Fillable Small Estate Affidavit Template for New Hampshire

When a loved one passes away, the legal formalities that follow can be overwhelming for families during their time of grief. In New Hampshire, the Small Estate Affidavit form offers a beacon of relief for those managing the estates of deceased individuals whose assets fall below a certain threshold. This form is a straightforward legal tool designed to simplify the process of asset distribution without necessitating a lengthy probate process. It serves to legally transfer the decedent's property to their rightful heirs or beneficiaries quickly and with fewer legal hurdles. Intended for use in specific circumstances, the form's applicability hinges on the total value of the estate being below the set limit established by state law. By enabling a more efficient transfer of assets, the Small Estate Affidavit form plays a pivotal role in helping families close the estate of their loved ones with dignity and peace, reducing the stress and financial burden often associated with probate proceedings. Understanding the stipulations, requirements, and steps involved in completing and filing this form is crucial for those looking to utilize this provision effectively.

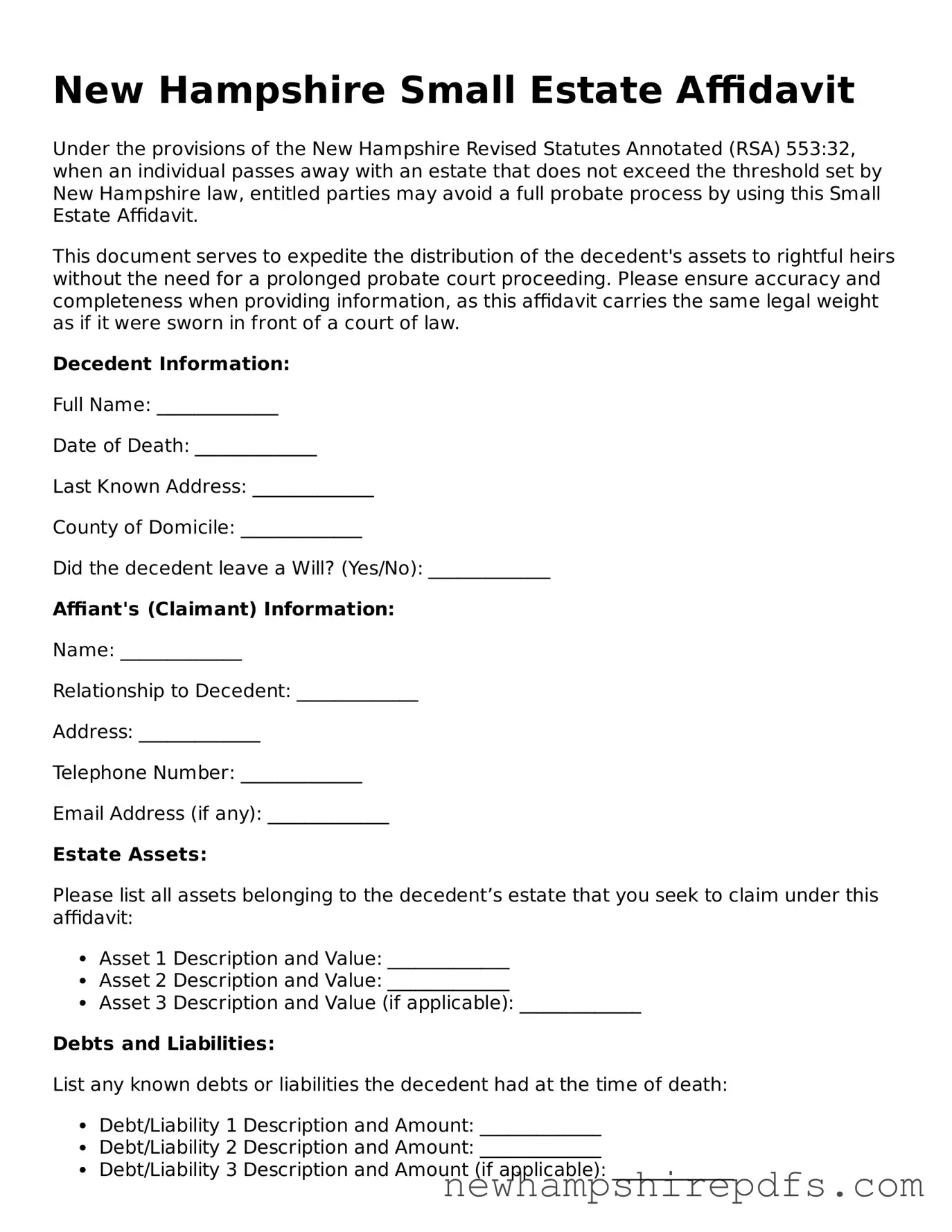

Document Sample

New Hampshire Small Estate Affidavit

Under the provisions of the New Hampshire Revised Statutes Annotated (RSA) 553:32, when an individual passes away with an estate that does not exceed the threshold set by New Hampshire law, entitled parties may avoid a full probate process by using this Small Estate Affidavit.

This document serves to expedite the distribution of the decedent's assets to rightful heirs without the need for a prolonged probate court proceeding. Please ensure accuracy and completeness when providing information, as this affidavit carries the same legal weight as if it were sworn in front of a court of law.

Decedent Information:

Full Name: _____________

Date of Death: _____________

Last Known Address: _____________

County of Domicile: _____________

Did the decedent leave a Will? (Yes/No): _____________

Affiant's (Claimant) Information:

Name: _____________

Relationship to Decedent: _____________

Address: _____________

Telephone Number: _____________

Email Address (if any): _____________

Estate Assets:

Please list all assets belonging to the decedent’s estate that you seek to claim under this affidavit:

- Asset 1 Description and Value: _____________

- Asset 2 Description and Value: _____________

- Asset 3 Description and Value (if applicable): _____________

