Fillable Transfer-on-Death Deed Template for New Hampshire

In the realm of estate planning, the New Hampshire Transfer-on-Death Deed form emerges as a pivotal legal instrument, allowing property owners to designate beneficiaries for their real estate, thus enabling the transfer of property upon the owner's demise without necessitating probate proceedings. This form, recognized under New Hampshire law, facilitates a smooth transition of ownership, ensuring that the property directly passes to the intended beneficiary. By completing this form, property owners can clearly outline their wishes regarding whom their real estate should transfer to, effectively bypassing the often time-consuming and costly probate process. The existence of this form underscores a proactive step toward simplifying the transfer of assets, providing peace of mind to property owners by knowing their real estate affairs are orderly arranged for the future. The mechanism behind the Transfer-on-Death Deed is not without its nuances, as it requires precise completion and adherence to specific legal standards to ensure its validity and enforceability, highlighting its significance in the broader context of estate planning and asset distribution.

Document Sample

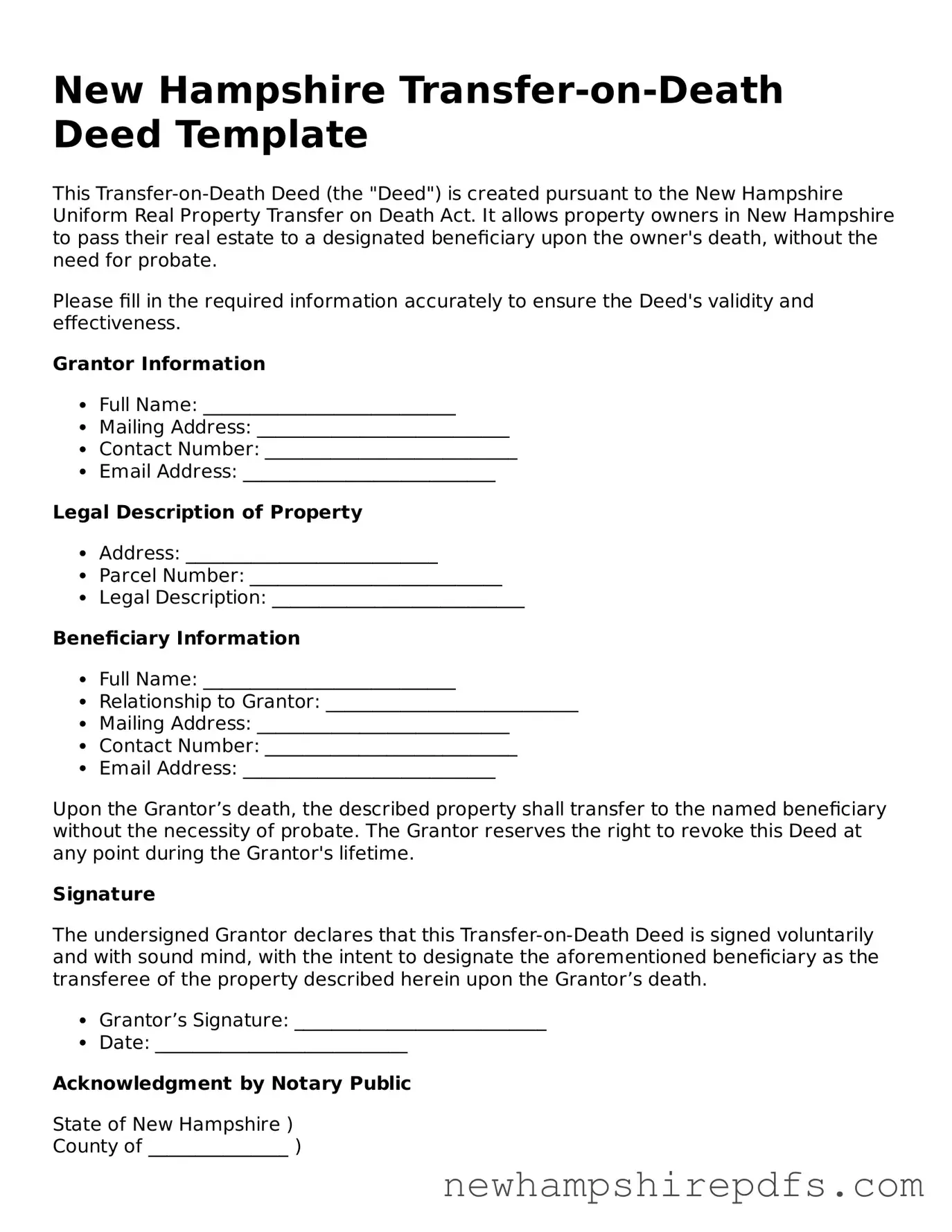

New Hampshire Transfer-on-Death Deed Template

This Transfer-on-Death Deed (the "Deed") is created pursuant to the New Hampshire Uniform Real Property Transfer on Death Act. It allows property owners in New Hampshire to pass their real estate to a designated beneficiary upon the owner's death, without the need for probate.

