be signed by the principal and either notarized or signed in front of two witnesses who are not the agent or related to the principal by blood, marriage, or adoption. |

| 7. Revocation | The principal can revoke a Power of Attorney at any time, as long as they are mentally competent. This revocation must be done in writing and communicated to the relevant parties. |

| 8. Springing Powers | A Power of Attorney can be "springing," meaning it only becomes effective upon the occurrence of a specific event, typically the principal's incapacitation. |

| 9. Filing Requirements | While not always required, a Power of Attorney document might need to be filed with the local county clerk's office, especially if it pertains to real estate transactions. |

How to Use New Hampshire Power of Attorney

Power of Attorney (POA) is a powerful legal document in New Hampshire, allowing you to appoint someone to manage your affairs if you become unable to do so yourself. Whether for financial reasons, health concerns, or other personal circumstances, ensuring the form is filled out accurately and thoroughly can protect your interests and make your intentions clear. The process to complete the New Hampshire Power of Attorney form involves gathering necessary information, understanding the extent of the powers being granted, and correctly finalizing the document in compliance with state law.

- Begin by reviewing the entire form to understand the scope and implications of granting a Power of Attorney.

- Gather personal information, including the full legal names and addresses of both the principal (person granting the power) and the agent (person receiving the power).

- Decide on the powers you wish to grant to your agent. This could range from broad, general powers to more specific ones. Take the time to consider future needs and circumstances.

- Fill in the personal details of both the principal and the agent in the designated areas on the form.

- Clearly specify the powers being granted in the sections provided. If the form includes checkboxes for different powers, mark each power you are granting. If there’s space for additional instructions or limitations, write them clearly.

- If applicable, indicate the duration of the Power of Attorney. Some POAs are effective immediately and last indefinitely, while others are activated only under certain conditions or have a specified end date.

- Review the completed form to ensure all the information is correct and that it reflects your wishes accurately.

- Sign and date the form in the presence of a notary public. New Hampshire may require notarization for the document to be legally valid.

- The agent should also sign the form, acknowledging their acceptance of the responsibilities being granted to them.

- Retain a copy for your records and provide the original to your agent. It’s also wise to inform any relevant financial institutions, healthcare providers, or other entities that may be affected by the Power of Attorney.

Completing the New Hampshire Power of Attorney form is a proactive step in managing your affairs and ensuring your interests are protected. By following these steps carefully, you can grant powers with confidence, knowing you have taken the necessary measures for a comprehensive and legally sound arrangement.

Understanding New Hampshire Power of Attorney

What is a Power of Attorney form in New Hampshire?

A Power of Attorney (POA) form in New Hampshire is a legal document that allows you to appoint someone else, called an agent, to make decisions on your behalf. This can include managing your finances, real estate, and other legal matters, especially when you are unable to do so yourself.

Who can be appointed as an agent in New Hampshire?

In New Hampshire, an agent can be any competent adult you trust, such as a family member, friend, or professional advisor. It's important that the person you choose is trustworthy and capable of handling the responsibilities you assign to them.

Are there different types of Power of Attorney forms in New Hampshire?

Yes, New Hampshire recognizes several types of Power of Attorney forms, including General Power of Attorney, Limited Power of Attorney, Health Care Power of Attorney, and Durable Power of Attorney. Each type serves different purposes and will be effective in various situations, depending on your needs.

What is a Durable Power of Attorney?

A Durable Power of Attorney remains in effect even if you become mentally incapacitated. This is critical for ensuring that the agent you have chosen can continue to act on your behalf, especially in situations where you are unable to make decisions for yourself.

How can I revoke a Power of Attorney in New Hampshire?

You can revoke a Power of Attorney in New Hampshire at any time, as long as you are mentally competent. This is typically done by notifying your agent in writing that their power has been revoked and, if applicable, informing any third parties who were aware of the original Power of Attorney. It is also recommended to destroy all copies of the old Power of Attorney form.

Does a Power of Attorney need to be notarized in New Hampshire?

Yes, for a Power of Attorney to be legally valid in New Hampshire, it must be notarized. This means that you and your chosen agent need to sign the document in the presence of a notary public, who will verify your identities and signatures.

What happens if I don't have a Power of Attorney in New Hampshire?

If you become incapacitated without a Power of Attorney in place in New Hampshire, the court may need to appoint a guardian or conservator to make decisions on your behalf. This process can be time-consuming and costly, and it might result in someone you wouldn't have chosen being appointed to manage your affairs.

Can I change my Power of Attorney once it has been created?

Yes, you can change or update your Power of Attorney at any time as long as you are mentally competent. To do so, you should create a new Power of Attorney document and revoke the previous one. Make sure to provide the new Power of Attorney to anyone who had a copy of the old one.

Common mistakes

Filling out a Power of Attorney (POA) form in New Hampshire is a significant step for individuals seeking to legally authorize someone else to make decisions on their behalf. However, errors in completing this form can lead to complications and even invalidation of the document. Among the common mistakes are overlooking the requirement for specificity, neglecting to specify a durability clause, failure to appoint a contingent agent, and not following the proper signing protocol.