Debts and Liabilities:

List any known debts or liabilities the decedent had at the time of death:

- Debt/Liability 1 Description and Amount: _____________

- Debt/Liability 2 Description and Amount: _____________

- Debt/Liability 3 Description and Amount (if applicable): _____________

Declaration:

I, ___________, declare under penalty of perjury under the laws of the State of New Hampshire that the information provided in this affidavit is true and correct to the best of my knowledge, and that I am legally entitled to claim the estate assets listed above.

Date: _____________

Signature of Affiant: ___________________________

This document is not valid until signed in the presence of a notary public.

Notary Information:

State of New Hampshire

County of _____________

On this __________ day of ___________, 20__, before me appeared _____________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: _____________

My Commission Expires: _____________

PDF Form Breakdown

| Fact | Detail |

|---|---|

| Applicability | The New Hampshire Small Estate Affidavit form is applied when dealing with estates of deceased persons where the total value does not exceed a specific threshold set by state law. |

| Monetary Threshold | In New Hampshire, the estate can be considered small if the total asset value does not exceed $10,000. |

| Governing Law | The form and procedure are governed by New Hampshire Revised Statutes, specifically RSA 553:32. |

| Waiting Period | A waiting period of thirty days after the death of the decedent is required before the Small Estate Affidavit can be filed. |

| Eligible Claimants | Surviving spouses and next of kin are typically eligible to claim the small estate assets using this affidavit, subject to the state’s laws on inheritance priorities. |

How to Use New Hampshire Small Estate Affidavit

When a loved one passes away in New Hampshire, handling their property and assets can feel overwhelming. If their estate is considered small under state laws, you may be able to use the Small Estate Affidavit procedure. This process helps to streamline the settlement of the estate without the need for a formal probate process. For those eligible to use the Small Estate Affidavit, it is important to accurately complete and submit the form to ensure a smooth transfer of assets to the rightful heirs. Here are the steps needed to fill out the New Hampshire Small Estate Affidavit form.

- Begin by reading the entire form carefully to ensure you understand the requirements and information needed.

