Fillable Prenuptial Agreement Template for New Hampshire

Before walking down the aisle, couples in New Hampshire have the option to plan ahead and prepare for their financial future together. The New Hampshire Prenuptial Agreement form serves as a critical tool in this preparation, allowing partners to define the terms of ownership and division of their assets and liabilities, should their marriage come to an end. This form isn't just about planning for the possible end of a marriage; it's about clarity, fairness, and mutual respect. By detailing how property would be divided, how debts would be handled, and even considering the possibility of alimony, couples can enter into their marriage with a clear understanding of each other's financial rights and responsibilities. Additionally, it includes provisions for the protection of each party's assets, ensuring that personal property, inheritances, or business interests remain safeguarded. This proactive step can ease potential financial tensions by setting expectations and providing a roadmap for the unlikely event of a dissolution of the marriage, therefore allowing couples to focus on building their future together with peace of mind.

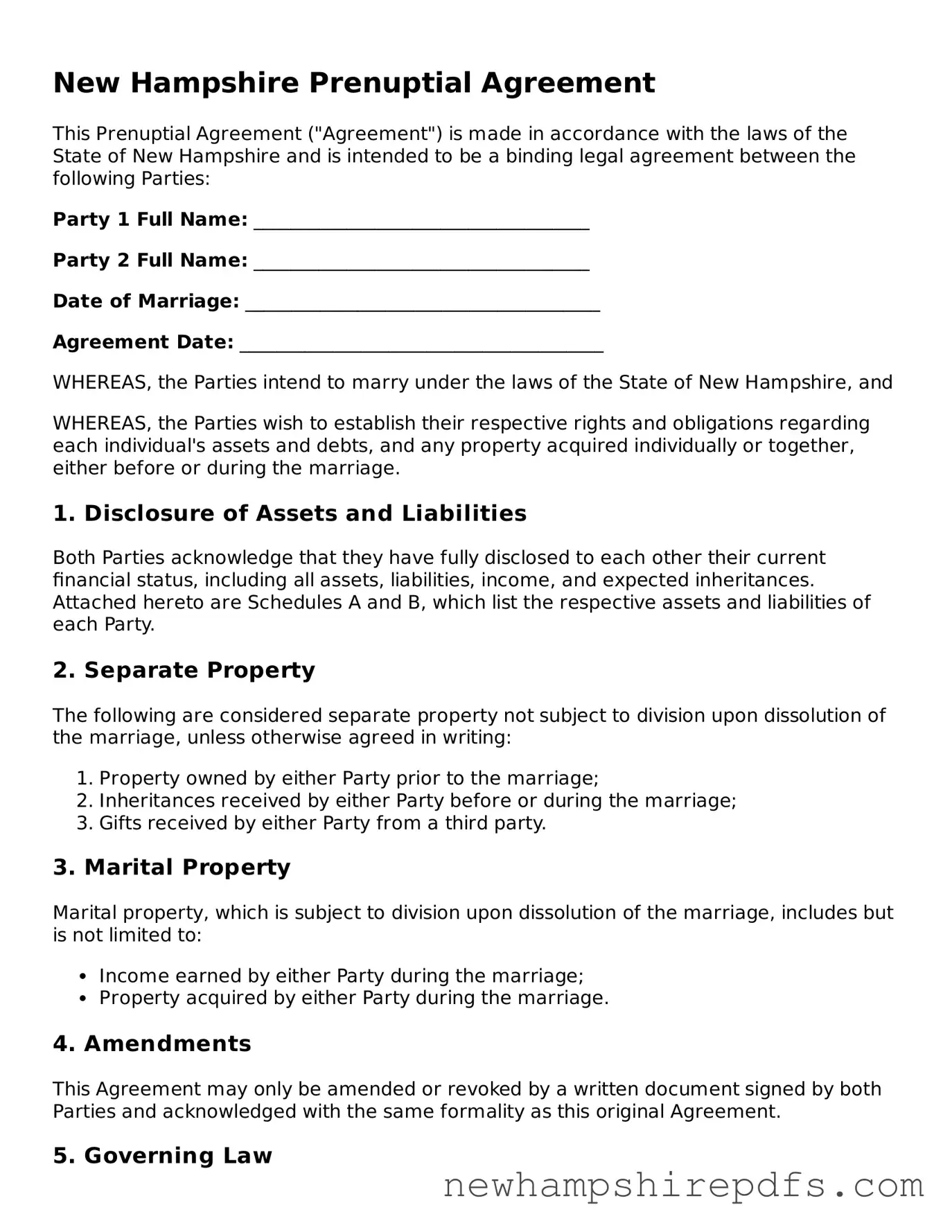

Document Sample

New Hampshire Prenuptial Agreement

This Prenuptial Agreement ("Agreement") is made in accordance with the laws of the State of New Hampshire and is intended to be a binding legal agreement between the following Parties:

