Fillable Promissory Note Template for New Hampshire

In the realm of financial agreements in New Hampshire, the Promissory Note form holds a significant place as a crucial document that outlines the details of a loan between two parties. This legally binding agreement specifies the amount of money borrowed, the interest rate applicable, repayment schedule, and the consequences of non-payment. It serves as a formal recognition of the debt and protects the interests of both the lender and the borrower by clearly stating their obligations and rights. Tailored to adhere to New Hampshire's state laws, this document ensures that all financial transactions are conducted within the legal framework, providing peace of mind to all involved parties. By clearly laying out the terms and conditions of the loan, the New Hampshire Promissory Note form plays a pivotal role in fostering trust and transparency between the lender and the borrower, making it an indispensable tool in the financial landscape.

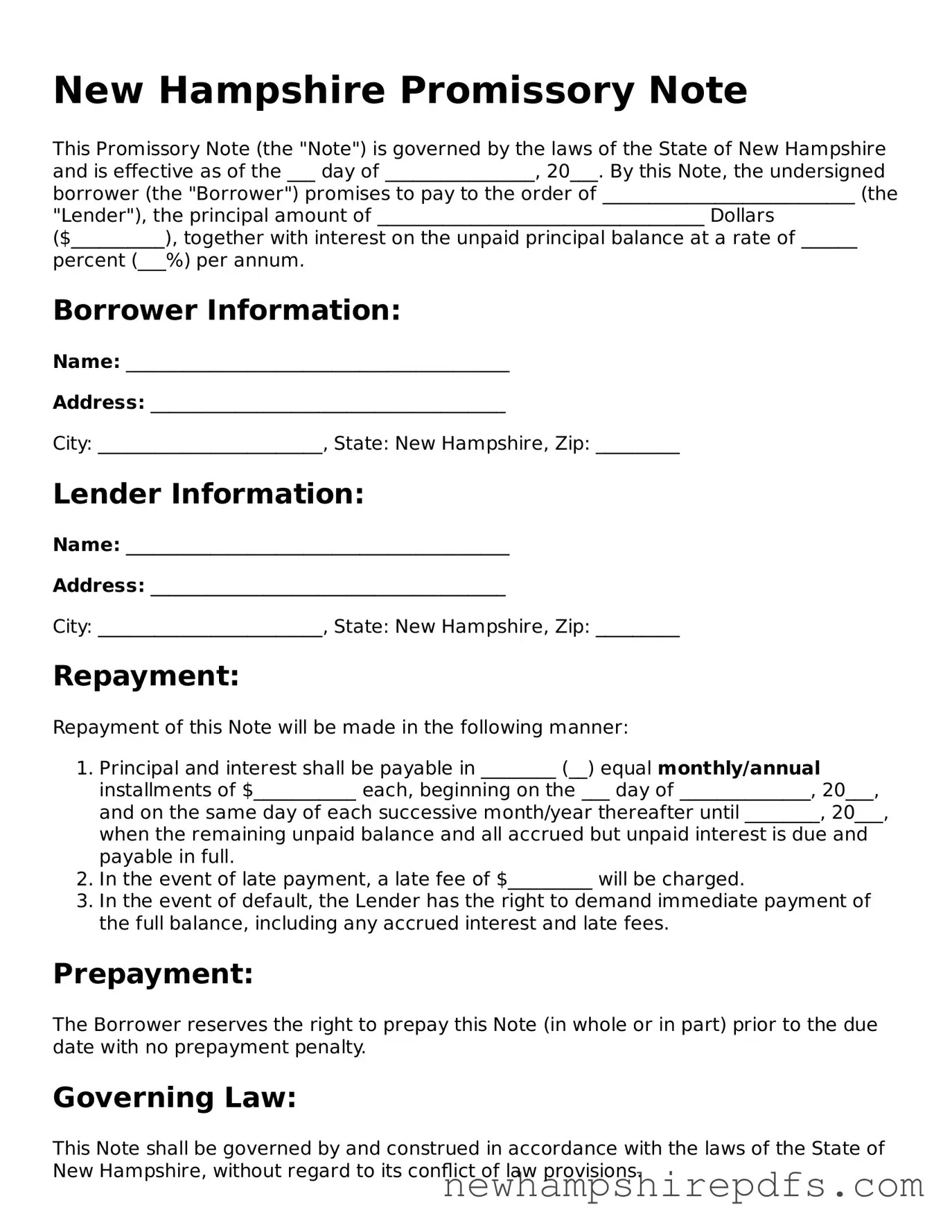

Document Sample

New Hampshire Promissory Note

This Promissory Note (the "Note") is governed by the laws of the State of New Hampshire and is effective as of the ___ day of ________________, 20___. By this Note, the undersigned borrower (the "Borrower") promises to pay to the order of ___________________________ (the "Lender"), the principal amount of ___________________________________ Dollars ($__________), together with interest on the unpaid principal balance at a rate of ______ percent (___%) per annum.