- Fill in the date of the affidavit at the top of the form.

- Enter the full legal name of the deceased, also known as the decedent, as it appears on the death certificate.

- Write the date of death of the decedent, making sure it matches the death certificate.

- State your relationship to the decedent to establish your right to submit the affidavit.

- List all known assets of the decedent, including but not limited to bank accounts, vehicles, real estate, and personal property. Include any account numbers and the estimated value of each asset.

- If applicable, identify any debts owed by the decedent, along with creditor information and the amount due.

- Provide the names and addresses of all heirs or persons legally entitled to receive the decedent’s property. Specify the relationship of each heir to the decedent.

- Read the statements at the end of the affidavit carefully. By signing the affidavit, you are swearing to the truthfulness of the information provided.

- Sign and date the affidavit in front of a notary public. Ensure the notary public notarizes the affidavit.

- Gather any required attachments, such as the death certificate or proof of your relationship to the decedent, and attach them to the affidavit.

- Review the completed affidavit and attachments to ensure all information is accurate and complete.

- Submit the affidavit and all attachments to the appropriate office or institution that holds the decedent’s assets, following their specific submission guidelines.

By following these steps, you can properly fill out and submit the New Hampshire Small Estate Affidavit form. This document is an important step in managing the assets of a loved one who has passed away, allowing for a more streamlined process to distribute their property to the rightful heirs.

Understanding New Hampshire Small Estate Affidavit

What is a New Hampshire Small Estate Affidavit?

A New Hampshire Small Estate Affidavit is a legal document used to streamline the process of settling a small estate in New Hampshire. When someone passes away, their estate often goes through a court process known as probate. However, if the estate's value is below a certain threshold, this affidavit allows the assets to be distributed without a lengthy probate process. It's a way to manage and distribute the decedent's assets more quickly and with less legal complexity.

Who can file a Small Estate Affidavit in New Hampshire?

In New Hampshire, the right to file a Small Estate Affidavit typically belongs to the surviving spouse or next of kin. However, if there's no surviving spouse or next of kin, a creditor of the decedent or another interested person may be allowed to file the affidavit. It's important to check the most current state laws or consult with a legal expert to understand who can file in specific circumstances.

What is the maximum value of an estate that qualifies for a Small Estate Affidavit in New Hampshire?

The maximum value of an estate that qualifies for a Small Estate Affidavit in New Hampshire is subject to change, as laws and dollar amounts are updated over time. Generally, an estate may qualify if its value, excluding real estate and certain other assets, falls below a specific threshold. To find the current threshold, it's advisable to consult the New Hampshire Revised Statutes or seek advice from a legal professional.

What documents are needed to file a Small Estate Affidavit in New Hampshire?

When filing a Small Estate Affidavit in New Hampshire, you'll need to gather several documents. These typically include a certified copy of the death certificate, a detailed list of the estate's assets, and sometimes, documentation proving your relationship to the deceased or your right to file. The exact documents required can vary, so verifying with local probate court guidelines or a legal advisor is recommended.

How long does it take to process a Small Estate Affidavit in New Hampshire?

The processing time for a Small Estate Affidavit in New Hampshire can vary depending on several factors, including the completeness of the application and the workload of the probate court. Generally, it might take a few weeks from the submission of the affidavit to the distribution of assets. However, checking with the local probate court for a more accurate estimate is a good idea.

Are there any fees associated with filing a Small Estate Affidavit in New Hampshire?

Yes, there are typically fees associated with filing a Small Estate Affidavit in New Hampshire. These fees can vary depending on the county and the specific requirements of the probate court. It's best to contact the local probate court directly to inquire about the current fee schedule.

Can a Small Estate Affidavit be contested in New Hampshire?

Yes, a Small Estate Affidavit can be contested in New Hampshire. If someone believes the affidavit has been filed improperly or that they have a better claim to the estate, they may challenge the affidavit in court. Challenges can lead to delays or additional legal proceedings, so it's beneficial to consult with a legal expert if you anticipate any disputes over the estate.

