Fillable Real Estate Purchase Agreement Template for New Hampshire

Embarking on the journey of buying or selling property in New Hampshire marks a monumental milestone in one's life. This process, intricate and bound by specific legal requisites, hinges greatly on a vital document known as the New Hampshire Real Estate Purchase Agreement form. This crucial form serves as the blueprint of the transaction, laying out the terms, conditions, and mutual agreements between the buyer and the seller. Within its pages, the form addresses numerous elements critical to the transaction, including but not limited to the agreed-upon sale price, detailed descriptions of the property, financing details, and any contingencies that either party wishes to apply. This document not only ensures a clear understanding and agreement between all involved parties but also acts as a legal record that can be referred to if disputes arise. Additionally, it specifies the obligations of each party and the timeline for the transaction to be completed, making it a comprehensive guide for navigating the complex process of real estate transactions in New Hampshire. Understanding the significance and components of this form is essential for anyone looking to engage in the real estate market, whether they're seasoned investors or first-time buyers.

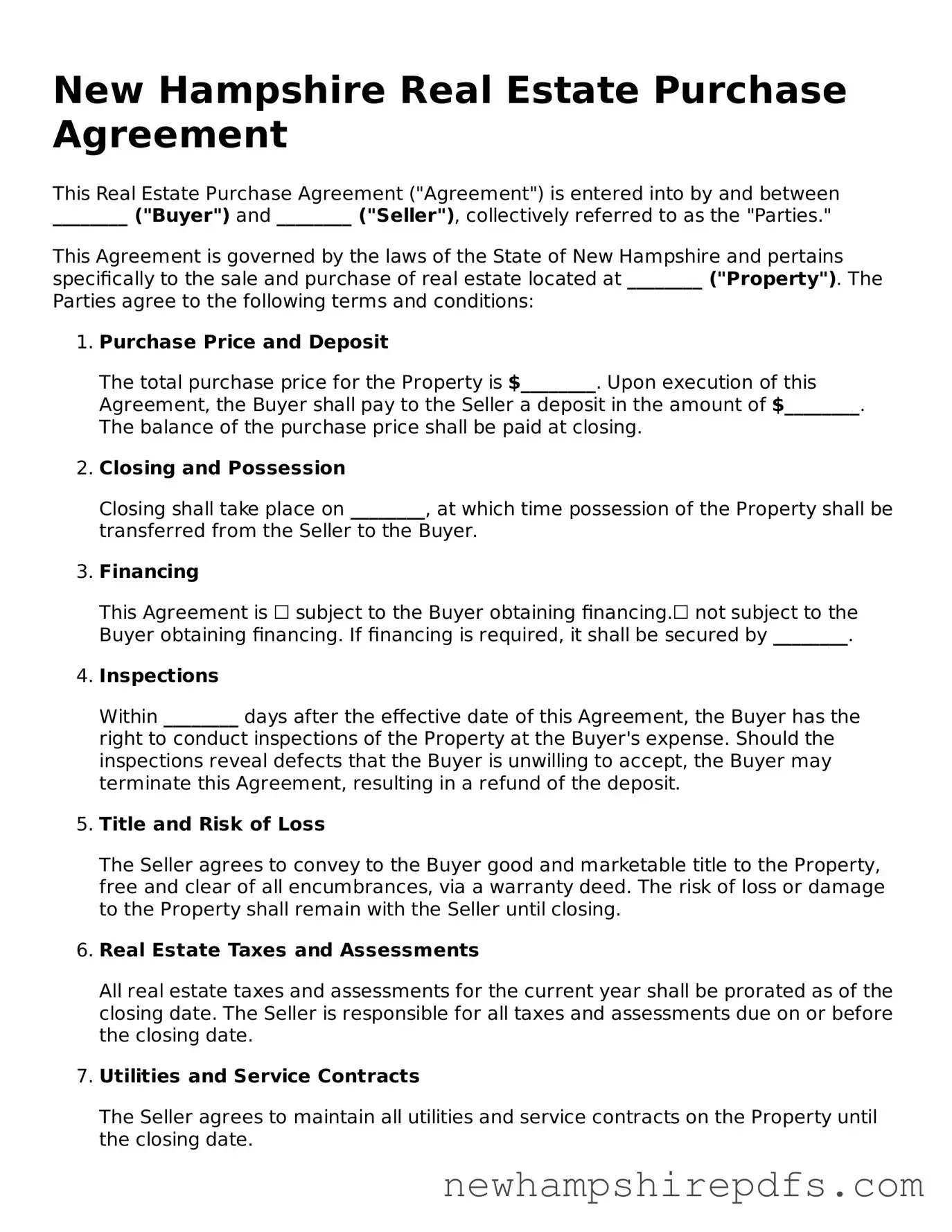

Document Sample

New Hampshire Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between ________ ("Buyer") and ________ ("Seller"), collectively referred to as the "Parties."

This Agreement is governed by the laws of the State of New Hampshire and pertains specifically to the sale and purchase of real estate located at ________ ("Property"). The Parties agree to the following terms and conditions:

- Purchase Price and Deposit

The total purchase price for the Property is $________. Upon execution of this Agreement, the Buyer shall pay to the Seller a deposit in the amount of $________. The balance of the purchase price shall be paid at closing.

- Closing and Possession

Closing shall take place on ________, at which time possession of the Property shall be transferred from the Seller to the Buyer.

- Financing

This Agreement is ☐ subject to the Buyer obtaining financing.☐ not subject to the Buyer obtaining financing. If financing is required, it shall be secured by ________.

- Inspections

Within ________ days after the effective date of this Agreement, the Buyer has the right to conduct inspections of the Property at the Buyer's expense. Should the inspections reveal defects that the Buyer is unwilling to accept, the Buyer may terminate this Agreement, resulting in a refund of the deposit.