Borrower Information:

Name: _________________________________________

Address: ______________________________________

City: ________________________, State: New Hampshire, Zip: _________

Lender Information:

Name: _________________________________________

Address: ______________________________________

City: ________________________, State: New Hampshire, Zip: _________

Repayment:

Repayment of this Note will be made in the following manner:

- Principal and interest shall be payable in ________ (__) equal monthly/annual installments of $___________ each, beginning on the ___ day of ______________, 20___, and on the same day of each successive month/year thereafter until ________, 20___, when the remaining unpaid balance and all accrued but unpaid interest is due and payable in full.

- In the event of late payment, a late fee of $_________ will be charged.

- In the event of default, the Lender has the right to demand immediate payment of the full balance, including any accrued interest and late fees.

Prepayment:

The Borrower reserves the right to prepay this Note (in whole or in part) prior to the due date with no prepayment penalty.

Governing Law:

This Note shall be governed by and construed in accordance with the laws of the State of New Hampshire, without regard to its conflict of law provisions.

Signatures:

By signing below, the Borrower and Lender agree to the terms and conditions of this Promissory Note and acknowledge receipt of a completed copy of the same.

Borrower's Signature: _____________________________ Date: _________

Lender's Signature: ______________________________ Date: _________

This document is not a substitute for legal advice or services. Consult with a New Hampshire licensed attorney for specific legal advice regarding this document and the transactions it relates to.

PDF Form Breakdown

| Fact | Detail |

|---|---|

| Governing Law | The New Hampshire promissory note form is governed by the state laws of New Hampshire, specifically by the Uniform Commercial Code as it applies to negotiable instruments within the state. |

| Type | There are two main types of promissory notes in New Hampshire: secured and unsecured. Secured notes are backed by collateral, while unsecured notes are not. |

| Interest Rate | In New Hampshire, the legal maximum interest rate for a promissory note, unless otherwise agreed upon, is subject to the state's usury laws. |

| Enforcement | Should a borrower fail to repay the note as agreed, the lender has the right to seek enforcement through the New Hampshire court system to recover the owed amount. |

| Requirements | A valid New Hampshire promissory note must include the amount of the loan, interest rate, repayment schedule, and the signatures of both the borrower and the lender. |

How to Use New Hampshire Promissory Note

After deciding to enter into a loan agreement in New Hampshire, filling out a Promissory Note form is the next critical step. This document outlines the loan's terms, ensuring both the lender and the borrower have a clear understanding of their obligations. A correctly filled Promissory Note secures the repayment of the loan, specifying the interest rate, payment schedule, and consequences of non-payment. Filling out this form requires attention to detail to ensure all the information provided is accurate and comprehensive. Below are the steps to complete the New Hampshire Promissory Note form effectively.

- Start by entering the date of the agreement at the top of the form. Ensure that the date reflects when the agreement is being made.

- Write the full legal names of both the borrower and the lender in the designated spots. Include their complete addresses to avoid any confusion.

- Determine the principal amount of the loan. This is the amount of money being lent, without interest. Write this amount in the section provided.

- Specify the interest rate. New Hampshire law requires that this rate not exceed the state's maximum allowed. Place this percentage in the corresponding section.

- Choose the repayment structure. Whether the loan is to be repaid in a lump sum, in regular installments, or upon demand of the lender, clearly outline this in the allocated space.

- If the repayment is to be made in installments, detail the amount of each installment and the due dates. This should include both the principal and interest components.

- Include any collateral being used to secure the loan, if applicable. Describe the collateral in detail to ensure there is no ambiguity regarding what is securing the loan.

- State the late fees and the grace period for late payments. These are crucial for enforcing the terms of the Promissory Note and must be clear and reasonable.

- Specify the actions to be taken in case of a default. This includes any remedies or rights that the lender has if the borrower fails to meet the terms of the agreement.

- Both the borrower and the lender must sign and date the bottom of the form. Witnesses or a notary public may also need to sign, depending on local requirements.