Common mistakes

The New Hampshire Small Estate Affidavit form is a document used to facilitate the transfer of property from a decedent's estate to their rightful heirs without the need for a formal probate process. This procedure is typically reserved for cases where the total value of the estate is considered small under state law. Despite its intended simplicity, individuals often encounter pitfalls during the completion process. Understanding these common mistakes can help filers navigate this crucial document more effectively.

1. Incorrect Valuation of the Estate: One of the most frequent mistakes made when completing the New Hampshire Small Estate Affidavit is the incorrect valuation of the estate. It's crucial to accurately assess the value of all assets to ensure it does not exceed the threshold established by New Hampshire law. Overestimation or underestimation can lead to processed delays or even rejection of the affidavit.

2. Failure to Properly Identify Heirs: Another common issue is the failure to properly and completely identify all legal heirs or beneficiaries. This includes not just primary heirs but also contingent heirs who might inherit in the absence of the primary beneficiaries. Incomplete or inaccurate information can lead to disputes among potential heirs and complicate the distribution of the estate's assets.

3. Incorrect or Incomplete Documentation: Furnishing incorrect or incomplete documentation alongside the Small Estate Affidavit is a mistake that can significantly hinder the process. Vital documents, such as death certificates, proof of relationship to the deceased, and documentation related to the assets being claimed, must be accurately provided. Any discrepancies can prompt authorities to request additional proof or clarification, delaying the transfer of assets.

4. Misunderstanding the Limitations of the Affidavit: A common misunderstanding is the scope and limitations of the Small Estate Affidavit. It's important to recognize that this form is suitable only for estates that fall under the specified value threshold and is limited to personal property. Real estate and certain other assets might not be transferable via this affidavit, leading some individuals to mistakenly believe they can transfer all types of assets using this form.

5. Failing to Properly Notify Creditors: Lastly, failing to properly notify creditors is a critical mistake. The process demands that creditors be notified and given an opportunity to claim against the estate. Not only is this a legal requirement, but it also helps protect the heirs from future claims made by creditors. Neglecting this step can result in financial complications and liabilities for the heirs.

To avoid these common pitfalls, individuals should approach the process of completing the New Hampshire Small Estate Affidavit with thoroughness and attention to detail. Consulting with legal professionals can provide guidance and ensure the accurate and effective handling of small estate matters.

Documents used along the form

In the context of managing a small estate in New Hampshire, the Small Estate Affidavit form is a vital document that initiates the process. However, it is not the only document required to comprehensively address the legal and administrative aspects of an estate. A series of other forms and documents often accompany this affidavit to ensure thoroughness and compliance with state laws. Each of these documents serves a specific purpose and collectively, they facilitate the seamless execution of the deceased's estate.

- Death Certificate: A certified copy of the death certificate is essential to confirm the decedent’s death and establish the date. It is a prerequisite for the processing of the Small Estate Affidavit and other legal matters regarding the estate.

- Will (if available): If the decedent left a will, it outlines the distribution of their assets and the executor of the estate. This document guides the process, even in a small estate situation, ensuring the deceased's wishes are honored.

- Inventory of Assets: An exhaustive list detailing the assets within the estate, including personal property, bank accounts, and real estate. This inventory clarifies the estate's composition and value, helping to determine eligibility for the small estate process.

- Appraisal Reports: For assets like real estate and valuable personal property, professional appraisal reports might be necessary to establish their fair market value accurately. These reports are crucial for equitable asset distribution and tax purposes.

- Creditor Claims Form: If the estate owes debts, creditors must be notified and given the opportunity to claim repayment. This form documents any claims made by creditors against the estate.

- Receipts and Disbursements Record: A detailed account of all financial transactions involving the estate, including the payment of debts and distribution of assets. This record ensures transparency and accountability.

