Fillable Quitclaim Deed Template for New Hampshire

Transferring property in New Hampshire can be efficiently handled with a Quitclaim Deed form, a legal document used to move ownership of real estate without warranties. This means the seller, known as the grantor, does not guarantee the title's clearness to the buyer, referred to as the grantee. It is most often used among family members, in divorce settlements, or to transfer property into a trust, emphasizing its utility in situations where the property's history is well known to both parties. Drafting this document requires precise details about the property and the transaction. Although it simplifies transferring property rights, parties should approach the Quitclaim Deed with a clear understanding of its limitations and the rights it does not guarantee. Engaging with this form marks a straightforward approach, yet it comes with the critical responsibility of ensuring all parties are informed about what the deed entails and does not cover.

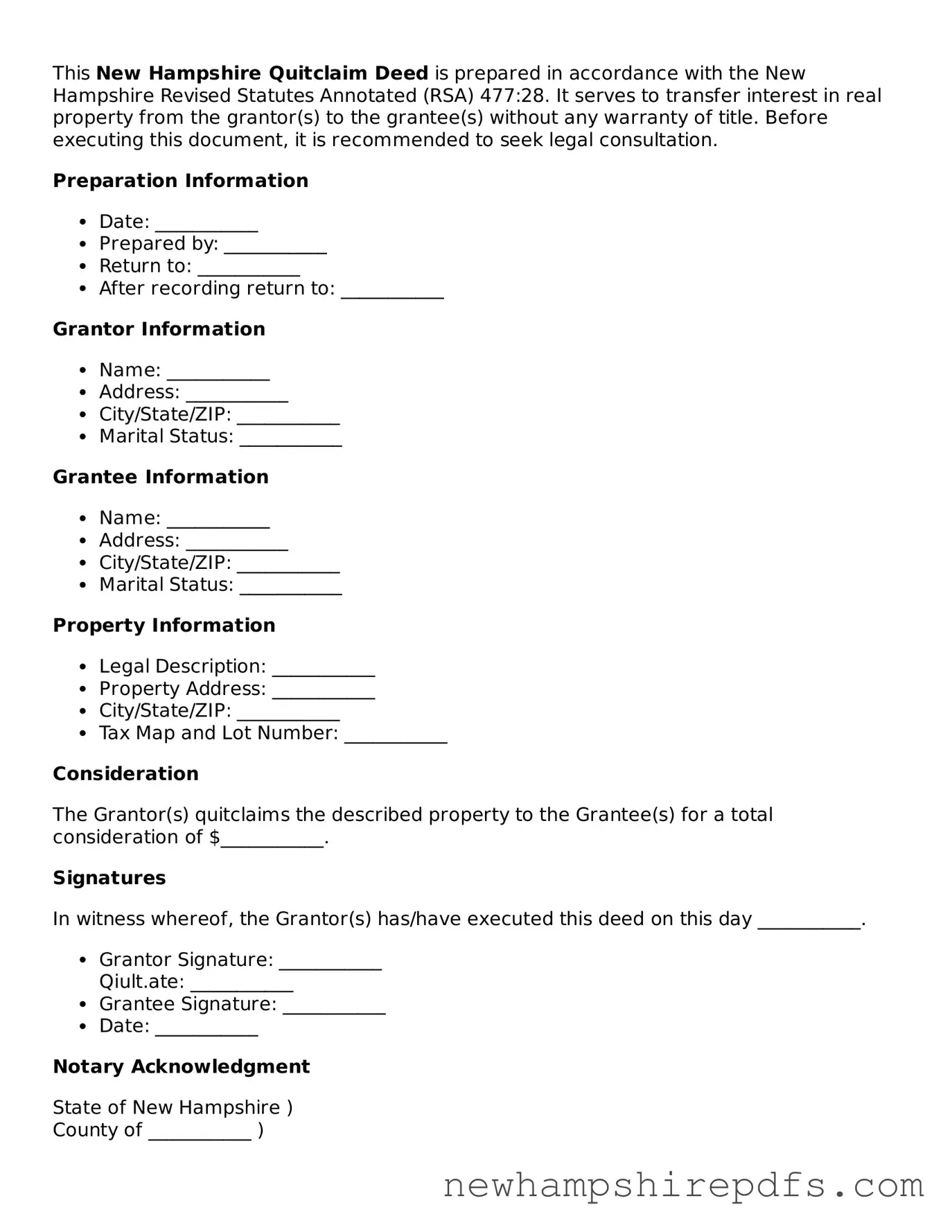

Document Sample

This New Hampshire Quitclaim Deed is prepared in accordance with the New Hampshire Revised Statutes Annotated (RSA) 477:28. It serves to transfer interest in real property from the grantor(s) to the grantee(s) without any warranty of title. Before executing this document, it is recommended to seek legal consultation.