Completing the New Hampshire Promissory Note form is a step towards establishing a legally binding agreement between a lender and a borrower. It is important that both parties review the document carefully before signing. This ensures that everyone involved understands their responsibilities and the terms of the loan. A well-documented Promissory Note helps protect the interests of both the lender and the borrower, making it a crucial component of any loan agreement.

Understanding New Hampshire Promissory Note

What is a New Hampshire Promissory Note Form?

A New Hampshire Promissory Note Form is a legal document that outlines a borrower's obligation to repay a specified amount of money to a lender. It specifies the loan amount, interest rate, repayment schedule, and any other terms agreed upon between the parties. This form is commonly used in personal and business transactions within the state of New Hampshire.

Is the New Hampshire Promissory Note Form legally binding?

Yes, the New Hampshire Promissory Note Form is considered legally binding once it has been signed by both the borrower and the lender and any required witness or notary. This agreement establishes a legal obligation on the part of the borrower to repay the borrowed money under the specified terms and conditions.

Do I need to notarize a New Hampshire Promissory Note Form?

Notarization is not mandatory for a promissory note to be legally binding in New Hampshire. However, having the document notarized can add an extra layer of authenticity and may be helpful in the event of a legal dispute.

What should be included in a New Hampshire Promissory Note Form?

A thorough New Hampshire Promissory Note Form should include the following details: the full names and addresses of the borrower and the lender, the loan amount, the interest rate, repayment schedule, late fees, the formality of the payment structure (e.g., installments, lump sum), and the governing law (New Hampshire). Clauses regarding default and acceleration may also be present.

How can I ensure a New Hampshire Promissory Note Form is legally enforceable?

To ensure the form is legally enforceable, it must be executed properly. This means that the document should clearly state the terms of the loan, including the repayment schedule, interest rate, and any other relevant terms. Both parties should sign and date the note, and ideally, the signatures should be witnessed or notarized for additional authenticity.

Can a New Hampshire Promissory Note Form be modified after it's signed?

Yes, modifications to a New Hampshire Promissory Note Form can be made after it's signed, but any changes require the consent of both the borrower and the lender. It's recommended that any amendments be made in writing and attached to the original document to maintain a clear record of the agreed terms.

Common mistakes

When individuals approach the task of filling out a New Hampshire Promissory Note form, mistakes can easily occur due to a lack of familiarity or oversight. These errors can complicate financial arrangements and potentially lead to disputes down the line. Recognizing and avoiding common pitfalls is essential in drafting an effective and legally binding document.

One significant mistake involves incorrect or imprecise identification of the parties involved. It is critical to include the full legal names of both the borrower and the lender. Additionally, providing a detailed contact address for each party can mitigate potential confusion regarding the parties' identities. This identification serves not only as a means of contact but also clarifies who is legally bound by the terms of the promissory note.

Another common error is neglecting to specify the terms of repayment in clear detail. The promissory note should articulate:

- The total amount of money lent.

- The interest rate, if applicable, and how it's calculated.

- The repayment schedule, including the due dates and whether payments are to be made monthly, quarterly, or in a lump sum.

Lacking this specificity can lead to ambiguity, making enforcement of the promissory note more challenging.

Failing to outline the consequences of late payments or default is a third mistake. This section protects the lender by defining:

- Late fees.

- The timeframe after a missed payment when a loan is considered in default.

- Legal remedies available to the lender.

Without these stipulations, the lender may find it difficult to recoup the loaned amount if the borrower becomes delinquent.

Lastly, not securing the note with a signature from a witness or notary public can undermine its legal enforceability. While not always a legal requirement, having the document witnessed adds an additional layer of validity. It verifies that the borrower and lender indeed entered into the agreement knowingly and voluntarily. This simple step can significantly bolster the promissory note's credibility, and it's a safeguard against disputes where the authenticity of the document is called into question.

By carefully addressing these areas, parties can ensure that their New Hampshire Promissory Note form is filled out correctly, reducing the risk of future misunderstandings or legal challenges.

Documents used along the form

In financial transactions, particularly those involving loans in New Hampshire, the Promissory Note form is a crucial document. However, this form does not stand alone. To ensure a comprehensive and legally binding agreement, several other documents are typically used alongside it. These documents serve to clarify, secure, and enforce the terms of the financial agreement, offering protection for all parties involved.