- Title and Risk of Loss

The Seller agrees to convey to the Buyer good and marketable title to the Property, free and clear of all encumbrances, via a warranty deed. The risk of loss or damage to the Property shall remain with the Seller until closing.

- Real Estate Taxes and Assessments

All real estate taxes and assessments for the current year shall be prorated as of the closing date. The Seller is responsible for all taxes and assessments due on or before the closing date.

- Utilities and Service Contracts

The Seller agrees to maintain all utilities and service contracts on the Property until the closing date.

- Disclosures

The Seller shall provide to the Buyer all relevant disclosures pertaining to the Property's condition, including any known material defects, as required under New Hampshire law, before the closing date.

- Closing Costs

Both the Buyer and the Seller shall be responsible for their respective closing costs, as customary in the State of New Hampshire.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New Hampshire.

- Entire Agreement

This Agreement constitutes the entire agreement between the Parties concerning the subject matter hereof and supersedes all previous agreements and understandings, whether oral or written.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of ________ (Date).

Seller's Signature: ________________________ Date: _________

Buyer's Signature: ________________________ Date: _________

PDF Form Breakdown

| # | Fact |

|---|---|

| 1 | The New Hampshire Real Estate Purchase Agreement is a binding document between a seller and buyer for the purchase of real estate. |

| 2 | It outlines terms and conditions of the sale, including the purchase price, financing, inspections, and closing details. |

| 3 | The agreement requires full disclosure of any known defects on the property by the seller. |

| 4 | It must comply with New Hampshire state laws, particularly RSA 477:4-a which mandates certain disclosures in real estate transactions. |

| 5 | Buyer's due diligence is a critical aspect, allowing for property inspections and review of documents before finalizing the transaction. |

| 6 | Contingencies such as financing, inspection, and appraisal can be included to protect both the buyer and the seller. |

| 7 | Custom clauses may be added to address specific concerns or requirements of the parties involved. |

| 8 | The agreement becomes legally binding once it is signed by both parties. |

| 9 | Closing dates and possession details are clearly specified to avoid any confusion. |

| 10 | An earnest money deposit is often required to demonstrate the buyer's serious intent to complete the transaction. |