Preparation Information

- Date: ___________

- Prepared by: ___________

- Return to: ___________

- After recording return to: ___________

Grantor Information

- Name: ___________

- Address: ___________

- City/State/ZIP: ___________

- Marital Status: ___________

Grantee Information

- Name: ___________

- Address: ___________

- City/State/ZIP: ___________

- Marital Status: ___________

Property Information

- Legal Description: ___________

- Property Address: ___________

- City/State/ZIP: ___________

- Tax Map and Lot Number: ___________

Consideration

The Grantor(s) quitclaims the described property to the Grantee(s) for a total consideration of $___________.

Signatures

In witness whereof, the Grantor(s) has/have executed this deed on this day ___________.

- Grantor Signature: ___________

- Grantee Signature: ___________

- Date: ___________

Notary Acknowledgment

State of New Hampshire )

County of ___________ )

On this day, ___________, before me, a notary public, personally appeared ___________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

- Notary Signature: ___________

- Seal:

- Date: ___________

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition of a Quitclaim Deed | A Quitclaim Deed in New Hampshire is a legal document used to transfer interest in real property from the grantor to the grantee without any warranty on the title. |

| Governing Law | New Hampshire's Quitclaim Deeds are governed by RSA 477:28 which mandates the execution requirements for a valid conveyance. |

| Recording Requirement | After execution, the deed must be recorded with the County Registry of Deeds where the property is located, as per New Hampshire law. |

| Signature Requirements | The grantor must sign the Quitclaim Dees in the presence of two witnesses and a notary public to ensure its validity under New Hampshire law. |

| Consideration Statement | A statement of consideration is required in the deed, detailing the value exchanged for the property transfer. |

How to Use New Hampshire Quitclaim Deed

When transferring property rights in New Hampshire without the guarantees that come with a warranty deed, a Quitclaim Deed is the form you will use. Typically, this form is employed when property is transferred between family members, or to add or remove someone’s name from the property title without a sale. Understanding the correct way to fill out this form can ensure a smooth process. Below, you will find step-by-step instructions tailored to help guide you through the completion of the New Hampshire Quitclaim Deed form.

- Begin with identifying the preparer of the document. Include the full name and address of the individual completing the form.

- Provide the return address. This is the address to which the document will be returned after recording. Usually, this is the new owner’s address.

- Enter the consideration amount, specifying the value being exchanged for the property transfer. Even if no money is exchanged, a nominal amount like $1 should be entered to validate the deed.

- List the grantor’s (seller’s) name exactly as it appears on the current deed, alongside their mailing address.

- Identify the grantee’s (buyer’s) full name and mailing address. Make sure to include accurate information as it will appear on public records.

- Include the legal description of the property. This should match exactly what is on the current deed and may include lot numbers, subdivision name, and parcel numbers among other details.

- Some forms require the name and address of the person who drafted the document. If applicable, include this information.

- Both the grantor and grantee must sign and date the deed in the presence of a notary public. Make sure this step is completed accurately to ensure the legality of the document.

- Check whether your county requires any additional attachments or forms to be submitted with your Quitclaim Deed.

- Finally, submit the completed form along with any required fees to the county registry office where the property is located for recording.

Once these steps have been faithfully followed and the document is recorded, the property rights will have been officially transferred. It's important to keep a copy of the recorded deed for your records. This document represents a key piece of evidence regarding the ownership of the property. If you encounter any difficulties or have specific questions during this process, seeking legal assistance can provide clarity and ensure that everything is handled correctly.

Understanding New Hampshire Quitclaim Deed

What is a New Hampshire Quitclaim Deed?

A New Hampshire Quitclaim Deed is a legal document used to transfer a property owner's interest in a piece of real estate to another person without any warranties or guarantees about the property's title. This type of deed is commonly used between family members or close acquaintances where there's a high level of trust, as it offers no protection for the buyer against any title defects.