Party 1 Full Name: ____________________________________

Party 2 Full Name: ____________________________________

Date of Marriage: ______________________________________

Agreement Date: _______________________________________

WHEREAS, the Parties intend to marry under the laws of the State of New Hampshire, and

WHEREAS, the Parties wish to establish their respective rights and obligations regarding each individual's assets and debts, and any property acquired individually or together, either before or during the marriage.

1. Disclosure of Assets and Liabilities

Both Parties acknowledge that they have fully disclosed to each other their current financial status, including all assets, liabilities, income, and expected inheritances. Attached hereto are Schedules A and B, which list the respective assets and liabilities of each Party.

2. Separate Property

The following are considered separate property not subject to division upon dissolution of the marriage, unless otherwise agreed in writing:

- Property owned by either Party prior to the marriage;

- Inheritances received by either Party before or during the marriage;

- Gifts received by either Party from a third party.

3. Marital Property

Marital property, which is subject to division upon dissolution of the marriage, includes but is not limited to:

- Income earned by either Party during the marriage;

- Property acquired by either Party during the marriage.

4. Amendments

This Agreement may only be amended or revoked by a written document signed by both Parties and acknowledged with the same formality as this original Agreement.

5. Governing Law

This Agreement shall be governed by the laws of the State of New Hampshire.

Signatures

This Agreement is entered into voluntarily, with full understanding of its terms and effects and with the intention of it being a binding document.

Party 1 Signature: ___________________________ Date: ___________

Party 2 Signature: ___________________________ Date: ___________

Witness Signature: ___________________________ Date: ___________

PDF Form Breakdown

| Fact | Description |

|---|---|

| Governing Law | New Hampshire prenuptial agreements are governed by New Hampshire Revised Statutes Chapter 460:2-a. |

| Enforceability | Prenuptial agreements in New Hampshire are enforceable if entered into voluntarily and with full disclosure of assets. |

| Disclosure Requirement | Full and fair disclosure of the assets and financial obligations of each party is required for the agreement to be valid. |

| Legal Representation | Parties are not required by law to have legal representation to execute a prenuptial agreement, but it is highly advised. |

| Amendment or Revocation | The agreement can be amended or revoked only by a written agreement signed by both parties. |

| Scope | It can cover property division, alimony, and inheritance rights, but it cannot dictate terms regarding child support or custody. |

How to Use New Hampshire Prenuptial Agreement

Filling out the New Hampshire Prenuptial Agreement form is a crucial step for couples planning to marry, ensuring clarity and understanding regarding their financial arrangements before entering marriage. A properly completed form can safeguard both parties' interests, providing peace of promise about future financial matters. The process involves detailing assets, debts, and agreeing on how these should be handled in various scenarios. Below are the steps to fill out the form accurately and comprehensively.

- Gather all necessary financial documents for both parties, including bank statements, retirement accounts, property deeds, and any debts or liabilities.

- Clearly print the full legal names of both parties entering the agreement at the top of the form.

- Detail the current financial assets and liabilities of each person on the designated lines. This includes listing all bank accounts, real estate, investments, and any significant personal property along with any outstanding debts.

- Specify the terms of how these assets and liabilities will be treated in the event of a divorce or death of one party. It is crucial that both parties agree on these terms before proceeding.

- Include any special agreements or conditions that are important to both parties. This might cover future inheritances, business ownership, or arrangements regarding children from previous relationships.

- The agreement must specify any separate property that each person wishes to retain as their own, not subject to division.

- Discuss and decide if there will be spousal support in the event of a divorce, and include the details. If not, this should also be stated clearly.

- Both parties should review the agreement carefully, ensuring that it reflects their understanding and agreement. It's advisable to seek legal counsel to ensure that the rights and obligations are understood by both parties.

- Once satisfied, both parties should sign and date the form in the presence of a notary public to validate the agreement. Ensure the notary also signs and applies their seal to confirm the authenticity of the signatures.

- Keep the original signed document in a secure but accessible place, and consider providing copies to legal counsel or financial advisors for safekeeping.

After completing the prenuptial agreement, the engaged couple has taken a proactive step towards managing their financial future together. This document, while often overlooked, serves as a foundational part of a strong and transparent marriage. It’s a reflection of mutual respect and a shared commitment to facing life's challenges together, prepared and informed. Ensuring that the agreement is completed and signed well before the wedding day can help alleviate any stress or concern, allowing both parties to focus on their relationship and future together.