- Tax Forms: Depending on the estate’s value and the decedent’s financial status, various tax forms may be required, including final income tax returns and estate tax returns. Accurate completion ensures compliance with tax obligations.

- Distribution Agreement: A document signed by all heirs or beneficiaries, agreeing to the distribution of the estate’s assets as outlined. This agreement can prevent disputes and provide a clear plan for asset allocation.

- Court Approval Forms: In some cases, court approval may be necessary to finalize certain actions or distributions within the estate. These forms are filed with the court to seek official authorization for specified activities.

Collectively, these documents support and streamline the process initiated by the Small Estate Affidavit, ensuring that all legal, financial, and administrative requirements are met. This careful and comprehensive approach benefits all parties involved, providing clarity, direction, and peace of mind during a challenging time.

Similar forms

The New Hampshire Small Estate Affidavit form is similar to other legal documents used to manage the assets of someone who has passed away. This document allows for the distribution of the deceased's assets without a formal probate process, making it a valuable tool for settling small estates efficiently. Its resemblance to documents like the affidavit for the transfer of personal property without probate and the affidavit for the collection of all personal property are evident in their purpose, structure, and the relief they offer to the grieving families.

Affidavit for the Transfer of Personal Property Without Probate: The New Hampshire Small Estate Affidavit shares many characteristics with this document. Both are designed to simplify the legal proceedings required after someone’s death by avoiding the lengthy and often complex probate process. Each requires the affiant to assert their right to the deceased's property and to ensure that all debts and taxes have been paid before distribution. They specifically cater to estates that fall below a certain value threshold, making them accessible and practical tools for the lawful transfer of assets.

Affidavit for the Collection of All Personal Property: This document also mirrors the New Hampshire Small Estate Affidavit in its goal to facilitate the collection and distribution of the deceased's personal property. Like the small estate affidavit, it acts under the assumption that the estate does not necessitate a full probate procedure due to its limited size. Both affidavits demand detailed information about the deceased, their assets, and the claimant, ensuring that the process is carried out with thoroughness and integrity. Moreover, they require the claimant to acknowledge their legal responsibility to honor the deceased's debts and distribute the assets according to the law.

Dos and Don'ts

Filling out the New Hampshire Small Estate Affidavit form requires attention to detail and an understanding of what is expected. To ensure the process is completed correctly, here are key dos and don'ts to keep in mind:

- Do gather all necessary documents related to the decedent's estate before beginning. This includes bank statements, property deeds, and any other assets or debt information.

- Do ensure that you meet the qualifying criteria to file a Small Estate Affidavit in New Hampshire. This typically involves estates that fall below a certain value threshold and do not include real estate.

- Do carefully read each section of the form to understand what information is required. This ensures accurate completion, which is crucial for legal documents.

- Do use black ink or type the information when filling out the form to ensure legibility and to meet standard filing requirements.

- Don't leave any required fields blank. If a section does not apply to the decedent's estate, it is appropriate to write "N/A" for not applicable.

- Don't guess or estimate values of assets. Make sure to use exact figures to accurately represent the estate's worth. It may require appraisal or professional valuation for certain assets.

- Don't sign the affidavit without a notary public present. Your signature needs to be notarized to verify your identity and the truthfulness of your statements.

- Don't file the form without making sure all attachments and supporting documents are included. This often includes death certificates, a list of heirs, and documentation of any debts owed by the estate.

By following these guidelines, you can streamline the process of completing the New Hampshire Small Estate Affidavit form and ensure it meets all legal requirements. Remember, this document plays a critical role in the estate settlement process and should be handled with care and precision.

Misconceptions

When it comes to settling a small estate in New Hampshire, the Small Estate Affidavit form is often discussed. However, there are several misconceptions surrounding this document that can lead to confusion. Understanding these misconceptions is crucial for anyone involved in administering a small estate.

It allows immediate transfer of all assets. Many assume that the Small Estate Affidifact form enables the instant transfer of the deceased's assets. In reality, the process requires the affidavit to be filed and processed, which can take time.