The first common mistake is the lack of specificity within the document. A POA must clearly outline the scope of authority granted to the agent. This means identifying what decisions the agent can make and under what circumstances. Without this clarity, third parties may reject the POA for being too vague or broad, leading to delays or refusal in the acceptance of the document. It's paramount that the principal precisely detail the agent’s powers, whether financial, medical, or otherwise.

Another frequently encountered error is neglecting to include a durability clause. Should the principal become incapacitated, a standard POA ceases to be effective unless it explicitly states otherwise. Here, durability refers to the POA's ongoing validity even if the principal can no longer make decisions for themselves. This critical aspect ensures that the agent can continue to act on behalf of the principal, particularly during times when they are most needed.

Failure to appoint a contingent agent is also a common oversight. Life is unpredictable, and the initially chosen agent may become unavailable or unwilling to serve due to unforeseen circumstances. Without a successor agent named in the POA, the document may become ineffective precisely when it's needed most. It is advisable to designate an alternate, or contingent, agent to step in should the original agent be unable to fulfill their duties.

Last but not least, not adhering to the proper signing protocol can render the document void. New Hampshire law requires the POA to be signed by the principal in the presence of a notary public or other qualified individuals. Additionally, certain types of POA may require witnesses. Overlooking these formalities can lead to the rejection of the POA by financial institutions, healthcare providers, and government agencies, among others. Ensuring that all signing requirements are meticulously followed is crucial for the document’s validity.

Documents used along the form

When setting up a Power of Attorney in New Hampshire, it's important to know it's often just a piece of the puzzle. Several other forms and documents can complement it or are necessary to ensure comprehensive coverage of your legal and financial wishes. Let’s explore some of the documents frequently used alongside the New Hampshire Power of Attorney form.

- Advance Directive: This document includes a living will and health care proxy. It outlines your wishes regarding medical treatment if you become unable to communicate or make decisions due to illness or incapacitation.

- Will: A will outlines how you want your property and assets distributed after your death. It can complement a Power of Attorney by covering aspects not addressed while you are alive.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) form gives someone you trust the authorization to access your medical records. This is crucial for making informed decisions about your health care under a medical Power of Attorney.

- Revocation of Power of Attorney: This form is essential if you decide to cancel or change the Power of Attorney. It legally revokes the authority granted to the agent.

- Trust Agreement: A trust agreement can be used alongside a Power of Attorney to manage your assets. It involves setting up a trust and appointing a trustee to handle your affairs, often used for estate planning purposes.

These documents, while not always required, serve to protect your interests and ensure your wishes are respected in various situations. Having a well-rounded approach to your legal and financial planning can bring peace of mind to you and your loved ones. Always consider consulting with a professional to determine which forms are suitable for your specific needs.

Similar forms

The New Hampshire Power of Attorney form is similar to various other legal documents that enable individuals to appoint representatives to act in their stead for a range of decisions and actions. Though each document serves a unique purpose, they share commonalities in functionality, legal requirements, and the delegation of authority.

Healthcare Proxy or Healthcare Power of Attorney: This legal document specifically allows an individual to appoint someone else to make healthcare decisions on their behalf if they become unable to do so. Similar to the New Hampshire Power of Attorney, which can include or specifically relate to health decisions depending on how it is drafted, both documents require the principal to clearly outline the extent of authority granted to their representative. However, the Healthcare Proxy is solely focused on medical decisions, while a Power of Attorney might be broader or include various types of decisions beyond healthcare.

Durable Power of Attorney: It closely resembles the New Hampshire Power of Attorney but is distinct in how it remains effective even if the principal becomes incapacitated. Like a standard Power of Attorney, it allows an individual to delegate authority to another person to manage their affairs. The key similarity lies in the delegation of authority, but the durable variant emphasizes maintaining that authority beyond the principal's capacity to make their own decisions, thereby ensuring continuity in decision-making and management of the individual's affairs.

Springing Power of Attorney: This form of Power of Attorney is conditional and takes effect only when certain specified conditions are met, usually the incapacity of the principal. Similar to the New Hampshire Power of Attorney in the aspect of appointing an agent to act on one's behalf, its unique feature is that it "springs" into action based on specific events, as outlined in the document. Both documents necessitate clarity in defining the powers granted and require the principal to consider carefully whom they trust to act on their behalf.

Dos and Don'ts

When drafting a Power of Attorney (POA) in New Hampshire, individuals should approach the process with attention and diligence. This document grants another person or entity the legal authority to act on one's behalf in matters specified within the document. While the form itself is straightforward, understanding the essentials of filling it out correctly can prevent future legal complications. Below are key dos and don’ts to consider.

Do:- Thoroughly review the New Hampshire statutes related to powers of attorney to ensure understanding of the document’s scope and limitations.

- Clearly identify the principal (the person granting the power) and the agent (the person receiving the power) with full legal names and addresses.