Understanding New Hampshire Prenuptial Agreement

What is a Prenuptial Agreement in New Hampshire?

A prenuptial agreement in New Hampshire is a legal contract entered into by two individuals before they marry. This document outlines how assets and financial responsibilities will be handled during the marriage and in the event of divorce or death. It aims to protect the financial interests of both parties, clarifying property division, debt allocation, and potentially, spousal support matters.

Who should consider a Prenuptial Agreement?

Anyone entering into marriage with significant assets, debts, or children from previous relationships should consider a prenuptial agreement. This includes individuals looking to protect inherited assets, business owners, or those who wish to clearly define their financial rights and responsibilities in marriage. It's not just for the wealthy; it's a practical measure for anyone wanting to secure their financial future and clarify financial expectations before marrying.

Are Prenuptial Agreements enforceable in New Hampshire?

Yes, prenuptial agreements are enforceable in New Hampshire, provided they meet certain legal requirements. For an agreement to be valid, it must be entered into voluntarily, with full and fair disclosure of all assets and liabilities by both parties. Additionally, both parties should have the opportunity to consult with their own independent legal counsel before signing. The agreement must also be fair and not result in unconscionable circumstances for either party at the time of enforcement.

Can a Prenuptial Agreement cover child support or custody issues in New Hampshire?

No, prenuptial agreements in New Hampshire cannot dictate terms regarding child support or custody. These matters are determined based on the child's best interests at the time of divorce, not pre-set agreements. Courts retain the authority to make decisions on child support and custody that best protect the child's welfare, regardless of any prenuptial provisions.

How can someone create a Prenuptial Agreement in New Hampshire?

To create a prenuptial agreement in New Hampshire, both parties should start by independently listing their assets, liabilities, and expectations for the agreement. It's highly recommended to seek individual legal advice to ensure that the agreement accurately reflects each party's interests and meets state legal requirements. Once drafted, both parties must voluntarily sign the agreement, preferably with witness or notary acknowledgment, to solidify its enforceability. Engaging a legal professional can help navigate the complexities of creating a comprehensive and enforceable agreement.

Common mistakes

When couples decide to draft a prenuptial agreement in New Hampshire, they often approach the task with care and attention. However, despite their best intentions, they can make mistakes that impact the effectiveness of the agreement. Understanding these common pitfalls can help individuals avoid them and ensure their agreements hold up if they ever need to be enforced.

One significant mistake is not providing full disclosure of assets and liabilities. This mistake can lead to a situation where the agreement is not enforceable because one party did not have a clear understanding of the financial situation they were entering into. It's crucial that both parties list all their assets and liabilities completely and accurately.

Another mistake is failing to obtain independent legal advice. Often, couples might try to save on expenses by using one lawyer for their prenuptial agreement or foregoing legal advice altogether. This approach can result in an agreement that does not protect both parties' interests or one that could be challenged in court.

A third mistake is not considering the need for updates. Like life, financial situations can change, necessitating updates to the agreement. Neglecting this need means that an agreement might not reflect the current circumstances or wishes of the parties, rendering it less effective.

The fourth mistake involves rushing the process. Couples might wait until just before their wedding to draft a prenuptial agreement. This rush can result in inadequate review and consideration, leading to issues with the agreement's terms or enforceability.

Besides these, many couples overlook the importance of specificity and clarity in their agreement. Vague or ambiguous terms can cause significant confusion and conflict if the agreement needs to be interpreted by a court.

Last but not least, some people mistakenly believe that a prenuptial agreement can include terms about child support or custody. New Hampshire law, like that in many jurisdictions, does not allow prenuptial agreements to dictate terms involving children since their welfare is determined based on their best interests at the time of the separation or divorce.

In conclusion, while drafting a prenuptial agreement in New Hampshire, couples should avoid these common mistakes:

- Failing to provide full disclosure of assets and liabilities.

- Not obtaining independent legal advice.

- Ignoring the need for future updates.

- Rushing the drafting process.

- Being vague and not specific enough.

- Including terms about child support or custody.

Documents used along the form

When entering into a prenuptial agreement in New Hampshire, several other forms and documents may be used in conjunction with the agreement to ensure clarity, legality, and comprehensive coverage of all concerned matters. These documents serve to provide additional information, legal certainty, and an overall understanding of each party's financial situation and expectations. Below is a list of frequently used forms and documents alongside the New Hampshire Prenuptial Agreement form.