Please fill in the required information accurately to ensure the Deed's validity and effectiveness.

Grantor Information

- Full Name: ___________________________

- Mailing Address: ___________________________

- Contact Number: ___________________________

- Email Address: ___________________________

Legal Description of Property

- Address: ___________________________

- Parcel Number: ___________________________

- Legal Description: ___________________________

Beneficiary Information

- Full Name: ___________________________

- Relationship to Grantor: ___________________________

- Mailing Address: ___________________________

- Contact Number: ___________________________

- Email Address: ___________________________

Upon the Grantor’s death, the described property shall transfer to the named beneficiary without the necessity of probate. The Grantor reserves the right to revoke this Deed at any point during the Grantor's lifetime.

Signature

The undersigned Grantor declares that this Transfer-on-Death Deed is signed voluntarily and with sound mind, with the intent to designate the aforementioned beneficiary as the transferee of the property described herein upon the Grantor’s death.

- Grantor’s Signature: ___________________________

- Date: ___________________________

Acknowledgment by Notary Public

State of New Hampshire )

County of _______________ )

On this __________ day of ________________, 20___, before me, the undersigned notary public, personally appeared ___________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

- Notary Public’s Signature: ___________________________

- Printed Name: ___________________________

- Commission Expiration Date: ___________________________

PDF Form Breakdown

| Fact | Detail |

|---|---|

| Governing Law | New Hampshire Transfer-on-Death (TOD) deeds are governed by RSA 564-D: Transfer-on-Death Deeds. |

| Purpose | The deed allows property owners to pass their real estate to a beneficiary upon the owner’s death without the need for prob" + "ate court proceedings. |

| Eligibility | Any owner of real property in New Hampshire can create a Transfer-on-Death deed. |

| Recording Requirement | The deed must be recorded in the county where the property is located before the owner's death to be effective. |

| Revocability | The owner can revoke the deed at any time before death without the beneficiary’s consent. |

| Effect on Ownership | The property owner retains full control and use of the property during their lifetime. The transfer of ownership to the beneficiary occurs only upon the owner's death. |

How to Use New Hampshire Transfer-on-Death Deed

When you're planning your estate, it's essential to know how each document works and where it fits into the bigger picture. A Transfer-on-Death (TOD) Deed allows property owners in New Hampshire to pass their real estate directly to a beneficiary upon their death, without the need for probate court proceedings. This can simplify the process significantly for your loved ones. Filling out the TOD deed correctly is vital to ensure that your property transfers according to your wishes. Here's a step-by-step guide on how to complete the form:

- Start by locating the official New Hampshire Transfer-on-Death Deed form. Make sure you're using the most current version for legal accuracy.

- Enter the full legal name and mailing address of the current property owner(s) in the designated section at the top of the form. This identifies who is creating the TOD deed.

- Next, fill in the legal description of the property. This information can be found on your current deed or property tax documents. It's essential to be accurate, as this describes the property you're transferring.

- Then, designate your beneficiary or beneficiaries. Write their full legal names and addresses. If you wish to name more than one beneficiary, specify the percentages of ownership each will receive, ensuring the total equals 100%.

- Decide if the beneficiaries will hold the property as joint tenants with the right of survivorship or as tenants in common. This choice affects what happens if a beneficiary passes away before inheriting the property.

- Sign the deed in front of a notary public. This step is crucial as it verifies your identity and intention. Notarization ensures that the document is legally binding.

- Finally, record the completed deed with the New Hampshire county where the property is located. There's usually a small fee for recording, which varies by county.

After you complete and record the TOD deed, it's a waiting game. The property remains under your control during your lifetime. You can use it, sell it, or even change the beneficiary if you wish. Upon your passing, the property will transfer directly to the named beneficiary or beneficiaries, bypassing the often lengthy and costly probate process. Remember to inform the beneficiary of the TOD deed so they know your intentions and can take the necessary steps when the time comes.