- Security Agreement: This document is often used in conjunction with a Promissory Note when the loan is secured with collateral. It details the specific assets pledged as security by the borrower, outlining the rights of the lender to seize the collateral if the borrower defaults on the loan.

- Guaranty: A Guaranty is a legal commitment by a third party (the guarantor) to assume responsibility for the loan if the primary borrower fails to repay it. This document adds an additional layer of security for the lender, particularly in situations where the borrower's creditworthiness may be in doubt.

- Loan Agreement: While a Promissory Note specifies the repayment terms of the loan, a Loan Agreement covers a broader range of terms and conditions of the loan. This includes the responsibilities and obligations of both the lender and the borrower, interest rates, repayment schedules, and what constitutes a default.

- Mortgage or Deed of Trust: For loans secured by real estate, a Mortgage or a Deed of Trust is crucial. This document places a lien on the property as security for the loan. It details the rights of the lender to foreclose on the property if the borrower fails to make timely payments.

- Amendment Agreement: Over the lifespan of a loan, it may be necessary to alter its terms. An Amendment Agreement is used to make changes to the original Promissory Note or Loan Agreement. It ensures that all modifications are documented and agreed upon by all parties.

Understanding the function and importance of each accompanying document enhances the effectiveness of the Promissory Note. Collectively, they serve to detail the specifics of the loan agreement, offer protection to the lender by securing the loan, and provide clarity and assurance to the borrower about their obligations. Integrating these documents into financial agreements generates a clear, enforceable, and comprehensive contract, mitigating risks and fostering trust between the parties involved.

Similar forms

The New Hampshire Promissory Note form is similar to other financial and legal documents that are used to agree upon and document the terms of a financial transaction. This includes documents like the loan agreement and the IOU (I Owe You). Each of these documents serves a particular purpose in financial transactions, detailing repayment terms, interest rates, and the obligations of the parties involved. Though they share common features, important distinctions make each one uniquely suited to different circumstances.

Loan Agreement

A loan agreement shares similarities with the New Hampshire Promissory Note in that both are used to document the terms and conditions of a loan between two parties. However, a loan agreement is generally more comprehensive. It includes detailed clauses on the repayment schedule, interest rates, collateral (if any), and the consequences of default. This document is often used in more complex transactions and can involve multiple parties and detailed legal stipulations. While a promissory note may be sufficient for smaller, personal loans, a loan agreement is preferred for larger, more formal lending arrangements.

IOU (I Owe You)

The IOU is another document similar to the New Hampshire Promissory Note, yet it is much simpler in form and content. An IOU merely acknowledges that a debt exists and that one party owes a certain amount to another. Unlike a promissory note or a loan agreement, an IOU typically does not specify repayment dates, interest rates, or what happens if the debt is not repaid. It serves as a basic acknowledgment of debt without the detailed terms and conditions. This simplicity can be sufficient for informal loans between individuals who have a high level of trust, but it lacks the legal robustness and enforceability of a promissory note or loan agreement.

Dos and Don'ts

In the state of New Hampshire, when preparing a Promissory Note, attention to detail can make a significant difference. This document, serving as a legal agreement for borrowing money, demands clear, precise, and informed completion. To ensure the process is approached with the necessary care, here is a comprehensive guide outlining the actions individuals should and should not take.

Things You Should Do- Review State Laws: Before filling out the form, familiarize yourself with New Hampshire’s specific regulations regarding promissory notes to ensure compliance.

- Complete All Sections: Provide complete information in all required fields to avoid ambiguity or legal challenges in the future.

- Clearly Define Terms: Include clear definitions of the loan terms, such as the interest rate, repayment schedule, and any collateral involved, to ensure both parties have a mutual understanding.

- Sign in Front of a Notary: Although not always mandatory, having the document notarized can lend additional legal weight and help authenticate the signatures.

- Keep Records: Both the borrower and the lender should retain copies of the signed document for their records, as this serves as proof of the agreement and terms.

- Leave Fields Blank: Avoid leaving any sections incomplete, as this could lead to misinterpretations or disputes over the terms of the agreement.

- Use Vague Language: Avoid ambiguous terms that could be interpreted in multiple ways. Clarity is paramount in legal documents.

- Ignore the Total Cost of the Loan: When setting the terms, ensure that the total amount repayable (principal plus interest) is clearly stated to prevent misunderstandings.

- Forget to Specify Late Fees: If applicable, detail any penalties for late payments to discourage delinquency and ensure both parties are aware of the consequences.