- Financial Disclosure Statements: These documents provide a detailed account of each party's financial situation, including assets, liabilities, income, and expenses. Financial disclosures are essential for the enforceability of a prenuptial agreement, ensuring that both parties are making informed decisions.

- Will and Testament: Often updated or created in conjunction with a prenuptial agreement, wills ensure that assets are distributed according to the individuals’ wishes, which may include stipulations outlined in the prenuptial agreement.

- Life Insurance Policies: Life insurance documents might be reviewed or obtained to align with the terms of a prenuptial agreement, especially concerning the provision for a spouse in the event of one party's death.

- Property Deeds and Titles: Documents relating to property ownership, including deeds and titles, are often reviewed or transferred to reflect the agreements made about property distribution and ownership in the prenuptial agreement.

- Postnuptial Agreement: Although not as common, a postnuptial agreement can be drafted after marriage to make changes to the prenuptial agreement or to address issues not previously considered. This can be particularly useful if the financial situations of the parties change significantly after marriage.

Using these documents in tandem with a New Hampshire Prenuptial Agreement ensures both parties are fully informed and agree upon the terms of their arrangement. It's crucial for individuals to understand each document thoroughly and consider legal consultation to protect their rights and interests fully. These supportive documents and the prenuptial agreement itself aim to provide a solid foundation for the future, addressing financial matters and responsibilities directly and clearly.

Similar forms

The New Hampshire Prenuptial Agreement form is similar to other legal agreements that also focus on planning ahead for financial and personal affairs. These documents typically outline terms and conditions agreed upon by the parties involved, much like a prenuptial agreement outlines the financial agreements between partners before marriage. Understanding these similarities can help individuals better grasp the nature and importance of a prenuptial agreement.

Will and Testament: The similarity between a New Hampshire Prenuptial Agreement and a Will and Testament lies in their forward-looking nature. Both are proactive measures taken to arrange personal and financial matters in anticipation of a future event—marriage in the case of a prenuptial agreement and the death of an individual for a will. Each document clearly outlines how assets and responsibilities are to be handled; a prenuptial agreement does so for the possibility of divorce, while a will does so for the distribution of an estate after death.

Power of Attorney: This document resembles a New Hampshire Prenuptial Agreement in that it involves designating roles and responsibilities about financial decisions. A Power of Attorney grants someone the authority to act on behalf of another in financial affairs or health care decisions. Similarly, a prenuptial agreement may delineate how financial decisions and responsibilities are managed in a marriage. The parallel is the preventive approach both documents take, allowing individuals to decide in advance how matters should be handled.

Living Trust: A Living Trust and a New Hampshire Prenuptial Agreement share similarities in asset management and protection. Both serve the purpose of specifying how assets are controlled and distributed, but under different circumstances. A prenuptial agreement addresses asset division between spouses in the event of separation, divorce, or death, while a living trust is concerned with providing a mechanism for managing one's estate during their lifetime and distributing it upon their death, often without the need for probate.

Overall, while each of these documents serves distinct functions, they share the common theme of offering individuals a way to organize their affairs. The New Hampshire Prenuptial Agreement, similar to wills, powers of attorney, and living trusts, provides a structured approach to planning for the future, reflecting an individual's wishes and intentions.

Dos and Don'ts

Filling out a New Hampshire Prenuptial Agreement form requires attention to detail and an understanding of what is legally binding and what is fair for both parties. Here are seven key dos and don'ts to help guide you through the process.

Do:

- Ensure both parties have ample time to review the agreement before the wedding. This prevents any claims of being rushed or coerced into signing.

- Disclose all assets, liabilities, and income fully and truthfully. Transparency is critical to a valid and enforceable prenuptial agreement.

- Seek independent legal advice. Each party should have their own attorney to ensure their interests are adequately represented and understood.

- Consider the inclusion of a sunset clause, which sets an expiration date for the prenuptial agreement if desired.

- Use clear and unambiguous language to prevent misunderstandings or disputes in the future.

- Update the agreement in the event of significant financial changes or every few years as needed to reflect the current state of affairs.

- Maintain a respectful and cooperative tone throughout discussions about the prenuptial agreement. This process can strengthen your relationship by fostering open communication.

Don't:

- Include provisions about non-financial matters, such as chores, relationships with in-laws, or decisions about children. These topics are generally considered invalid and unenforceable in prenuptial agreements.

- Sign the agreement without fully understanding every term and condition. If something is unclear, ask your attorney for clarification.