When should a Quitclaim Deed be used in New Hampshire?

A Quitclaim Deed should be considered in situations such as transferring property between family members, settling property issues in a divorce, or clearing up title discrepancies. It is suitable for transactions where the buyer is willing to accept the property "as is," understanding the risks associated with potential title issues.

Does the New Hampshire Quitclaim Deed form require notarization?

Yes, for a Quitclaim Deed to be legally valid in New Hampshire, it must be signed by the grantor (the person transferring the property) in the presence of a notary public. The notarization process provides an additional level of legitimacy, confirming the identity of the parties involved in the transaction.

Are there any specific filing requirements for a Quitclaim Deed in New Hampshire?

After being properly executed and notarized, the Quitclaim Deed must be filed with the Registry of Deeds in the county where the property is located. Each county may have slightly different filing requirements, such as fees or forms, so it is important to contact the local Registry of Deeds for specific information.

Does a Quitclaim Deed provide any warranty on the title?

No, a Quitclaim Deed does not provide any warranty regarding the title of the property being transferred. It only transfers whatever interest the grantor has in the property, if any, without guaranteeing that the title is clear of liens, claims, or other encumbrances.

Can I use a Quitclaim Deed to transfer property to a trust in New Hampshire?

Yes, a Quitclaim Deed can be used to transfer property to a trust in New Hampshire. This is often done as part of estate planning. However, it is important to ensure that the transfer aligns with the overall estate plan and that all necessary legal prerequisites are met.

What are the tax implications of using a Quitclaim Deed in New Hampshire?

The transfer of property using a Quitclaim Deed may have tax implications, such as real estate transfer taxes or federal gift taxes, depending on the circumstances. It is advisable to consult with a tax professional to understand the potential tax obligations and exemptions that may apply to your specific situation.

How can I ensure my Quitclaim Deed is legally binding?

To ensure your Quitclaim Deed is legally binding in New Hampshire, ensure the document includes accurate details of the property and parties involved, is signed by the grantor in the presence of a notary public, and is properly filed with the appropriate county Registry of Deeds. Consulting with a legal expert can also help verify that all legal requirements are met.

Common mistakes

In the process of transferring property from one party to another, the completion of the New Hampshire Quitclaim Deed form plays a crucial role. However, even with its critical nature, there are common mistakes individuals often make during the process. Addressing these errors can significantly streamline the transition and ensure that the transfer is executed smoothly and legally.

The first and most frequent mistake involves incorrectly identifying the grantor and grantee. The grantor is the individual transferring the property, whereas the grantee is the recipient. Accurate names, including middle initials, and the relationship between the parties, need to be clearly stated to prevent confusion.

- A frequent issue is failing to provide a complete legal description of the property. This description should include not only the address but also any relevant legal identifiers that are used to distinguish the property in public records.

- Another common blunder is not having the document notarized. New Hampshire law requires that the Quitclaim Deed be notarized to validate the identities of the parties involved.

- Individuals often omit necessary signatures. Besides the grantor, certain circumstances may require the grantee or witnesses to sign the document as well.

- There is also the mistake of using incorrect or outdated forms. Ensuring that the most current form is used is vital, as laws and requirements may change.

- Submitting incomplete forms is a pitfall that many fall into. Every field should be reviewed to ensure that no required information is missing.

- Misconceptions around the need for adding ancillary documents may lead to the omission of necessary attachments that verify the legitimacy of the parties or the property details.

- Not understanding the implications of the deed, leading to unintended transfer of rights. It’s crucial to know that a Quitclaim Deed transfers ownership without warranty, possibly affecting future disputes or sales.

- A common oversight is failing to file the deed with the appropriate county office after execution. This step is essential for the document to become part of the public record.

- Lastly, neglecting to seek legal advice when uncertainties arise can lead to errors. Professional guidance can clarify complexities and ensure that the deed is filled out correctly.

Moreover, certain aspects of the Quitclaim Deed demand careful attention beyond the common mistakes listed. For instance, the acknowledgement section, located towards the end of the document, is occasionally overlooked but crucial for the deed’s validation. Furthermore, understanding the tax implications of transferring property can prevent unforeseen financial burdens on either party.