Understanding New Hampshire Transfer-on-Death Deed

What is a Transfer-on-Death Deed in New Hampshire?

A Transfer-on-Death Deed, also known as a TOD deed, is a legal document that enables property owners in New Hampshire to pass on their real estate to a beneficiary upon their death without the need for probate court proceedings. This document allows the property owner to retain full control over the property during their lifetime, including the right to alter or revoke the deed.

How can someone create a Transfer-on-Death Deed in New Hampshire?

To create a Transfer-on-Death Deed in New Hampshire, the property owner must complete a deed form that meets state-specific requirements. This includes accurately describing the property, naming the beneficiary clearly, and stating that the transfer will occur upon the owner’s death. The deed must then be signed in the presence of a notary public and recorded with the county registry of deeds where the property is located before the owner’s death.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time prior to the property owner's death. This can be accomplished in a few ways, including creating and recording a new deed that explicitly revokes the previous TOD deed, transferring the property to someone else during the owner's lifetime, or executing and recording a formal revocation document. It’s important that the revocation is carried out according to New Hampshire laws to ensure its validity.

Are there any restrictions on who can be named a beneficiary in a Transfer-on-Death Deed?

In New Hampshire, almost any individual or legal entity—such as a trust, corporation, or charity—can be named as a beneficiary in a Transfer-on-Death Deed. However, it's crucial for the property owner to consider the implications of their choice, including how it aligns with their overall estate plan and whether the designated beneficiary is prepared to assume responsibility for the property.

What happens if the beneficiary predeceases the property owner?

If the named beneficiary in a Transfer-on-Death Deed predeceases the property owner, the deed typically becomes null and void, resulting in the property becoming part of the owner’s estate upon their death and subject to probate. Property owners can address this possibility by naming alternative or contingent beneficiaries in the Transfer-on-Death Deed to ensure the property transfers according to their wishes even if the primary beneficiary is no longer alive.

Common mistakes

Filling out a New Hampshire Transfer-on-Death (TOD) Deed form can be a straightforward process to ensure your real estate passes directly to your chosen beneficiaries upon your death without going through probate. However, some common mistakes can complicate or invalidate the deed, leading to unintended consequences. Below are six prevalent errors people make when filling out this crucial document.

- Not Specifying Beneficiaries Clearly: It's crucial to clearly identify each beneficiary by their full legal name and relationship to you. Vague descriptions or incomplete information can lead to disputes and potential legal challenges after your passing.

- Failing to Add a Contingency Plan: Life is unpredictable, and a beneficiary might predecease you. Without specifying what should happen in such cases, the deed might not effectively transfer property as you had intended. Providing clear instructions for contingencies ensures the property is distributed according to your wishes, even if circumstances change.

- Omitting Required Legal Descriptions of the Property: A common and critical mistake is not including the legal description of the property. This description is more detailed than a simple address and is necessary for the deed to be legally valid and recordable. Without it, the transfer could be deemed invalid.

- Improper Execution: Every state has specific requirements for how a deed must be signed to be valid. In New Hampshire, a Transfer-on-Death Deed must be signed in the presence of a notary public and, in some cases, witnesses. Failing to adhere to these formalities can void the document.

- Not Filing the Deed Before Death: A TOD Deed only becomes effective if it is properly filed with the county recorder’s office before the death of the grantor. Merely signing the deed without recording it can lead to it being disregarded, despite the grantor's intentions.

- Overlooking the Impact on Medicaid Eligibility: Before executing a TOD Deed, consider the implications on Medicaid eligibility. Transferring real estate can affect eligibility for such benefits, so understanding the consequences in advance is important. Some people unintentionally jeopardize their financial assistance by not consulting with a legal or financial professional first.

In conclusion, while a Transfer-on-Death Deed can be a powerful estate planning tool, it's vital to complete the form accurately and with thorough understanding of the implications. Avoiding these common pitfalls can ensure your property seamlessly transfers to your beneficiaries according to your wishes, avoiding unnecessary legal hurdles and familial discord. Consultation with a legal professional can provide personalized advice and peace of mind when navigating these matters.

Documents used along the form

In the realm of estate planning, the New Hampshire Transfer-on-Death (TOD) Deed is recognized as a significant document that enables property owners to designate beneficiaries who will inherit their property upon the owner’s death without the need for probate. This not only simplifies the inheritance process but also ensures that property is transferred efficiently and directly to the designated beneficiaries. Alongside the TOD deed, there are several other forms and documents often utilized to complement and bolster one’s estate plan. Understanding these documents helps in creating a comprehensive estate planning strategy that addresses various aspects of an individual’s assets and wishes.