How to Use New Hampshire Real Estate Purchase Agreement

After deciding to buy or sell a property in New Hampshire, the next step involves legally documenting the transaction with a Real Estate Purchase Agreement. This form serves a crucial role in outlining the terms and conditions of the sale, ensuring both parties are on the same page. Proper completion of this form is essential to facilitate a smooth transaction, protecting the rights and interests of both the buyer and seller. Here is a straightforward guide to help you accurately fill out the New Hampshire Real Estate Purchase Agreement.

- Begin by providing the date of the agreement at the top of the form.

- Enter the full names and contact information of both the buyer and the seller.

- Describe the property being sold, including its legal description, address, and any relevant details that uniquely identify the property.

- Specify the purchase price agreed upon by both parties.

- List the terms of the payment, including the deposit amount, financing details, and any other arrangements pertaining to the payment schedule.

- Include any contingencies that must be met before the sale can proceed, such as home inspections, financing approval, and the sale of the buyer's current home, if applicable.

- Detail the closing costs and specify who is responsible for each cost.

- Indicate the closing date and location where the final transaction will take place.

- State the condition of the property and any warranties or guarantees being offered by the seller at the time of sale.

- Clarify any items that will not be included in the sale, such as personal property or specific fixtures.

- Add any additional terms or conditions that have been agreed upon by both the buyer and the seller.

- Ensure both parties sign and date the form to indicate their agreement to the terms outlined in the document.

Once the New Hampshire Real Estate Purchase Agreement is fully completed and signed by both parties, it becomes a legally binding contract. The next steps typically involve performing any agreed-upon inspections, securing financing if necessary, and preparing for the closing date. Both the buyer and seller should work closely with their respective legal and real estate professionals to ensure all conditions are met satisfactorily before the final transfer of ownership takes place. By following these steps and seeking appropriate guidance, participants can look forward to a successful transaction.

Understanding New Hampshire Real Estate Purchase Agreement

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document between a buyer and a seller wherein the buyer agrees to purchase real estate from the seller for a specific price and under agreed-upon conditions. This document outlines the terms and conditions of the sale, including the purchase price, financing details, inspection rights, and other conditions precedent to the closing of the transaction.

Why is a Real Estate Purchase Agreement important in New Hampshire?

In New Hampshire, a Real Estate Purchase Agreement is crucial because it formally records the terms of the transaction, providing a clear framework that guides both the buyer and the seller through the sale process. It serves as a legally enforceable contract that can be used in court if disputes arise regarding the sale of the property.

What details are typically included in a New Hampshire Real Estate Purchase Agreement?

A comprehensive Real Estate Purchase Agreement in New Hampshire usually includes the names of the buyer and seller, a description of the property, the purchase price, the terms of payment, contingencies such as financing and inspections, closing date, condition of the property at the time of sale, and any other special requirements agreed upon by both parties.

How does financing affect the Real Estate Purchase Agreement?

Financing is a critical aspect of most real estate transactions. In the agreement, the financing terms detail how the buyer intends to pay the purchase price, whether through obtaining a mortgage, paying cash, or other financing arrangements. These terms must be clearly defined since the sale is often contingent upon the buyer securing financing within a specific timeframe.

Are there any contingencies that should be considered in the agreement?

Yes, contingencies are crucial components of a Real Estate Purchase Agreement. Common contingents include the buyer obtaining financing, the home passing certain inspections, the sale of the buyer's current home, and any legal requirements specific to New Hampshire real estate laws. These contingencies protect both parties and must be fulfilled for the transaction to proceed.

What happens if either the buyer or seller breaches the agreement?

If a party breaches the agreement, the other party may have legal recourse. Remedies can range from the forfeiture of earnest money deposits (by the buyer) to legal action to enforce the contract. The specific consequences depend on the terms of the agreement and New Hampshire law.

Can amendments be made to the agreement after it's been signed?