In summary, when dealing with the New Hampshire Quitclaim Deed, it’s important for individuals to proceed with caution and thoroughness. By avoiding the mistakes outlined above, parties can ensure a legal and hassle-free transfer of property. It is always advisable to consult with legal professionals to navigate any complexities and verify that all aspects of the quitclaim transfer are in order.

Documents used along the form

In the process of transferring property, a New Hampshire Quitclaim Deed is often employed to convey the seller's interest to the buyer quickly without the warranty of clear title that accompanies a warranty deed. While the Quitclaim Deed is a pivotal document, several other forms and documents are frequently utilized alongside it to ensure a comprehensive and legally sound transaction. Highlighting these additional documents can provide clarity on the overall process and requirements for both parties involved in the property transfer.

- Real Estate Transfer Tax Declaration of Consideration (Form CD-57): Required for recording the sale with local authorities, this form reports the transfer and calculates the tax due on the sale of real property.

- Title Search Report: While not a form, this document is crucial. It provides a detailed history of the property title, revealing any liens, encumbrances, or claims that may impact the buyer’s interests.

- Mortgage Discharge: If there is an existing mortgage on the property, this document from the lender acknowledges that the mortgage has been paid in full and releases the lien from the property records.

- Property Tax Forms: It’s essential to provide documentation related to the current status of property taxes to ensure they are up-to-date and to disclose any outstanding obligations to the buyer.

- Homestead Declaration: Although not always required, a homestead declaration can be filed with the Quitclaim Deed for homeowners who want to protect a portion of their home’s value from creditors.

- Federal and State Tax Forms: Depending on the nature of the property transfer, specific federal and state tax documents may need to be filed to report the transaction and ensure compliance with tax laws.

Understanding and obtaining the correct forms and documents that accompany a New Hampshire Quitclaim Deed is vital for a smooth and legally compliant property transfer. Whether you're the grantor or the grantee, being aware of these additional requirements can facilitate a more informed and efficient process. It's always recommended to seek professional advice or assistance when dealing with real estate transactions to navigate the complexities of property law effectively.

Similar forms

The New Hampshire Quitclaim Deed form is similar to other documents used in real estate transactions, specifically the Warranty Deed and the Deed of Trust. These documents, while serving unique purposes, share common features in facilitating the transfer of property rights. However, they differ notably in the level of protection they offer to the buyer and the conditions under which they are typically used.

Warranty Deed: This type of deed is akin to the Quitclaim Deed in its fundamental purpose of transferring ownership rights from one party to another. However, a critical distinction lies in the level of guarantee the grantor provides to the grantee. Unlike Quitclaim Deeds, which do not guarantee that the grantor has clear title to the property, Warranty Deeds come with a promise that the grantor holds a good title and the right to sell the property. This assurance includes protection against any past discrepancies in the title, such as liens or claims, thus offering the buyer a higher degree of security in the transaction.

Deed of Trust: Another document related to the Quitclaim Deed is the Deed of Trust, though it serves a somewhat different purpose. This document is used in certain states as an alternative to a mortgage. Like Quitclaim Deeds, Deeds of Trust involve the transfer of property rights. However, in this case, the transfer is from the borrower to a trustee, who holds the property as security for a loan rather than transferring ownership outright. The Deed of Trust thus facilitates a triangular relationship between the borrower, lender, and trustee, contrasting with the direct transfer of rights between individuals or entities typical of Quitclaim Deeds.

Dos and Don'ts

When filling out the New Hampshire Quitclaim Deed form, it’s important to approach the task with care and attention to detail. Here are six do’s and don’ts to keep in mind to ensure the process goes smoothly and your document is legally sound.

Do's:

- Review the form thoroughly to understand all sections before beginning to fill it out. This helps prevent mistakes that could arise from misunderstanding the information required.

- Use black ink or type the information to ensure clarity and legibility. This makes the document easier to read, copy, and record.

- Double-check the legal description of the property. It should match the description on the current deed or the property’s official records to avoid any disputes over the property’s boundaries.

- Include all necessary parties in the transaction. Every person with an interest in the property should sign the deed to ensure the transfer is legally binding.

- Obtain a witness and notarization, if required by state law. This formalizes the document, making it harder to contest.

- Record the deed with the appropriate county office after it is signed. Recording creates a public record of the property transfer, which is crucial for protecting your interests.

Don'ts:

- Don’t leave any sections blank. If a section does not apply, mark it as “N/A” to indicate that it was considered but not applicable.