It avoids probate entirely. While it's true that this form can simplify the process, it doesn't eliminate the need for probate in all cases. Certain situations and asset types may still require formal probate proceedings.

It can transfer real estate. A common misunderstanding is that the Small Estate Affidavit can be used to transfer real estate. In New Hampshire, this form is typically limited to personal property and assets, excluding real estate.

There's no financial threshold. Contrary to what some believe, there is a limit on the value of the estate that can be administered through a Small Estate Affidavit. This threshold ensures that the form is used only for smaller estates, in line with state regulations.

Any family member can file it. While it might seem that any relative can submit this form, New Hampshire law specifies who has priority to act in this capacity. Typically, it’s the surviving spouse or next of kin, under certain conditions.

It's only for intestate estates. Some people think the Small Estate Affidavit is only for cases where the deceased did not leave a will. However, it can also apply to estates with a will, provided they meet the specific criteria for using this simplified procedure.

It eliminates the need for an attorney. While the Small Estate Affidavit process is straightforward, legal advice might still be necessary. Especially in complex situations, consulting with an attorney can help navigate potential legal issues.

There are no fees involved. Filing a Small Estate Affidavit does involve some costs. These can include filing fees and, potentially, expenses related to settling the deceased's debts or final affairs.

Understanding these misconceptions about the New Hampshire Small Estate Affidavit form is key to effectively managing a small estate. By recognizing what this form can and cannot do, individuals can better navigate the estate administration process with clarity and confidence.

Key takeaways

Handling estate matters can be a tough process, especially in times of grief. In New Hampshire, the Small Estate Affidavit form simplifies the procedure for small estates, making it easier for individuals to manage the legalities following the loss of a loved one. To ensure that the process goes smoothly, here are key takeaways about filling out and using this form:

- Eligibility Criteria: The form is applicable only if the total value of the estate, minus liens and encumbrances, does not exceed $10,000. This ensures that only small estates can use this expedited process.

- Waiting Period: New Hampshire law mandates a 30-day waiting period from the decedent's death before the Small Estate Affidavit can be filed. This allows enough time for all potential claimants to come forward.

- Required Documentation: When submitting the affidavit, it’s essential to include a certified copy of the death certificate and a detailed list of the estate's assets. Accurate documentation streamlines the process.

- No Probate Court Required: One of the significant advantages of using this form is bypassing the probate court. This can save considerable time and expense, though it’s advisable to consult with a legal professional to ensure compliance with all relevant laws.

- Filing with the Correct Authority: Although the form avoids probate court, it must still be filed with the appropriate local or state agency. Identifying the proper authority is crucial for the effective transfer of assets.

- Signing Requirements: The affidavit needs to be signed in the presence of a notary public. This formalizes the document, helping to prevent fraud and ensuring that all statements made are truthful and accurate.

- Limited Asset Types: The Small Estate Affidavit can only be used for certain types of assets. Typically, this excludes real estate and certain high-value assets. Understanding which assets can and cannot be transferred using this form is essential.

- Legal Responsibility: The person filing the affidavit assumes legal responsibility for distributing the assets according to the laws of New Hampshire. They are liable to the state and to any creditors of the estate, underscoring the importance of accuracy and honesty in the process.

Properly managing a loved one’s final affairs is a significant responsibility. The New Hampshire Small Estate Affidavit form is designed to simplify this process for small estates. However, while the process may seem straightforward, it is always recommended to seek legal advice to navigate any complexities that may arise, ensuring that all legal requirements are met and protecting oneself from potential liabilities.

Some Other New Hampshire Forms

What Is a Nda Agreement - The form should be comprehensive yet precise to avoid ambiguities regarding its provisions.

Hold Harmless Waiver - This agreement may be unilateral, benefiting one party, or mutual, protecting all parties involved in the agreement.

Nh Bill of Sale - Helps in accurately calculating taxes or fees associated with the sale and transfer of the motorcycle.