Yes, amendments can be made to the agreement if both the buyer and seller agree to the changes. These amendments must be documented in writing and signed by both parties, ensuring that the agreement remains enforceable and reflects the modified terms.

Is a Real Estate Purchase Agreement the same as closing the sale?

No, the agreement is a step toward closing the sale but is not the final act. Closing the sale involves the transfer of the property title from the seller to the buyer, the payment of the purchase price, and the completion of all agreed-upon conditions. The Real Estate Purchase Agreement sets the terms under which the closing will happen.

Who should be consulted before signing a Real Estate Purchase Agreement?

Before signing a Real Estate Purchase Agreement, it's advisable to consult with a real estate attorney who is experienced with New Hampshire laws. They can provide guidance, ensure the agreement complenes with all legal requirements, and help negotiate terms favorable to your position. Additionally, a real estate agent with knowledge of the local market conditions can offer valuable insights.

Common mistakes

In the process of navigating the complexities of real estate transactions, individuals often overlook essential details. One significant document, the New Hampshire Real Estate Purchase Agreement form, plays a pivotal role in the buying and selling of property within the state. A well-executed agreement ensures a smooth transition for all parties involved. However, common errors can complicate this process, leading to delays, legal disputes, or financial losses. The following outlines four prevalent mistakes to be mindful of.

Failing to Clearly Identify the Property: One of the most critical elements of any real estate purchase agreement is the accurate description of the property being bought or sold. This description goes beyond the address; it includes legal identifiers like the property's lot number, block, and subdivision, as discerned from official records. A lack of precision in this area can lead to legal challenges or disputes over what was intended to be part of the transaction.

Omitting Financial Details: A comprehensive breakdown of the financial aspects of the deal is essential. This includes the purchase price, earnest money deposits, adjustment costs, and details regarding the closing costs. The agreement should delineate who bears the burden of specific expenses. Neglecting to specify these details can result in misunderstandings and disagreements down the line.

Overlooking Contingencies: Contingencies provide a safety net for both the buyer and the seller. Common contingencies include inspections, financing, and the sale of the buyer's existing home. Failing to explicitly address these conditions can leave parties exposed to unforeseen risks. For instance, a buyer may find themselves legally obligated to proceed with a purchase despite unsatisfactory inspection results or the inability to secure financing.

Incorrect Signatures: The validity of the Real Estate Purchase Agreement hinges on the proper execution of the document. This necessitates the signatures of all parties who hold an interest in the property, including co-owners. Occasionally, the requisite signatures are incomplete or missing entirely, a mistake that can invalidate the entire agreement. Furthermore, ensuring that all signatures are dated provides clarity regarding the agreement's effective date.

Attention to detail is paramount when completing the New Hampshire Real Estate Purchase Agreement form. By avoiding these common pitfalls, parties can protect their interests and foster a smooth property transfer process. Inviting a legal or real estate professional to review the document before finalization can further mitigate potential issues. It's crucial to approach this process with the seriousness it warrants, recognizing that the sale or purchase of a property is a significant life event demanding diligence and precision.

Documents used along the form

In the process of buying or selling property in New Hampshire, the Real Estate Purchase Agreement form is a crucial document, but it usually doesn't stand alone. This document specifies the terms and conditions of the sale, including the price, the closing date, contingencies, and other important details. Alongside it, several other documents and forms are commonly used to ensure a smooth and legally compliant transaction. These can provide additional details, offer protections to the parties involved, and comply with state or local regulations.. Here are some of the forms and documents often used with the New Hampshire Real Estate Purchase Agreement:

- Disclosure Forms - These forms, which may vary based on the property type, provide critical information about the property's condition and history. For residential properties, sellers are typically required to disclose any known defects or issues that could affect the property's value or safety.

- Title Insurance Policy - A document that offers protection to the buyer and the mortgage lender against problems with the property's title. Before issuing the policy, a title search will be conducted to ensure there are no issues such as liens, encumbrances, or legal claims against the property.