- Overlook a Co-Signer: If the borrower's creditworthiness is uncertain, failing to include a co-signer can be a missed opportunity to secure the loan for the lender.

Properly filling out a promissory note in New Hampshire is a crucial step in formalizing a loan. By following these guidelines, individuals can help protect their interests and ensure that the agreement is legally sound and enforceable. Always consider consulting with a legal professional to address any specific concerns or nuances related to the document.

Misconceptions

When it comes to the New Hampshire Promissory Note form, several misconceptions exist that can lead to confusion and misuse. Understanding the facts behind these misconceptions is crucial for anyone engaging in a financial agreement in New Hampshire. Here's a list of ten common misunderstandings and the clarifications to set them straight:

One Form Fits All: Many believe one generic form is suitable for all promissory notes in New Hampshire. In reality, the form should be tailored to the specific loan agreement, including interest rates, repayment schedules, and any collateral involved.

Not Legally Binding: A common misconception is that promissory notes are not legally binding. However, when executed properly, they are enforceable contracts in New Hampshire.

Witnesses Not Necessary: Though not always required, having witnesses or a notary public sign the form can add an extra layer of legitimacy and might be needed for enforcement or if the document is contested.

Oral Agreements are Just as Good: While some oral agreements can be legally binding, a written promissory note provides a clear, enforceable record of the loan's terms, which is especially important in dispute scenarios.

Interest Rates Are Unregulated: New Hampshire law caps the interest rate that can be charged on a personal loan. The promissory note must adhere to these legal limits to be enforceable.

Doesn’t Affect Credit Scores: If the promissory note is tied to a formal lending institution, failure to comply with its terms can indeed affect the borrower's credit score. However, for private agreements, this typically isn't the case unless the case goes to court.

Only for Large Sums of Money: Promissory notes can be used for loans of any size. They are just as applicable for small personal loans as they are for larger, more substantial amounts.

No Legal Assistance Required: While it’s possible to draft a promissory note without legal help, consulting with a legal professional can ensure that it complies with New Hampshire laws and adequately protects all parties involved.

Collateral Must Always Be Specified: Collateral is not required for all promissory notes. Secured notes include collateral, whereas unsecured notes do not. The decision to secure a loan should be based on the agreed terms between the lender and borrower.

Cannot Be Modified: The terms of a promissory note can be modified if both the lender and borrower agree. Any modifications should be done in writing to maintain the enforceability of the agreement.

Understanding these points can help ensure that any use of a promissory note in New Hampshire is done correctly and effectively, avoiding common pitfalls and misconceptions.

Key takeaways

Filling out and using the New Hampshire Promissory Note form requires careful attention to detail and understanding of its importance. This document is a binding agreement between a borrower and a lender, detailing the borrower's promise to repay a specified sum of money under agreed terms. Here are key takeaways to consider:

- Understanding the Terms: Before signing, both the borrower and lender must fully understand the terms, including the interest rate, repayment schedule, and any penalties for late payments.

- Legal Requirements: The form must comply with New Hampshire's legal requirements to ensure its enforceability. This includes adhering to the state's usury laws regarding maximum interest rates.

- Complete Information: All parties' information, including names, addresses, and contact details, must be accurately filled out to avoid future disputes.

- Interest Rate Declaration: The note must clearly state the interest rate. If it charges interest, the rate must not exceed the legal limit set by New Hampshire law.

- Repayment Plan: The form should specify the repayment plan, including dates and amounts for each installment, if applicable, to ensure both parties are clear on expectations.

- Security: If the promissory note is secured, the collateral must be clearly described. This assures the lender of a specific recourse should the borrower default.

- Witnesses and Notarization: While not always mandatory, having witnesses or notarization can add a layer of verification and authenticity, potentially making the note more enforceable in court.

- Consequences of Non-Payment: It is crucial to outline the consequences of non-payment or late payment, including any late fees or legal actions that can be taken. This holds the borrower accountable and clarifies the risks involved.

Properly completed, a New Hampshire Promissory Note is a powerful document that protects both the lender's interests and clarifies the borrower's obligations. Ensuring accuracy and completeness when filling it out can prevent conflicts and help maintain a good relationship between the lender and borrower.

Some Other New Hampshire Forms

How to Get Power of Attorney in Nh - When used judiciously, this form strengthens the safety net around the child, fortifying their support system in parents' absence.

How to Get Power of Attorney in Nh - By granting broad financial powers, the document helps in the continuous management of one’s estate and assets.