- Specify the exact powers being granted, including any limitations or special conditions you wish to apply.

- Include a durability clause if you wish the power to remain effective even if the principal becomes incapacitated.

- Ensure the document meets New Hampshire’s legal requirements for a power of attorney, including any witness or notarization mandates.

- Sign and date the document in the presence of a notary public or other authorized official as required by state law.

- Provide clear instructions for termination of the power of attorney, detailing any events or dates that will end the authorization.

- Keep the original document in a safe, accessible place and provide copies to relevant parties, such as financial institutions or medical providers.

- Regularly review and update the document as necessary to reflect changes in wishes or personal circumstances.

- Consult with a legal professional to ensure the document meets all legal requirements and accurately reflects your intentions.

- Use vague language that could be open to interpretation; be precise about the powers and limitations you are granting.

- Forget to notify your chosen agent and discuss your expectations and their responsibilities under the power of attorney.

- Overlook the importance of a successor agent in case the original agent is unable or unwilling to serve.

- Assume the form is universal; state laws vary, and a POA valid in one state may not be valid in another without modifications.

- Ignore the requirements for signing and witnessing the document, as failing to meet these can invalidate the power of attorney.

- Neglect to specify a termination date or condition, leaving the power of attorney open-ended and potentially in effect indefinitely.

- Fail to consider the implications of granting broad powers without sufficient oversight or limitations.

- Avoid discussing your plans with family members or other affected parties who may need to understand your arrangements.

- Keep only one copy of the document; multiple copies ensure that your agent and institutions can act without delay when necessary.

- Delay creating a power of attorney until it is urgently needed, as unforeseen circumstances can arise at any time.

Misconceptions

When it comes to comprehending the New Hampshire Power of Attorney (POA) form, a few misconceptions frequently arise. Clearing up these misunderstandings is key to ensuring that individuals make informed decisions about delegating authority for personal, financial, or health-related decisions.

- One Size Fits All: A common belief is that the New Hampshire POA form applies in a uniform manner across all situations. However, this document can be highly customized to fit specific needs and circumstances. Various forms cater to different purposes, such as financial matters, medical decisions, or limited transactions.

- Immediate Activation: Many assume that once a POA form is signed, it becomes active immediately. This isn't always the case. The document can be structured to come into effect upon certain conditions, such as the incapacitation of the principal (the person granting the power).

- Lasts After Death: There's a misconception that a POA continues to be effective after the principal's death. In reality, all powers granted through a POA cease upon the principal's death. At that point, the executor of the estate, as designated in a will, takes over.

- No Legal Oversight: Some people believe that once a POA is executed, it operates without any legal oversight. While it's true that the agent (the person granted the power) operates with considerable autonomy, they must always act in the best interests of the principal. There are legal mechanisms in place to address misuse or abuse of these powers.

- Irrevocability: Another common misconception is that once a POA is established, it cannot be revoked. On the contrary, as long as the principal is mentally competent, they can revoke or amend the POA at any time.

- Legal Representation Is Not Necessary: While it's possible to create a POA without legal advice, the belief that it's best to do so can lead to issues. Misunderstandings about the form’s contents or the extent of the powers granted can result in a document that doesn't serve the principal's best interest or intentions. Consulting with a legal professional can ensure that the POA reflects the principal's wishes and complies with New Hampshire law.

Understanding these misconceptions can help individuals navigate the complexities of creating a POA that accurately reflects their wishes and needs. It's always advised to seek professional advice to ensure that all legal requirements are met and that the document is tailored to the individual's circumstances.

Key takeaways

Accurately completing a Power of Attorney (POA) form is a critical step for ensuring your wishes are carried out in New Hampshire. Here are four key takeaways to guide you through the process:

- Understand the Types: Recognize the different types of POA available. Some are specific to healthcare decisions, while others cover financial matters. Choosing the right type is crucial to address your needs.

- Choose Your Agent Wisely: Selecting a trustworthy individual to act as your agent is essential. This person will have significant authority to make decisions on your behalf, so trust and reliability should be top considerations.

- Be Specific: Clearly detail what powers you are granting. New Hampshire law allows you to tailor the POA to your specific requirements, whether it's broad authority or limited to certain acts.

- Follow Legal Requirements: For a POA to be valid in New Hampshire, it must comply with state laws, including being signed in the presence of a notary public. Ensure all legal formalities are observed to avoid challenges to its validity.

Properly completing and using a POA form can safeguard your interests and ensure your affairs are managed according to your preferences. If you have any doubts, consulting with a legal professional can offer peace of mind and ensure that all requirements are met.

Some Other New Hampshire Forms

How to Write a Divorce Agreement - The divorce settlement agreement is a critical step in the divorce process, symbolizing the finality of the separation and the beginning of new arrangements.

Auto Bill of Sale New Hampshire - It’s a universally recognized form that establishes a formal agreement between buyer and seller, legitimizing the transaction in the eyes of the law.

Nh Small Estate Probate - An essential form for families looking to resolve estate matters without engaging in the full probate process.