- Don’t use correction fluid or tape. Mistakes should be corrected by completing a new form to avoid any suspicions of tampering.

- Don’t forget to check for any additional documentation that might be required by the county where the property is located. Requirements can vary, and missing documents can delay the process.

- Don’t disregard the need for legal advice if there are any uncertainties about the quitclaim deed process. Consulting a professional can prevent legal issues down the line.

- Don’t overlook the importance of confirming that all parties understand the implications of a quitclaim deed. Unlike other types of deeds, a quitclaim does not warrant that the grantor has good title to the property.

- Don’t delay in delivering the signed deed to the grantee after it has been fully executed. Holding onto the document without a legitimate reason can lead to unnecessary complications.

Misconceptions

A common misconception is that a New Hampshire Quitclaim Deed guarantees that the seller (grantor) has a valid interest in the property. However, this form does not assure the grantee (buyer) of the grantor's ownership status or rights. Instead, it simply transfers whatever interest the grantor may have without any guarantees.

Many believe that the New Hampshire Quitclaim Deed form provides a complete history of the property's title. In reality, this form does not offer any information on the property’s title history or disclose any potential encumbrances, like liens or mortgages, that may exist against the property. Prospective buyers are advised to conduct a thorough title search to uncover any potential issues.

There's a mistaken idea that once a Quitclaim Deed is signed and notarized, the process is complete. Yet, for the transfer to be legally recognized and to ensure the change in ownership is formally recorded, the deed must be filed with the appropriate county office in New Hampshire where the property is located.

Some people think Quitclaim Deeds are only used between strangers in a real estate transaction. More accurately, these deeds are often utilized between family members, trusted friends, or in divorce proceedings to quickly and easily transfer property interests without the assurances typically associated with a Warranty Deed.

There’s a misconception that preparing a New Hampshire Quitclaim Deed form is complex and requires a lawyer’s assistance. While legal advice is beneficial, especially in complicated situations, many individuals are able to fill out and file a Quitclaim Deed on their own by following the correct procedures and requirements set forth by New Hampshire law.

Many are under the impression that the Quitclaim Deed affects mortgages or other liens on the property. The truth of the matter is that executing a Quitclaim Deed does not alter the responsibilities of existing debts or liens. If the property is mortgaged, the person receiving the property interest takes it subject to the mortgage unless specifically released by the lender.

Key takeaways

When filling out and using the New Hampshire Quitclaim Deed form, it's important to understand its purpose and how it operates. Below are key takeaways to guide you through the process:

- Understand what a Quitclaim Deed is: It transfers any interest the grantor (the person giving the title) has in the property to the grantee (the person receiving the title), without any warranties of clear title.

- Know when to use it: Quitclaim Deeds are often used between family members, in divorce proceedings, or in other informal transactions where the property is transferred without a sale.

- Confirm the property location: The Quitclaim Deed is specific to New Hampshire properties, so ensure the property in question is within state lines.

- Fill out the form accurately: Include the full legal names of both the grantor and grantee, a legal description of the property, and the parcel number if applicable.

- Notarization is required: For the deed to be legally valid, it must be signed by the grantor in the presence of a notary public.

- Consider the implications: Transferring property using a Quitclaim Deed may have implications on taxes, the grantee’s title, and possible future sale of the property.

- Recording is crucial: After the deed is notarized, it must be filed with the county recorder’s office where the property is located to be effective.

- Prepare for fees: Filing the deed involves paying a recording fee. This fee varies by county, so check with the local recorder's office.

- Seek professional advice: Mistakes can be costly. It might be wise to consult with a legal or real estate professional before proceeding.

Completing and using a New Hampshire Quitclaim Deed requires attention to detail and an understanding of the broader legal and financial implications. Proper execution ensures a smoother transfer of property rights and helps avoid potential disputes or complications in the future.

Some Other New Hampshire Forms

New Hampshire Rental Application - Indispensable for ensuring the safety and well-being of existing tenants and property.

Acknowledgement Certificate Notary - It affirms that every signature is accounted for and legally binding, making it a cornerstone of secure document processing.

Transfer on Death Deed New Hampshire - For owners with multiple heirs, a Transfer-on-Death Deed can specify percentages of interest that each beneficiary will receive, allowing for clear and precise distribution instructions.