- Will: A legal document that outlines how a person’s assets will be distributed upon their death. It names an executor who will manage the estate, pay any debts, taxes, and distribute assets per the deceased’s wishes. The will covers assets not included in the TOD deed.

- Durable Power of Attorney: This document grants a trusted person the authority to make financial decisions on behalf of the principal if they become incapacitated. It's essential for managing assets not covered by the TOD deed or a trust.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document assigns a trusted individual to make healthcare decisions on the principal’s behalf in case they can no longer make those decisions themselves.

- Living Will: Sometimes referred to as an advance directive, this document specifies what actions should be taken for a person's health if they are no longer able to make decisions due to illness or incapacity. It outlines the types of medical treatment the individual does or does not want.

- Revocable Living Trust: A highly flexible document that allows the individual (grantor) to specify how their assets should be managed and distributed both during their lifetime and after death. Assets in the trust bypass probate, similar to the TOD deed, but offer greater control over distribution timing and conditions.

Each document outlined above plays a pivotal role in comprehensive estate planning. Together with the New Hampshire TOD deed, these documents ensure that all aspects of an individual’s estate are accounted for and handled according to their wishes. Estate planning can be complex, but by utilizing these key documents, individuals can create a solid plan that protects their assets and provides for their loved ones with confidence and clarity.

Similar forms

The New Hampshire Transfer-on-Death Deed form is similar to a traditional deed used in real estate transactions, but it has a unique feature. This unique feature is the capacity to pass property ownership upon the death of the deed holder directly to the named beneficiary, bypassing the probate process. While it functions similarly to a standard deed in terms of transferring property rights, its effect is postponed until the death of the owner. This makes it distinct in its operation and the legal implications for the parties involved.

Another document that bears similarities to the New Hampshire Transfer-on-Death Deed form is a Last Will and Testament. Both documents are used for planning the distribution of an individual's estate after their death. However, the mechanisms and legal processes they initiate differ significantly. A Last Will and Testament requires probate, a legal process through which a court oversees the distribution of assets, whereas a Transfer-on-Death Deed bypasses this process, allowing for a more expedient transfer of property to the beneficiary. Moreover, while the Last Will and Testament can encompass a wide array of assets and detailed instructions for their distribution, a Transfer-on-Death Deed is specifically focused on real estate.

The form also shares a resemblance with beneficiary designations found on accounts like retirement funds, life insurance policies, and bank accounts. These designations, like the Transfer-on-Death Deed, allow assets to pass directly to the named beneficiaries upon the account holder's death, sidestepping the probate process. Both tools provide a streamlined method for transferring assets, but they apply to different types of property: Transfer-on-Death Deeds are exclusive to real estate, while beneficiary designations typically apply to financial accounts and insurance policies.

Dos and Don'ts

When preparing to fill out the Transfer-on-Death (TOD) Deed form in New Hampshire, it's important to approach the task with care and diligence. This document is a powerful estate planning tool that allows you to pass on property to your beneficiaries upon your death, bypassing the sometimes lengthy and costly probate process. To ensure that your intentions are clearly understood and legally upheld, here’s a list of dos and don'ts to consider:

Do:- Review all instructions carefully. Before you start filling out the form, make sure you understand each section and what information is required. This helps prevent errors that could potentially invalidate the document.

- Consult with an attorney if you have questions. While the TOD Deed form may seem straightforward, estate planning can be complex. Seeking legal advice ensures that your deed aligns with your overall estate plan and complies with New Hampshire law.

- Correctly identify the property. Use the legal description of the property as recorded in the county records, not just the street address. This precision is crucial for the effective transfer of your property.

- Designate beneficiaries clearly. Be specific about who you want to inherit the property. Include full names and relationships to avoid any ambiguity.

- Sign the deed in front of a notary public. For your deed to be valid, it must be signed in the presence of a notary public. This step is critical for ensuring the document is legally binding.

- Record the deed with the county recorder's office. After signing the deed, it must be filed with the recorder's office in the county where the property is located. This public recording formalizes the intended transfer upon your death.

- Keep the original in a safe place. After recording, store the original document in a secure location and let your executor or beneficiaries know where to find it.

- Delay recording the deed. Filling out the deed is only part of the process. If it's not recorded before your death, it may not be effective.