- Home Inspection Report - This report, created by a professional home inspector, details the condition of the property’s physical structure and various systems, identifying any problems that may need to be addressed.

- Final Walk-Through Checklist - Conducted just before the sale is finalized, this checklist allows the buyer to verify that the condition of the property matches what was agreed upon in the Purchase Agreement and that any agreed-upon repairs have been made.

While the New Hampshire Real Estate Purchase Agreement serves as the central document in a real estate transaction, these additional forms and documents play essential roles in providing transparency, ensuring due diligence, and protecting the rights and interests of both buyers and sellers. It's important for all parties involved to understand these documents and how they contribute to the transaction's overall process.

Similar forms

The New Hampshire Real Estate Purchase Agreement form is similar to other documents used in the process of buying and selling property. These documents include the Residential Purchase Agreement, the Offer to Purchase Real Estate Form, and the Sales Contract for Real Estate. While they each serve to facilitate the transaction between a buyer and seller, their similarities lie in their structure and purpose. However, the specific legal requirements and details they contain can vary depending on the state in which the transaction is taking place.

Residential Purchase Agreement: This document is akin to the New Hampshire Real Estate Purchase Agreement in that it outlines the terms and conditions of a home sale. Both include critical information such as the purchase price, the closing date, and any contingencies that must be met before the sale can proceed. Similarly, they detail the responsibilities of both the buyer and seller, ensuring each party is aware of their commitments. The key difference often lies in the form's adaptation to meet local state laws and regulations.

Offer to Purchase Real Estate Form: The Offer to Purchase Real Estate Form closely resembles the New Hampshire Real Estate Purchase Agreement as it serves as a proposal from a prospective buyer to a seller, indicating their interest in purchasing the property. It includes details about the offer price, financing terms, and any contingencies, like the need for a satisfactory home inspection. While this document initiates the negotiation process, it becomes binding once the seller accepts the offer, much like the Purchase Agreement which formalizes the agreement between the parties.

Sales Contract for Real Estate: Much like the New Hampshire Real Estate Purchase Agreement, the Sales Contract for Real Eastate is a legally binding document that outlines the terms of a property sale. It captures agreements on sale price, property condition, inspections to be carried out, and other pertinent details. The similarity lies in its function to officially record the agreement to transfer property from the seller to the buyer, but variations might exist in terms of specific clauses and disclosures required by local state law.

Dos and Don'ts

Filling out a Real Estate Purchase Agreement form in New Hampshire is a crucial step in the process of buying or selling property. It’s a legal document that outlines the terms and conditions of the sale. To ensure a smooth transaction, it’s important to approach this task with caution and thoroughness. Below are some dos and don'ts to keep in mind when completing your New Hampshire Real Estate Purchase Agreement.

Do:

- Review the entire form before filling it out to ensure you understand all the questions and sections.

- Provide accurate and complete information for every required field to avoid potential legal issues or delays.

- Use clear and concise language to describe the terms of the sale, including the legal description of the property, to prevent misunderstandings.

- Consult with a real estate attorney or professional if there are any clauses or terms that you do not understand.

- Include all agreed-upon conditions, such as repair obligations or specific items to be included or excluded from the sale.

- Ensure that both the buyer and the seller sign and date the form to make it legally binding.

- Keep copies of the signed agreement for both parties' records.

- Review the financial terms, including the purchase price, deposit amount, financing arrangements, and closing costs, for accuracy.

- Check that all necessary attachments or addendums are included, signed, and dated.

Don't:

- Leave any sections blank; if a section does not apply, write “N/A” to indicate this.

- Misrepresent any facts or details about the property, as this can lead to legal consequences down the line.

- Rush through the process without carefully reviewing each part of the agreement.

- Ignore local and state laws that might affect the real estate transaction in New Hampshire.

- Forget to specify the closing date and location, as this is critical for the completion of the sale.

- Assume verbal agreements will be honored; ensure all agreements are documented in the purchase agreement.