- Forget to consider the impact of state laws. New Hampshire may have unique requirements or interpretations for prenuptial agreements.

- Assume a prenuptial agreement creates distrust in a relationship. When done properly, it can provide clarity and protection for both parties.

- Pressure or be pressured into signing a prenuptial agreement. It should be a mutual decision made without duress.

- Leave out any assets or liabilities, as doing so could invalidate the agreement or parts of it.

- Rely solely on templates or generic forms. Each couple's situation is unique, and the prenuptial agreement should reflect that.

Misconceptions

When it comes to preparing for marriage, many couples in New Hampshire may consider entering into a Prenuptial Agreement. However, there are several misconceptions surrounding these agreements that can lead to confusion. Below are five common misunderstandings clarified to help individuals better understand Prenuptial Agreements in New Hampshire.

- Only the Wealthy Need Them: A common belief is that Prenuptial Agreements are only for those with substantial assets. In reality, these agreements benefit anyone who wants to clearly define their financial rights and responsibilities during marriage and in the event of a divorce or death.

- They Are Only Useful in Divorce: While it's true that Prenuptial Agreements are often used to outline the division of assets and liabilities in the event of a divorce, they also play a crucial role in estate planning and protecting inheritances.

- Prenuptial Agreements Are Automatically Enforced: For a Prenuptial Agreement to be enforceable in New Hampshire, it must meet certain legal requirements. Both parties need to fully disclose their assets, and the agreement must be entered into voluntarily without coercion. Additionally, the terms cannot be unjust or extremely one-sided at the time of enforcement.

- Discussing a Prenuptial Agreement Indicates a Lack of Trust: Many believe that suggesting a Prenuptial Agreement implies a lack of confidence in the relationship. On the contrary, discussing financial matters openly can strengthen trust and ensure both parties are entering the marriage with a clear understanding of each other’s expectations. li>They’re Too Expensive: While it is true that drafting a Prenuptial Agreement involves legal fees, the cost can vary widely depending on the complexity of the couple’s finances and the extent of negotiations required. Considering the potential cost and emotional stress of dividing assets and liabilities in a divorce without an agreement, many find Prenuptial Agreements to be a worthwhile investment.

Key takeaways

When considering the use of a prenuptial agreement in New Hampshire, there are several key points that both parties should understand. These points provide a foundation for understanding what a prenuptial agreement is, its purpose, and how it should be properly filled out and utilized:

- Understand the Purpose: A prenuptial agreement is a legal document that determines how assets and financial affairs will be handled in the event of a divorce or death. It is crucial for protecting individual assets and clarifying financial responsibilities.

- Full Disclosure is Required: Both parties must fully disclose their assets, liabilities, and income. Transparency is vital for the agreement to be enforceable.

- Separate Legal Representation: Each party should have their own legal representation when drafting and reviewing the prenuptial agreement. This ensures that the interests of both individuals are fairly represented.

- Consider Future Changes: The agreement can address future changes in finances, such as inheritance, business growth, or changes in employment. Often, provisions are included to revisit the agreement under certain conditions.

- Cannot Include Child Support or Custody: Prenuptial agreements cannot dictate terms regarding child support or custody arrangements. These issues are determined based on the child's best interest at the time of separation or divorce.

- Must Not Be Entered Under Duress: For a prenuptial agreement to be valid, it must be signed voluntarily by both parties without any pressure or duress.

- Understand State Laws: New Hampshire has specific laws governing the enforceability of prenuptial agreements. Familiarity with these laws is critical for ensuring that the agreement complies with state requirements.

- Consult with a Lawyer: While there are templates and examples of prenuptial agreements, consulting with a lawyer ensures that the document is tailored to meet the specific needs and legal requirements of the parties involved.

- Amendment and Revocation: The agreement should include provisions on how it can be amended or revoked. Such changes typically require mutual consent and proper documentation.

- Proper Execution: The agreement must be properly executed. This means it should be in writing, signed by both parties, and notarized if required by state law.

By adhering to these key takeaways, parties can ensure that their prenuptial agreement in New Hampshire is legally sound, reflects their intentions, and provides the desired protections. Given the complexities involved, the guidance of experienced legal counsel is invaluable in this process.

Some Other New Hampshire Forms

Nh Bill of Sale Template - For insurance purposes, this form can be necessary to show proof of ownership and value of the mobile home.

Power of Attorney New Hampshire - For adults with aging parents, a Power of Attorney is a fundamental part of elder care planning, addressing both financial and healthcare needs.

Free Car Bill of Sale - Acts as a physical record of the transaction, complementing electronic records and other forms of evidence.