- Forget to update the deed if circumstances change. Life changes such as marriage, divorce, or the death of a beneficiary may necessitate updating your TOD Deed. Regularly review and adjust as needed.

- Overlook the impact on your overall estate plan. Ensure the TOD Deed complements your broader estate strategy. It should not conflict with the provisions of your will or other estate planning documents.

- Assume the deed covers everything. The TOD Deed only applies to the specific property described in the document. Other assets will be distributed according to your will or state law.

- Fail to consider joint ownership implications. If the property is co-owned, the rights of the other owner(s) may impact the transfer on your death. Understand how joint ownership affects the deed.

- Use the form without fully understanding it. If you're unsure about any parts of the deed or how to fill it out correctly, seeking clarification is crucial. Misunderstandings can lead to disputes or unintended consequences.

- Ignore alternative transfer methods. While a TOD Deed may be appropriate for some, others might benefit more from a different estate planning tool. Explore all options to determine what's best for your situation.

Misconceptions

When considering the planning and management of one’s estate, many people turn to tools such as the Transfer-on-Death (TOD) Deed, especially in states like New Hampshire where it's recognized. However, there are a number of misconceptions about how the TOD deed operates. Understanding the facts can clear up confusion and aid in making informed decisions regarding property transfer after death.

- Misconception #1: A Transfer-on-Death Deed overrides a will. In reality, a TOD deed takes precedence over a will when it comes to the specific asset it covers. This means that even if the will states differently, the property will transfer to the beneficiary designated in the TOD deed.

- Misconception #2: The beneficiary inherits the property immediately upon the property owner's death. Although the TOD deed is designed to bypass probate, the transfer of ownership is effective only after the owner’s death, and may still require some administrative steps.

- Misconception #3: Creating a TOD deed requires a lawyer. While it's always wise to consult with a legal professional, New Hampshire law allows individuals to create and file a TOD deed without mandatory legal representation, as long as the form meets state requirements.

- Misconception #4: The beneficiary cannot be changed once a TOD deed is filed. Property owners retain the right to change the beneficiary (or revoke the deed entirely) at any time before their death, as long as the change complies with state laws.

- Misconception #5: Filing a TOD deed avoids estate taxes. The transfer of property through a TOD deed does not inherently avoid estate taxes. The value of the property may still be considered part of the estate for tax purposes.

- Misconception #6: The property owner can still sell or mortgage the property without the beneficiary's consent. This is true; the TOD deed does not restrict the owner's right to manage, sell, or encumber the property during their lifetime.

- Misconception #7: A TOD deed can transfer any type of property. In New Hampshire, the TOD deed can only be used for real estate. Other assets, such as vehicles or personal property, require different mechanisms for transfer-on-death arrangements.

- Misconception #8: The beneficiary takes the property free of debts and liens. The property is transferred to the beneficiary subject to any mortgages or liens against it at the time of the owner's death. Beneficiaries inherit the property along with any associated financial obligations.

Key takeaways

When dealing with the New Hampshire Transfer-on-Death (TOD) Deed form, it's crucial to understand several key points to ensure the process is completed correctly and effectively. This legal instrument allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing the often lengthy and costly probate process. Here are the essential takeaways to keep in mind:

- Accuracy is paramount: The TOD deed form must be filled out with precise information about the property and the individuals involved. Any mistakes can invalidate the deed or cause significant confusion after the property owner's death.

- Notarization is required: After completing the form, it must be notarized to be legally binding. This step ensures that the property owner's signature is verified, adding a layer of protection against fraud.

- Immediate recording is crucial: Once notarized, the TOD deed must be filed with the local county recorder's office as soon as possible. Delaying this step can lead to complications, especially if the property owner passes away before the deed is recorded.

- The TOD deed can be revoked or changed: Property owners are not locked into their decisions forever. The TOD deed allows for flexibility, as the owner can revoke or amend the deed at any time before their death, as long as the revocation or new deed is properly executed and recorded.

Understanding these critical aspects can greatly streamline the process of utilizing a Transfer-on-Death Deed in New Hampshire, offering a straightforward method for transferring real estate upon death without the need for probate court involvement.

Some Other New Hampshire Forms

Starting a Small Business in Nh - They are a prerequisite for obtaining various business licenses and permits, enabling corporations to legally engage in their chosen business activities.

Power of Attorney Form Nh - Revocation of this power is possible at any time, as long as you have the mental capacity to do so, giving you control over your affairs.