- Sign the agreement if there are any unresolved issues or concerns; negotiate and settle any disputes first.

- Rely purely on generic forms without considering specific New Hampshire real estate laws and regulations.

- Overlook the importance of getting a professional inspection of the property before finalizing the agreement.

By following these guidelines, parties involved in a real estate transaction can ensure a smoother process and avoid common pitfalls that can complicate or delay the sale. Always remember, when in doubt, seek professional advice to guide you through the legal intricacies of real estate agreements in New Hampshire.

Misconceptions

When it comes to buying or selling property in New Hampshire, the Real Estate Purchase Agreement form plays a crucial role. However, there are several misconceptions surrounding this document that can lead to confusion.

- One Size Fits All: Many believe that the New Hampshire Real Estate Purchase Agreement form is a standard document that fits every transaction. Each real estate deal is unique, and the agreement may need to be adjusted to match the specifics of the deal, such as clauses on financing, inspections, and closing conditions.

- Legally Binding Once Signed: A common misconception is that the agreement is binding as soon as it's signed. In reality, it becomes legally binding only after both parties have signed and all contingencies, like financing approval and home inspections, have been met or waived.

- Attorney Review Is Not Necessary: Some assume legal review is optional. Despite the form's straightforward nature, having an attorney review the document can prevent misunderstandings and ensure the agreement reflects the parties' intentions and complies with state law.

- No Negotiation After Signing: Another myth is that terms are set in stone once the agreement is signed. Parties can still negotiate changes or amendments to the agreement if both sides consent. Such changes should be documented in writing and signed by both parties.

- Deposits Are Non-Refundable: People often believe that all deposits made when the agreement is signed are non-refundable. In truth, the conditions under which deposits may be returned or retained should be explicitly stated in the agreement, taking into account contingoencies.

- Verbal Agreements Are Enforceable: Lastly, there is a misconception that verbal agreements related to the real estate transaction can be enforceable. The New Hampshire statute of frauds requires that real estate purchase agreements be in writing and signed by the parties to be enforceable.

Understanding these misconceptions about the New Hampshire Real Estate Purchase Agreement form can help buyers and sellers navigate their real estate transactions more effectively, ensuring a smoother process for all involved.

Key takeaways

Filling out and using the New Hampshire Real Estate Purchase Agreement form is an important step in buying or selling property within the state. It outlines the terms and conditions of the transaction between the buyer and seller. Here are key takeaways to keep in mind:

- Ensure all parties have a clear understanding of the property's boundaries and any easements or rights of way.

- Include a detailed description of the property, including the address, legal description, and any personal property being included in the sale.

- State the purchase price clearly and the terms of the payment, including any deposit or earnest money required upfront.

- Specify the closing date and location, giving both parties a clear timeline for when the transfer of ownership should be completed.

- Outline who is responsible for closing costs, inspections, and any repairs that need to be made before the sale is finalized.

- Determine any contingencies that must be met before the sale can proceed, such as the buyer obtaining financing or the sale of their current home.

- Clarify the conditions under which the earnest money may be refunded, and the circumstances under which it may be forfeited.

- Include provisions for any inspections to be completed, specifying who will arrange and pay for these inspections.

- Ensure that both the buyer and seller agree on the condition of the property at the time of sale, acknowledging any defects or issues.

- Require signatures from all parties involved, indicating their agreement with the terms of the purchase agreement.

By keeping these key points in mind, parties can ensure a smoother and more transparent transaction process. Remember, consulting with a legal professional can provide additional guidance specific to your situation.

Some Other New Hampshire Forms

What Type of Deed Is Most Commonly Used - Deed forms play an essential role in the conveyance of property, acting as the final step in legally changing property ownership.

New Hampshire Employee Policy Manual - A clarifying document on the use of social media, outlining what is considered appropriate when representing the company online.

Nh Divorce Laws Adultery - Can cover temporary or permanent spousal support arrangements, providing financial clarity for both parties.